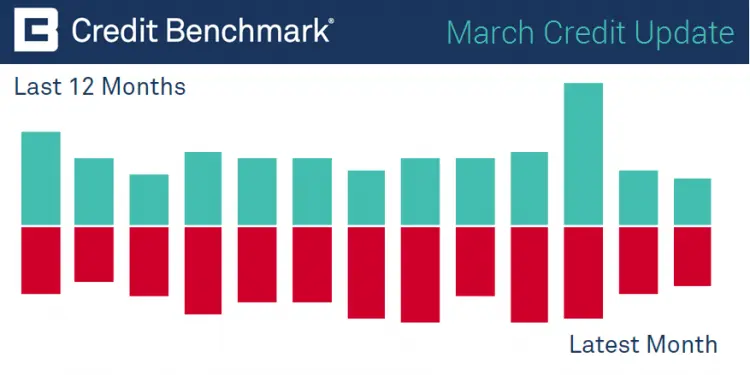

March Credit Update: Pre-Virus Financial Upgrades Outweigh Downgrades

Download PDF Credit Benchmark has published the latest monthly credit consensus data (from February 2020) based on contributions from 40+ financial institutions, covering 50,000 separate legal entities. The monthly upgrades and downgrades overview is now based on data adjusted for changes in contributor mix. Monthly consensus upgrades and downgrades: Last month showed improvements across 331 […]

Stimulus Promises May Tip the Balance on Sovereign Credit Risk

As COVID-19 unfolds, governments have announced unprecedented stimulus and support packages. Once the dust has settled and the money has been distributed, what view will lenders take on the creditworthiness of these sovereigns?

Auto Industry Credit Quality Declines in US & UK

The global automotive industry has felt the immediate impact of the COVID-19 economic slump, with factories across the world halting production or being hamstrung by supply-chain disruptions, whilst consumer demand rapidly shrinks. US auto sales are expected to fall by at least 15% this year, and a reported 95% of all US auto production has […]

Oil & Gas Credit Risk is Rising for US, UK

Default Risk for US Firms Up More Than 7% in Last Year US Oil & Gas The credit situation for large US oil & gas firms keeps getting worse. Credit quality for this sector has declined by 1% on a month-over-month basis and 7.4% on a year-over-year basis. The majority of this deterioration has happened […]

When Is Credit Data Not Credit Data? When It’s Liquidity Data

In the midst of a major global credit and liquidity transition, the Credit Benchmark dataset can help clients understand how this transition is happening. It is now evident that sometimes credit data is not just credit data – it can also provide valuable liquidity and solvency insight too.

Trade Credit Risk: Which Sectors Are Most Vulnerable During the Virus Crisis?

Download Report Private insurers to become increasingly selective in financial crisis The Trade Credit Insurance market currently handles about $2trn of revenue at risk annually. Most of this is focused on smaller companies that may be critical suppliers or buyers, but who also represent significant risks for operational or credit reasons. Some of these risks […]

March Credit Consensus Indicators (CCIs) – UK, EU and US Industrials

Credit Benchmark have released the March Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 20,000 credit analysts at 40 of the world’s leading financial institutions. Drawn from more than 800,000 contributed credit observations, the CCI tracks the […]

Bank Lenders Sound Alarm on Corporate Credit Risk – One-Third of BBB-Rated Bonds on Precipice of High-Yield Bond Cliff

US corporate debt is notoriously overrepresented in the ‘BBB’ rating category, and investors fear that economic pressure could topple these bonds Jenga-style into high-yield status. Enter coronavirus – the rapid spread of the disease has caused a sharp shock to global markets and a swathe of industries are vulnerable to take a profit hit as […]

Housing Credit Risk for US, UK Remains Vulnerable

The crucial upcoming spring season of home buying and selling may be under threat from the economic downturn posed by the spread of COVID-19. Though low interest rates pose a strong incentive for mortgage borrowers, the economic uncertainty may prove too strong a deterrent for some buyers. Both buyers and sellers are also likely to […]

Risk.net: Rising Tide Lifts Fund Houses – But Can it Last?

Monthly Credit Trends for Top 100 Fund Managers, Global Airlines & Airports, Australian Corporates, and Irish Corporates & Financials.