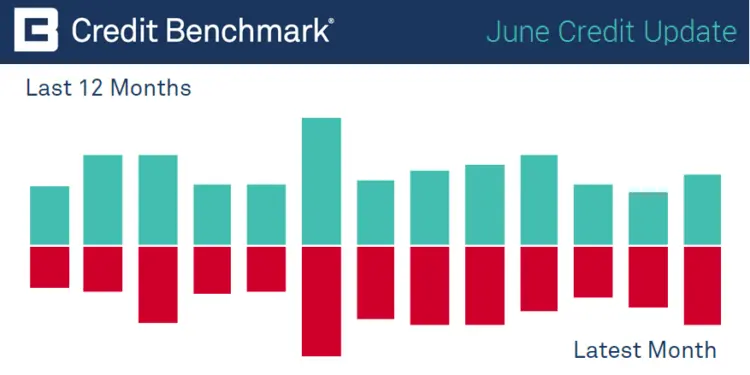

June Credit Update: Consensus Corporate Downgrades Outweigh Upgrades

Credit Benchmark has published the latest monthly credit consensus data (from May 2019) based on contributions from 40+ financial institutions, covering 50,000 separate legal entities. The monthly upgrades and downgrades overview is now based on data adjusted for changes in contributor mix. Monthly consensus upgrades and downgrades: Last month showed improvements across 261 obligors and […]

Risk.Net: More Trouble in the Oil and Gas Pipeline

Oil and gas lenders tend to be a stoic bunch. But even the hardiest among them could be forgiven for feeling rattled these days… …Brent crude has risen by a fifth in the past few months, see-sawing between just below $50 a barrel and as high as $86.74 in a wide 52-week range… …On paper, […]

Credit Quality of US Housing; Is Market Built From Bricks or Straw?

Download PDF Cracks are beginning to show in the foundations of the US Housing market, with the National Association of Realtors reporting a reduction of 4.4% in total sales from a year ago, and a rising housing inventory up by 3.6% in the same year. Excess housing stock plus falling sales is an unwelcome combination […]

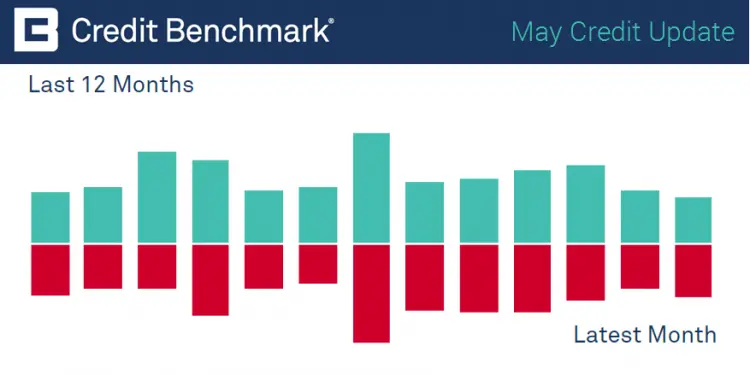

May Credit Update: Consensus Upgrades and Downgrades are in Balance

Credit Benchmark has published the latest monthly credit consensus data (from April 2019) based on contributions from 30+ financial institutions, covering over 27,600 separate legal entities. The monthly upgrades and downgrades overview is now based on data adjusted for changes in contributor mix. Monthly consensus upgrades and downgrades: Last month showed improvements across 267 obligors […]

Is Brexit Driving Major Regional Credit Differences in UK SMEs?

The Brexit vote has had a major impact on the credit quality of British industry over the past three years. Credit Benchmark has regularly reported on the declining credit health of a range of UK Sectors, including Auto Companies, Retailers, Large Corporates, Healthcare, and Telecomms. The UK has experienced uncertainty since the vote took place in June 2016, and with no […]

Automotive Bubble Shows Signs of Deflation for US, UK, EU Companies

The challenges facing the automotive industry are well known. Investment into electric and driverless vehicles presents a formidable looming cost for car manufacturers, and some companies have announced partnerships in order to manage the enormous sums required for future development. Fiat-Chrysler and Renault have recently proposed a €36.2bn transformative merger, while Daimler and BMW have […]

Who are the Winners and Losers in Retail & Consumer Goods?

Another day, another store closing – this is the current environment for UK retailers, with the Arcadia Group announcing this week the closure of 23 stores including Topshop, Dorothy Perkins and Miss Selfridge. These closures follow recent announcements that M&S will close 100 stores by 2022, and Debenhams’ ongoing administration woes. Some retailers are determined […]

Political Tensions Create Uncertainty in Global Oil & Gas

Oil is a temperamental commodity at the best of times, with prices heavily influenced by the slightest fluctuations in supply. The US is currently acting as the proverbial cat amongst the pigeons, with its sanctions on Iran and ongoing trade negotiations with China. If the talks go sour, diminished Chinese economic activity and thus a […]

Risk.Net: Worrying Trends in Sovereign Risk

Sovereign credit risk is a complex beast. It is often country—specific, but can also be driven by regional and global themes. Currently, all three factors are in play. Looking ahead, changing geopolitical alliances, trade flows and supply chains will have a more profound and far-reaching effect. It all adds up to a more volatile environment […]

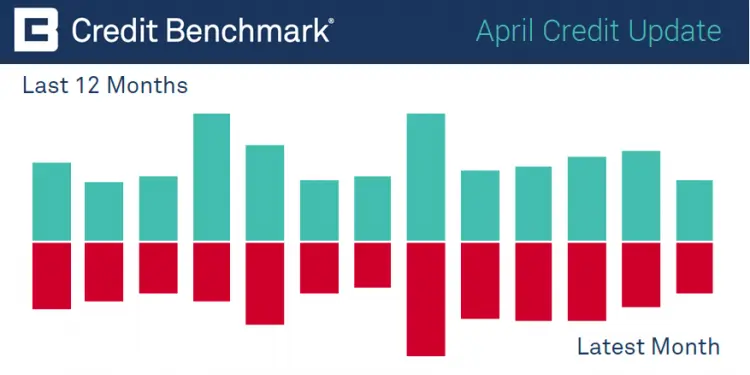

April Credit Update: Consensus Upgrades and Downgrades are in Balance

Credit Benchmark has published the latest monthly credit consensus data (from March 2019) based on contributions from 30+ financial institutions, covering over 27,400 separate legal entities. The monthly upgrades and downgrades overview is now based on data adjusted for changes in contributor mix. Monthly consensus upgrades and downgrades: Last month showed improvements across 415 obligors […]