Risk.net: No-deal Brexit Threatens UK Retail Sector

The UK retail sector could be particularly vulnerable to a no-deal Brexit. New UK prime minister Boris Johnson’s vow to leave the European Union on October 31 with or without a withdrawal agreement has driven fresh weakness in sterling, reducing local purchasing power and quite possibly undermining consumer sentiment. The GfK consumer confidence survey for July shows expectations […]

Will Trade Tensions Cause Trade Credit Insurance Costs to Rise?

Book a Demo A chain is only as strong as its weakest link – and with international political tensions causing disruption to trade networks worldwide, global supply chains are being put to the test. The US-China trade war has triggered major readjustments to existing global supply chain networks. US Farmers have seen a 38% […]

July Credit Update: Consensus Upgrades and Downgrades are in Balance

Download PDF Credit Benchmark has published the latest monthly credit consensus data (from June 2019) based on contributions from 40+ financial institutions, covering 50,000 separate legal entities. The monthly upgrades and downgrades overview is now based on data adjusted for changes in contributor mix. Monthly consensus upgrades and downgrades: Last month showed improvements across 356 […]

Lenders Tap the Brakes on Auto Companies as Sales Lose Momentum

Download PDF Auto sales for July are expected to decrease by 1.8% compared to a year ago, according to the most recent J.D. Power and LMC Automotive forecast. The gloomy outlook is supported by Cox Automotive, who have reported a 2.2% decrease in sales for the first half of 2019 and are expecting an even larger reduction […]

Risk.net: China, US Corporates Feeling Trade Tensions

The G20 meeting in Osaka at the end of June brought a clutch of positive developments in the trade war between China and the US – a resumption of talks that had broken down in May, an accompanying ceasefire on new tariffs and a partial lifting of the US blockade of telecoms giant Huawei. No-one […]

July Credit Consensus Indicators (CCIs) – US, UK and EU Industrials

Credit Benchmark have released the July Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 30,000 credit analysts at 40 of the world’s leading financial institutions. Drawn from more than 750,000 contributed credit observations, the CCI tracks the […]

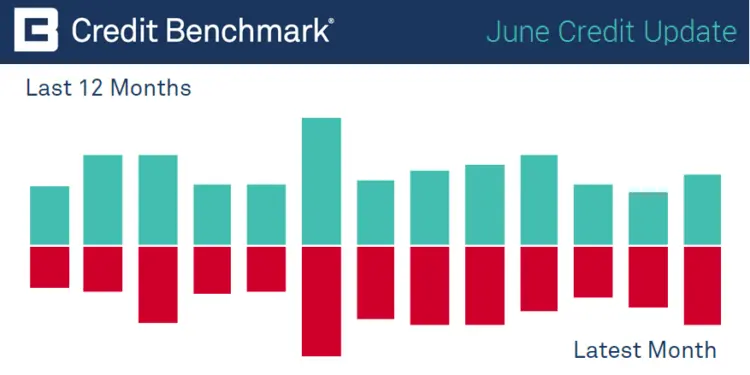

June Credit Update: Consensus Corporate Downgrades Outweigh Upgrades

Credit Benchmark has published the latest monthly credit consensus data (from May 2019) based on contributions from 40+ financial institutions, covering 50,000 separate legal entities. The monthly upgrades and downgrades overview is now based on data adjusted for changes in contributor mix. Monthly consensus upgrades and downgrades: Last month showed improvements across 261 obligors and […]

Global Credit Chartbook

Download Chartbook Political and economic factors have driven some major changes in credit over the last year. Trade disputes, geopolitical tensions and climate change have all played a role in steering the credit quality of international industry. Credit Benchmark’s global credit Chartbook draws on the credit risk views of 30,000 expert analysts from 40+ leading […]

Credit Benchmark Launches Credit Consensus Indicator – New Monthly Measure of Credit Risk for US, UK and EU Industrials

Credit Benchmark, the leader in consensus based credit analytics, today announced the launch of a new monthly measure of credit risk for US and European corporates in the industrials sector. The Credit Benchmark Credit Consensus Indicator (CCI) is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views […]

Risk.Net: More Trouble in the Oil and Gas Pipeline

Oil and gas lenders tend to be a stoic bunch. But even the hardiest among them could be forgiven for feeling rattled these days… …Brent crude has risen by a fifth in the past few months, see-sawing between just below $50 a barrel and as high as $86.74 in a wide 52-week range… …On paper, […]