Taking the Pulse of Healthcare Credit

Global Healthcare has had a difficult time in recent years, with Deloitte reporting that global healthcare spending grew by less than 3% in the period 2013-2017. Governments face the challenges of aging populations, increasing longevity, a growing list of chronic health conditions, and increasingly expensive traditional medical technology. The sector has also been hit by […]

German Corporates Well Positioned to Weather Any Downturn

German growth numbers are at a five-year low and a recession looks increasingly likely. German exports are still growing but the rate has been hit by China’s internal and external economic challenges, as well more global trade-related problems. The global auto sector is facing a pause in demand as technology pivots towards electric cars, and […]

US Corporate Bonds and Borrowers – Real Risks May Lurk in the B Category

The large proportion of US Corporate debt in BBB bonds has raised concerns in the financial press that any economic weakness could see a significant proportion of these downgraded to Non-investment Grade. But bonds are only part of the Corporate debt picture; bank-sourced data shows the credit distribution of corporate borrowers that use bank financing, […]

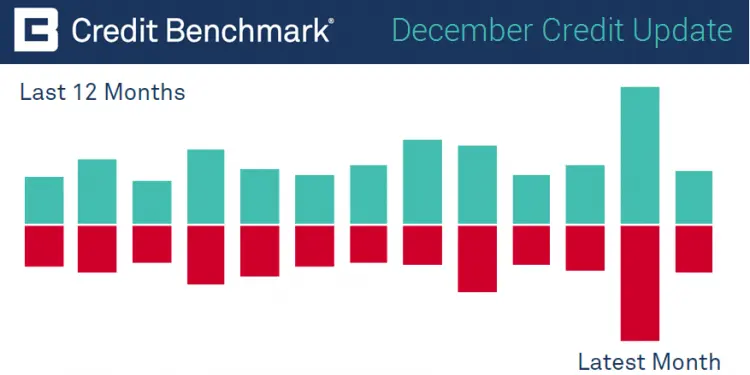

December Credit Update: Consensus Upgrades Outnumber Downgrades

Credit Benchmark has published the latest monthly credit consensus data (from November 2018), with 29 contributor banks. The set of bank-sourced credit views (CBCs*) now covers nearly 24,500 separate legal entities. The monthly upgrades and downgrades overview is now based on data adjusted for changes in contributor mix. Monthly consensus upgrades and downgrades: 190 obligors […]

Risk.Net: December Credit Data Review

In the recent US mid-term elections, both parties claimed enough of the spoils to declare victory – the Democrats regaining control of the House of Representatives, the Republicans tightening their grip on the Senate. But at the halfway point in a deeply divisive administration – one that saw many sectors benefit from a huge fiscal stimulus last year, […]

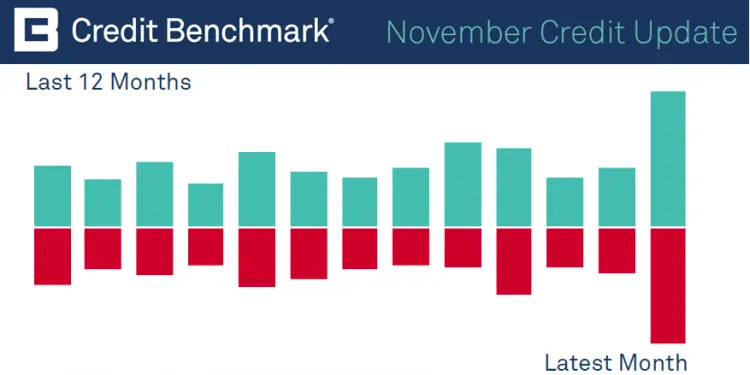

November Credit Update: Consensus Upgrades Outnumber Downgrades

Credit Benchmark has published the latest monthly credit consensus data (from October 2018), with 29 contributor banks. The set of bank-sourced credit views (CBCs*) now covers more than 24,000 separate legal entities. The monthly upgrades and downgrades overview is now based on data adjusted for changes in contributor mix. Monthly consensus upgrades and downgrades: 307 […]

Tech Credit Foundation Still Solid

Recent stock market declines have been led by Technology stocks. In early October, Apple became the first company in history to reach a market value of $1trn; but since then the combined market cap of the FAANG* stocks has lost more than that amount. Apple, in particular, is now officially in bear market territory. Investors […]

Global Oil & Gas Credit Improvement is Slowing

The price of oil has officially entered a bear market, down 25% this year. This includes a drop of 7% this week, surprising many analysts and funds who had been expecting a tighter market for a host of supply-related reasons. The simultaneous dramatic drop in the price of oil alongside an unprecedented 20% gas price […]

Risk.Net: November Credit Data Review

The guillotine and the rack are very different instruments. One does the job quickly: the blade comes down and the head comes off. The rack applies pressure – and pain – for a long, long time. Rate hikes are often seen more as guillotine than as rack, and for equity investors, that’s probably fair enough: […]

US Midterm Results Reflect Major Economic Changes

The US Midterms have been claimed as a victory by both sides, but Trump and Pelosi were both quick to propose a bipartisan approach with a likely focus on infrastructure , trade and healthcare. The Dow jumped on the result, with the expectation of a second, spending-based fiscal boost for the domestic economy as well […]