FOMC Meeting and Consensus Credit Views on US Financials

The Federal Reserve’s Federal Open Markets Committee is set to meet this week for the third time this year. Although no interest rate movements are expected, investors will still be watching to see if the Fed will continue its ‘wait and see’ approach. Considering the outcome of the March FOMC meeting reflected a change in […]

U.S. Auto Sales Poised for a Turn?

Following the March J.D. Power and LMC Automotive Forecast showing the slowest Q1 for U.S. auto sales since 2013, the industry hopes to see recovery in sales volumes in the coming months. According to a recent report from global research institute TrendForce, car manufacturers are hoping to see growth in the electric vehicle market. Electric […]

UN World Happiness Report: Does High Sovereign Credit Quality = Happy People?

The UN recently released their 7th World Happiness Report, which ranks 156 countries by how happy their citizens perceive themselves to be. The results of the report are not altogether unsurprising – nations with strong social welfare systems and high GDP per capita tend to sit at the top (the Nordics take 5 of the […]

Credit Benchmark Data Validates the Improving Health of US Oil and Gas

While oil demand is expected to grow moderately in 2019, it is still below the strong growth expected in the non-OPEC supply forecasted for this year. This highlights the continued responsibility of participating oil-producing countries to avoid a relapse of the imbalance, and to continue to support oil market stability in 2019. Recent healthier data […]

Risk.Net: UK Banks Hold Firm as Brexit Looms

The UK’s bumpy Brexit joyride has left London’s financial firms on edge. UK banks have set aside more than half a billion pounds to cover Brexit-related credit losses. Liquidity buffers have been reinforced, to the tune of £53 billion, at the insistence of the Bank of England. Assets are being shifted to the European Union, en masse. The credit market’s […]

Will Chinese Investment in Italy be a Game Changer?

Recently Italy and China signed a “memorandum of understanding” announcing their intentions to work together on China’s massive investment and infrastructure project, the Belt and Road Initiative (BRI). This would make Italy the first G7 country to agree to a cooperation package under the BRI program covering transport, infrastructure and – controversially – an extension […]

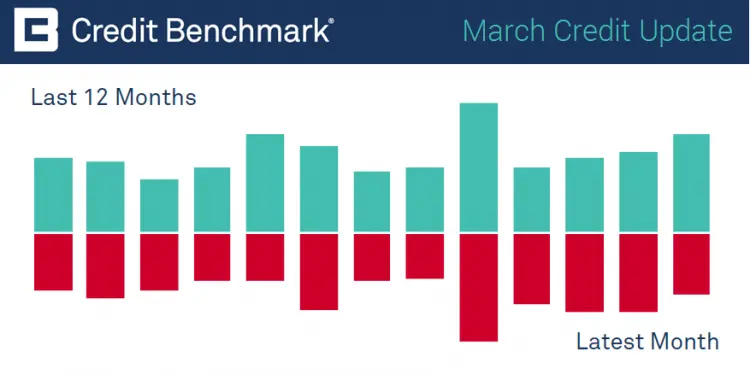

March Credit Update: Consensus Upgrades Outweigh Downgrades

Credit Benchmark has published the latest monthly credit consensus data (from February 2019) based on contributions from 30+ financial institutions, covering over 27,200 separate legal entities. The monthly upgrades and downgrades overview is now based on data adjusted for changes in contributor mix. Monthly consensus upgrades and downgrades: Last month showed improvements across 365 obligors […]

Q1 U.S. Auto Sales Stalling

According to the March J.D. Power and LMC Automotive Forecast, U.S. auto sales are off to the slowest Q1 start since 2013. The forecast cites weather, mixed economic data and lower tax refunds as factors causing the falling sales. Further, auto companies face mounting pressure from the Trump administration to manufacture in America. While sales […]

Credit Outlook: US Large Consumer Goods

The charts show Credit Benchmark’s credit risk data on Large Consumer Goods companies in the US sourced from 30+ of the world’s leading financial institutions. After a period of steady deterioration, the credit outlook for US Large Consumer Goods industries has recently improved. Consumer-driven sectors have been hit by some heavy corporate debt burdens and […]

Sovereign Credit Increasingly Volatile

Sovereign credit risk is important: not only do changes in government borrowing rates affect public funding, these same rates impact investment portfolios broadly. Sovereign risks serve as fundamental inputs to the analysis of most entities, especially corporate and financials. Sovereign credit risk is typically driven by country-specific factors, like the current situation in Venezuela, although […]