Risk.Net: A New PD Story for Brazil and Mexico?

For the past two years, there has been a clear story about the credit risk of Brazil and Mexico – a story that may now be on the verge of a twist. According to banks’ probability of default estimates, the former has been getting steadily riskier – slipping from bb+ to bb in early 2017 […]

African State-Owned Enterprises: Credit Trend Reflects Profitability Issues

State-owned enterprises (SOE) in Africa play a vital role in their respective economies – managing natural resources, energy, transportation, and telecommunications – but they often rely heavily on regular capital injections from their governments. South AfricaSouth Africa recently rescued Eskom, the state power monopoly, in the largest bailout in the country’s financial history. Eskom’s financial […]

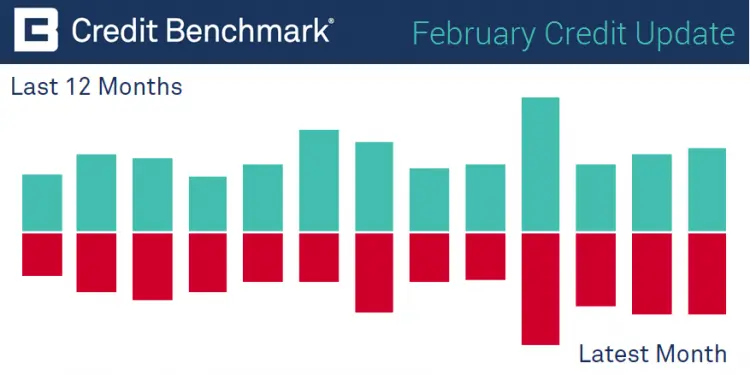

February Credit Update: Consensus Upgrades Continue to Outweigh Downgrades for Financials

Credit Benchmark has published the latest monthly credit consensus data (from January 2019) based on contributions from 30+ financial institutions, covering over 25,500 separate legal entities. The monthly upgrades and downgrades overview is now based on data adjusted for changes in contributor mix. Monthly consensus upgrades and downgrades: 365 obligors improved their credit standing by […]

Gauging The Credit Risk Of Global Car Manufacturers

2019 will be a big year for the auto technology space, with the pivot towards hybrid and electric vehicles underway. Europe, especially Germany, looks to be taking the lead in the auto tech race. VW Group is expecting to sell 3 million full-electric cars by 2025, and Porsche has announced that buyers of its new […]

Will Oil Output Cuts Mean Stronger OPEC Sovereign Credit?

OPEC production cuts agreed in December 2018 as well as US sanctions on Iran and Venezuela have pushed the price of WTI futures to more than $55, the highest level this year. But the group faces major headwinds: Qatar recently left the organization, and some other countries appear to be increasingly ambivalent about membership. OPEC’s […]

Chinese Banks: Will Improving Credit Support Trade Pledges To The US?

The US-China trade talks this month could be critical to the global economic outlook for the next few years. One Chinese proposal is for a sustained reduction in its trade surplus though a combination of monetary and fiscal expansion, in addition to targeted trade incentives. China’s debt levels have been a persistent concern, doubling over […]

Risk.Net: Falling Default Risk For China’s Banks

On London’s Shaftesbury Avenue, a chain of red lanterns hangs outside a branch of the Bank of China, marking the transition to the Year of the Pig – a symbol of fortune and wealth. But growing economic clouds suggest this will be a nervy year for China’s banks. After growing 6.8% in 2017, China’s economy […]

Brazil and Mexico – Are Sovereign Risk Trends About to Change?

The new leaders of the 9th and 15th largest economies in the world face major challenges in 2019, but both are riding waves of popular support and cautious optimism in financial markets. Brazil Brazil’s stock market has risen more than 10% (in USD) so far this year, and the 10-year Government bond yield has dropped […]

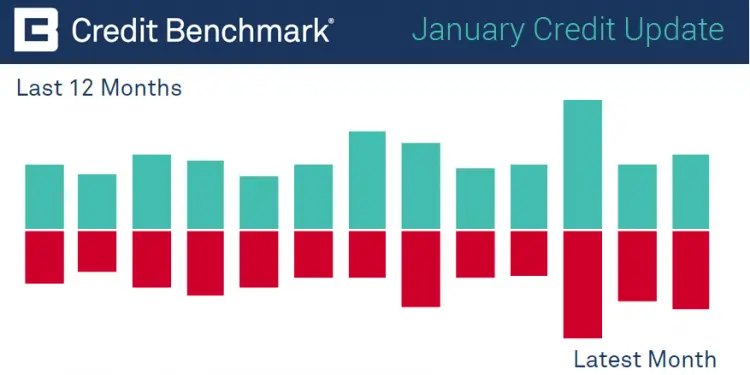

January Credit Update: Consensus Upgrades Outweigh Downgrades for Financials

Credit Benchmark has published the latest monthly credit consensus data (from December 2018), with 30 contributor banks. The set of bank-sourced credit views (CBCs*) now covers over 25,300 separate legal entities. The monthly upgrades and downgrades overview is now based on data adjusted for changes in contributor mix. Monthly consensus upgrades and downgrades: 346 […]

UK Corporate Credit Risk Rising – But Is It Just About Brexit?

Debate about the likely economic impact of Brexit has dominated UK news for weeks. Location changes and business warnings from some high profile UK stalwarts – such as Jaguar Land Rover, Bentley, Dyson and Barclays – suggest growing risks. And the corporate credit risk picture appears to confirm that UK plc faces some challenges which […]