Bank-Sourced Estimates Pass The Observed Default Rate Test

Bank-sourced data provides a broad cross section of forward looking default risk estimates. This dataset now also includes sufficient history to address a key question – how realistic are these estimates? Rating agencies, such as S&P, publish historically observed default rates. The publically available Annual Global Corporate Default Study and Rating Transitions, published by S&P […]

January Credit Update: Upgrades Significantly Outnumber Downgrades

Credit Benchmark has published the latest monthly credit consensus data (from December 2017), with 20 contributor banks now providing bank-sourced credit views (CBCs*) on more than 14,000 separate legal entities over the past 12 months. Monthly consensus upgrades and downgrades: 449 obligors improved their credit standing by at least one notch. 324 obligors deteriorated. 78 […]

Bank-Sourced Credit Improvements Mirror Recent Emerging Market Debt And Eurozone Moves

The current U.S. economic stance favours a weaker dollar but rising U.S. interest rates – a policy mix that would typically be bad for Emerging Market debt. But the Financial Times reports that the latest EPFR data (https://www.ft.com/content/b242b974-02aa-11e8-9650-9c0ad2d7c5b5) shows a continued appetite for Emerging market and Peripheral Eurozone debt. The main focus for inflows is […]

Recent BIS Reforms: Implications for RWA modelling

The latest BIS reforms were announced in December 2017, and are mostly expected to be in place by 2022. These will: Remove the option to use the Advanced IRB (A-IRB) approach for certain asset classes Adopt input floors for probability of default (PD) and loss given default (LGD) Provide greater specification on parameter estimation to […]

November Credit Update: Downgrades And Upgrades Balanced

Credit Benchmark has published the latest monthly credit consensus data (from October 2017), with 18 contributor banks now providing bank-sourced credit views (CBCs*) on more than 13,000 separate legal entities over the past 12 months. Monthly consensus upgrades and downgrades: 282 obligors saw improved consensus in their credit standing by at least one notch 248 […]

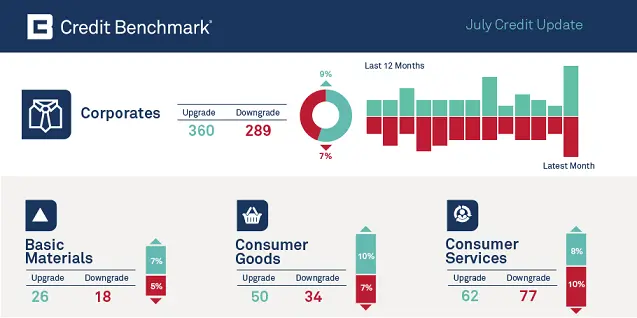

July Credit Update: High Number of Upgrades and Downgrades, Upgrades Significantly Outnumber Downgrades

Credit Benchmark has published the latest monthly credit consensus data (from June 2017), with 15 contributor banks now providing bank-sourced

Oil And Gas Pumping Up, With Upgrades Outweighing Downgrades For The First Time In 2017

Earlier this year, we unveiled the findings of our research into credit risk trends in the Oil & Gas sector. The report covered credit risk estimates for more than 384 entities in the sector, including many companies which are unrated by the “Big Three” credit ratings agencies. At the time the report was published, every sector of […]

Consensus Credit Risk Across Global Banks: Europe, Japan And U.S.

Credit Benchmark brings together the credit risk assessments of the world’s leading banks to deliver greater visibility into the credit quality of individual entities. Today’s blog post looks at the banking sector, specifically Scandinavia, the Visegrad group (Central Europe), Western Europe, the UK and Ireland, the U.S., Japan and Asia ex. Japan. Exhibit 1 compares […]

Consensus Credit Risk Across Global Banks: Europe, Japan And U.S.

Credit Benchmark brings together the credit risk assessments of the world’s leading banks to deliver greater visibility into the credit quality of individual entities. Today’s blog post looks at the banking sector, specifically Scandinavia, the Visegrad group (Central Europe), Western Europe, the UK and Ireland, the U.S., Japan and Asia ex. Japan. Exhibit 1 compares […]

June Credit Update: More Downgrades Than Upgrades, Coverage Includes Snap Inc

Credit Benchmark has published the latest monthly credit consensus data (from May 2017), with 14 contributor banks now providing bank-sourced credit views (CBCs*) on more than 10,300 separate legal entities over the past 12 months. Sovereign coverage now includes Government of Saint Kitts and Nevis . Additions to the data include Snap Inc, Fossil Group […]