Amidst Brexit Uncertainty, Default Risk Rises: Credit Benchmark Analysis Referenced in Barron’s Article

“The U.K. is due to leave the European Union in less than a year, but hasn’t agreed on just how do it. And that could be creating more risk for companies based in the U.K.” “The uncertainty around Brexit might already be taking a toll. Since the vote to leave the E.U. in June 2016, confidence […]

US Oil Credit Risk Improving Against Uncertain Global Backdrop

Oil price volatility has jumped. Annualised daily volatility reached a near term low of 19% earlier this year, but it is currently close to 30%, mainly because of a high level of uncertainty about supply. For example, Brent Crude recently fell 7% in one day (from a recent high of around $80) due to Libyan […]

Risk.Net: July Credit Data Review

“Since the 2008 financial crisis, Italian banks have seen particularly rapid growth in non-performing loans (NPLs) compared with other eurozone countries. In the past decade, the ratio of Italian bank NPLs to total loan value increased from 5.8% in 2007 to 18.1% in 2016.” “The problem is particularly acute in construction and real estate loans; these […]

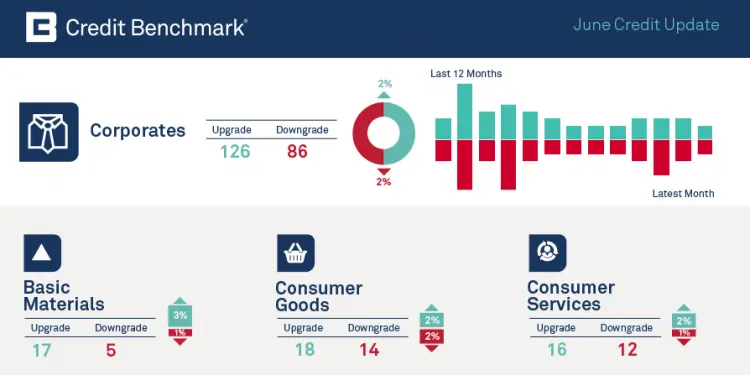

June Credit Update: Consensus Upgrades Outnumber Downgrades

Credit Benchmark has published the latest monthly credit consensus data (from May 2018), with 24 contributor banks. The set of bank-sourced credit views (CBCs*) now covers more than 19,500 separate legal entities. Monthly consensus upgrades and downgrades: 319 obligors improved their credit standing by at least one notch. 297 obligors deteriorated. 75 moved more […]

Credit Data Anticipates Emerging Market Stresses

Last week, the FT reported on recent signs of stress in Emerging Markets. These include weakness in a number of key currencies and stock markets, and increasing local currency yields for Sovereign bonds. Rising yields can compensate, in part, for currency losses; but investors usually need to see a currency floor being established before they […]

UK Retailers: Has Credit Decline Run Its Course?

In March we reported on the challenges facing UK Retailers. Retail sales in May were unexpectedly good (possibly due to the Royal Wedding), but recent store closure announcements from Carpetright, Debenhams, House of Fraser and John Lewis show that traditional companies in this sector continue to suffer. As can be seen in the charts below, […]

Credit Benchmark Promoted To FinTech50 Hall Of Fame

Credit Benchmark is promoted to the FinTech50 Hall of Fame in recognition of its innovation, pioneering spirit and achievements. To read the full article, please click the link below. View original article (external link)

Autoparts Supply Chain Credit Improvement May Reverse

The automotive industry is undergoing a major transformation. Sales continue to grow at 2% – 3% pa, but environmental concerns and new technologies means a prolonged period of uncertainty and re-alignment for manufacturers, including the entrance of new technology suppliers and decline of legacy component providers. Environmental drivers include the phasing out of diesel and […]

World Cup 2018: Betting Odds and Credit Risks

The 2018 FIFA World Cup again brings together most of the winning teams since 1930 – Argentina, Brazil, England, France, Germany, Spain and Uruguay – and each in their own group, for a change. In a previous blog we highlighted the link between Sovereign credit and Winter Olympic medal wins; here we compare credit quality […]

Risk.Net: June Credit Data Review

“Prospects for the diesel car do not look good. Attempts to rehabilitate the fuel continue, but appear to be running out of time. New emissions tests reportedly show that even new diesel vehicles are pumping out too much nitrogen oxide, and a court in Germany – Europe’s largest car market – recently ruled that cities […]