Basel IV Rules: The Impact Upon Capital Markets and the Securities Finance Industry

The forthcoming Basel IV regulations present a large-scale challenge for the securities finance industry. A new paper by Credit Benchmark outlines the cost ramifications of new rules limiting banks’ use of internal rating models for RWA purposes and the introduction of 100% RWA for unrated obligors.

The purpose of this paper is to help raise awareness of these regulations, to highlight their potential impact and to issue a call to action.

Sub-Custodians: Networks Reveal Credit Risk

The increasing complexity of global sub-custodial networks means less clarity about where an asset is held – and the credit risk of the legal entity holding it. A new whitepaper by Credit Benchmark maps this interconnectivity and sheds light on hidden potential credit risks within these networks.

The Creditworthiness of CCPs and the Global Clearing Member Network

This whitepaper examines the complex interconnected nature of the “CCP Network” – Central Counterparties, their clearing members, and the underlying clients of these members – and looks at the potential application of Consensus credit data to help bring transparency and alignment to the network.

Review of 2019 Credit Trends

This report uses bank-sourced credit risk assessments to show how 2019 unfolded in some key geographies and industries – assessments which, crucially, are based on actual expected default frequencies. By reviewing the year that was in credit risk, we can grasp some clues as to how the 2020 narrative may play out.

Consensus Sovereign Credit Data and Tradeable Anomalies in Government Bond Prices

Credit Benchmark’s latest whitepaper explores how consensus credit risk data can potentially be used in identifying tradeable short-to medium-term anomalies in Government bond prices.

July Credit Update: Consensus Upgrades and Downgrades are in Balance

Download PDF Credit Benchmark has published the latest monthly credit consensus data (from June 2019) based on contributions from 40+ financial institutions, covering 50,000 separate legal entities. The monthly upgrades and downgrades overview is now based on data adjusted for changes in contributor mix. Monthly consensus upgrades and downgrades: Last month showed improvements across 356 […]

July Credit Consensus Indicators (CCIs) – US, UK and EU Industrials

Credit Benchmark have released the July Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 30,000 credit analysts at 40 of the world’s leading financial institutions. Drawn from more than 750,000 contributed credit observations, the CCI tracks the […]

Global Credit Chartbook

Download Chartbook Political and economic factors have driven some major changes in credit over the last year. Trade disputes, geopolitical tensions and climate change have all played a role in steering the credit quality of international industry. Credit Benchmark’s global credit Chartbook draws on the credit risk views of 30,000 expert analysts from 40+ leading […]

Credit Benchmark Launches Credit Consensus Indicator – New Monthly Measure of Credit Risk for US, UK and EU Industrials

Credit Benchmark, the leader in consensus based credit analytics, today announced the launch of a new monthly measure of credit risk for US and European corporates in the industrials sector. The Credit Benchmark Credit Consensus Indicator (CCI) is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views […]

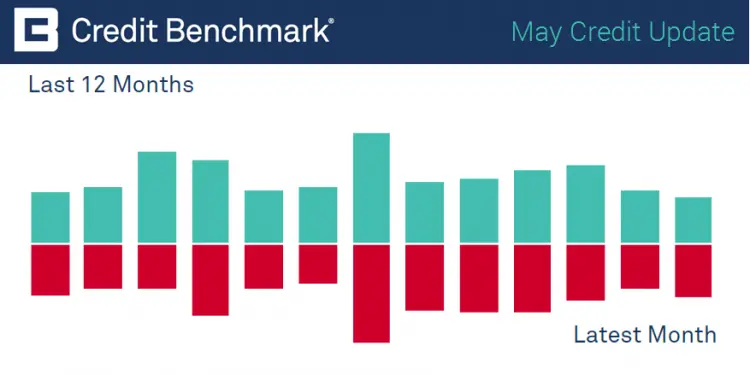

May Credit Update: Consensus Upgrades and Downgrades are in Balance

Credit Benchmark has published the latest monthly credit consensus data (from April 2019) based on contributions from 30+ financial institutions, covering over 27,600 separate legal entities. The monthly upgrades and downgrades overview is now based on data adjusted for changes in contributor mix. Monthly consensus upgrades and downgrades: Last month showed improvements across 267 obligors […]