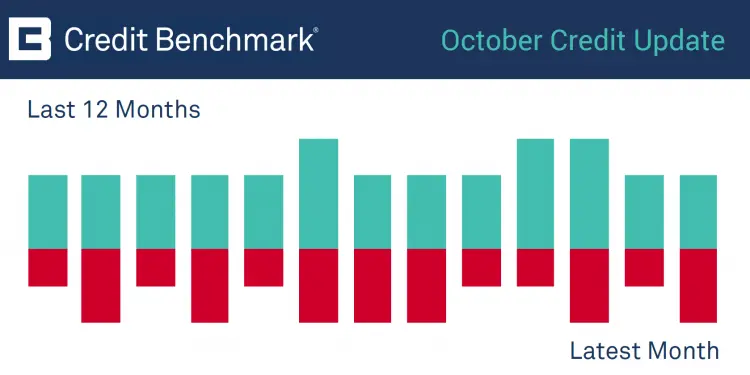

October Credit Update: Consensus Upgrades Outnumber Downgrades

Credit Benchmark has published the latest monthly credit consensus data (from September 2018), with 28 contributor banks. The set of bank-sourced credit views (CBCs*) now covers more than 22,500 separate legal entities. The monthly upgrades and downgrades overview is now based on data adjusted for changes in contributor mix. Monthly consensus upgrades and downgrades: 172 […]

Italian Credit Data Tells An Improving Story

The Italian financial position has been a major driver of market volatility, but credit data suggests that banks are turning more positive. Moody’s now has Italian Sovereign debt at one notch above junk, with a stable outlook; S&P has so far kept it at BBB, but with a negative outlook. The main concern is the […]

Risk.Net: October Credit Data Review

Rising global rates, coupled with trade tensions, have contributed to the recent bout of volatility in emerging markets. Venezuela now has hyperinflation, Argentina is struggling with a renewed currency crisis despite emerging from default two years ago, while Turkey is grappling with high levels of dollar debt and a prolonged devaluation. Even Italy – still […]

Credit Benchmark CEO William Haney Appears on Bloomberg TV

Credit Benchmark CEO William Haney talks about expansion plans on Bloomberg TV with Caroline Hyde and Romaine Bostick. Watch Now

Banking Industry Credit Trends Underpin Recent Equity Moves and Give Clues to Basel 2017 Winners

Bank stocks fell behind the main indices in 2017; but as interest rates rise they are now seeing renewed investor interest across the globe. In revenues and especially in profitability, US banks have dominated the global banking industry in recent years, but European banks are beginning to show signs of earnings improvements. Analysts are still […]

Wholesale Credit Regulations: An Uneven Playing Field for All

The Basel 2017 reforms have highlighted transatlantic differences in the implementation of wholesale banking regulation. There exists a significant gap between banks in the US and the rest of the world; this gap is due to genuine regional, business mix and obligor differences, as well as varying interpretations of the regulations in different jurisdictions, and […]

“Zombie” Companies: Credit Risk Shows The Strain Of Rising Interest Rates

The recent Fed hike has brought renewed focus on the broader impact of rising yield curves. While bond markets have been pushing long term bond yields higher for some time, short term interest rates have been close to zero (or even negative) for a prolonged period. The Fed is not alone in tightening policy – […]

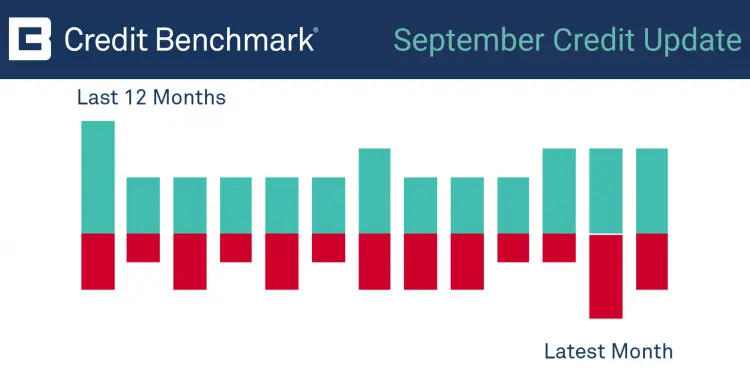

September Credit Update: Consensus Upgrades Outnumber Downgrades

Credit Benchmark has published the latest monthly credit consensus data (from August 2018) from 27 contributor banks. The set of bank-sourced credit views (CBCs*) now covers more than 22,000 separate legal entities. The monthly upgrades and downgrades overview is now based on data adjusted for changes in contributor mix. Monthly consensus upgrades and downgrades: Last […]

Trade Wars Highlight Supply Chain Credit Risks

Global supply chains are only as strong as their weakest links, and current trade tensions are shining a spotlight on operational and financial supply chain risks. Ratings agency Fitch has already cut its growth forecasts due to the knock-on effect of tariffs across the global economy, while the US-China trade war enters a new phase […]

US and European Telecoms: Credit Trends Beginning to Reflect Technology and Pricing Power Risks

Credit risk for the Telecoms sector has been relatively stable but the next few months will be critical in understanding how the balance of power in and around Telcos, Corporates or Big Tech will play out. Major changes in credit risk for Telcos are likely. The global Telecoms sector faces a significant transformation. 5G technology […]