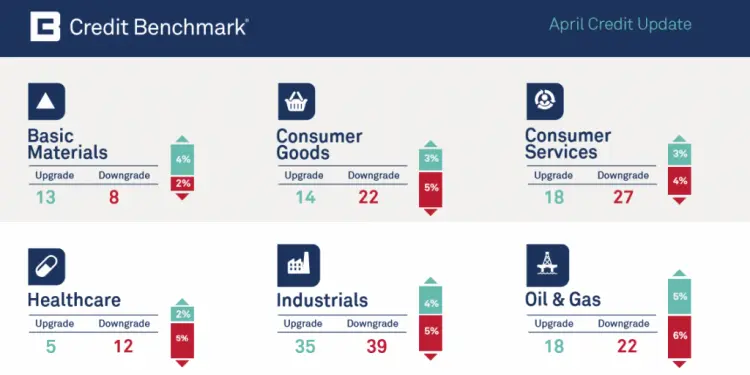

April Credit Update: More Downgrades Than Upgrades

Credit Benchmark has published the latest monthly credit consensus data (from April 2017), with 13 contributor banks now providing bank-sourced credit views (CBCs*) on more than 8,400 separate legal entities. Additions to the data include Nvidia Corp, Insight Enterprises, Korean Airlines, Hormel Foods Corp, Tupperware Brands, National Basketball Association, England & Wales Cricket Board, SL […]

Spain: Improving Sovereign Credit Risk Owes More To Economics Than Politics

The Spanish economy grew by 0.8% in Q1 2017, an annual rate of more than 3%, higher than recent data for Germany, France and the Netherlands. Unemployment has been trending down and currently stands at a post-crisis low of 18%. Spain suffered more than most during the Eurozone downturn but is now in the economic […]

Oil and Gas Industry Trends

Global Oil Sector: Credit Trends May 2017Oil and Gas Industry Trends Executive Summary Download the PDF “Oil and Gas Industry Trends” This paper uses bank-sourced data to track recent credit risk trends in the Oil and Gas industry. The data covers 384 legal entities of which 185 do not have a Long Term rating from […]

March Credit Update: Downgrades And Upgrades Balanced; Coverage Includes Saudi Aramco

We have published credit data for March, with 12 contributor banks now providing crowd-sourced credit views (CBCs*) on more than 8,200 separate legal entities. Sovereign coverage now includes Government of Brunei Darussalam. Other additions include Saudi Arabian Oil Company, Banca Popolare di Bari, China ZheShang Bank, Cheniere Energy, Mueller Industries, Canada Goose, Parques Reunidos Servicios Centrales, […]

Understanding The Credit Benchmark Consensus (CBC) Indicator

Introducing the CB Specialist series, a monthly chat with various thought leaders across the Credit Benchmark community. In today’s post, David Carruthers, Head of Research at Credit Benchmark breaks down the basics of the Credit Benchmark Consensus indicator (CBC). The CBC is a 21-category scale explicitly linked to probability of default estimates sourced from major […]

Risk.net: Monthly Credit Data Review

“Credit risk data is widely available for sovereigns and large corporates, but updates are infrequent and smaller companies are often ignored.” In this series of monthly articles from Risk.net, David Carruthers, head of research at Credit Benchmark, discusses monthly credit risk trends in rated and unrated obligors based on bank-sourced data. Read the full article here or […]

Crowd-Sourced Credit Transitions

Transition matrices can provide considerable insight into the likely pattern of losses over various time horizons (see summary below) – providing support for compliance with the CECL and IFRS9 accounting rules that require banks and corporates to estimate potential downgrades over the entire life of a loan. A recent whitepaper published by Credit Benchmark, compares bank-sourced transition […]

Bank Credit Analysts Turning Positive On Italy Despite Rising Yields And “Italexit” Risks

The European Central Bank intends to cut the pace of quantitative easing from €80bn to €60bn from this month. This has hit some of Europe’s peripheral bond markets: the spread of benchmark Italian government bonds yields versus Bunds rose above 2% this week, the highest in more than three years. The ECB now owns more […]

Turkish Vote Potential Lose-Lose For Credit

It has been hard not to make money in emerging markets during the first quarter of 2017. The JP Morgan Emerging Market Currency Index enjoyed its best return in five years (+4.2%). Emerging markets equities outperformed their developed market peers handily, with the MSCI EM index up 12.5% in dollar terms. Local currency bonds rose […]

Banks Sanguine Over “Frexit” Risk

With the election looming, French bonds have been under increasing scrutiny. The spread of French 10-year government bonds over the equivalent German bund reached a four-year high of 90 basis points at the beginning of February, though it has been falling more recently. The volatility of French government bonds only finds a faint echo in […]