COVID Crisis Continues to Shuffle the Deck on Corporate Credit Quality

The COVID-19 crisis continues to spark a great deal of volatility in corporate credit sentiment. The ranks of Fallen Angels (companies that have fallen from investment-grade to high-yield status) and Rising Stars (from high-yield to investment-grade) have

fluctuated over the course of the last 12 months.

Some Global Airlines Are Pulling Out of Credit Default Risk Tailspin

Download PDF The COVID-19 pandemic has not been kind to global airline credit quality. As of February 2021, a total of 21 major global airlines have been downgraded to high yield (HY) status since the start of the pandemic, according to Credit Benchmark data. But that grim statistic does not tell the full story. A […]

The Bust and the Boom: Sectors to Watch as Lockdown Eases

The economic damage of the pandemic is far from over, but some sectors are showing the leading indicators of their future recovery.

February 2021 Industry Monitor

Credit Benchmark have released the industry update for end-January, based on the final and complete set of the contributed credit risk estimates from 40+ global financial institutions.

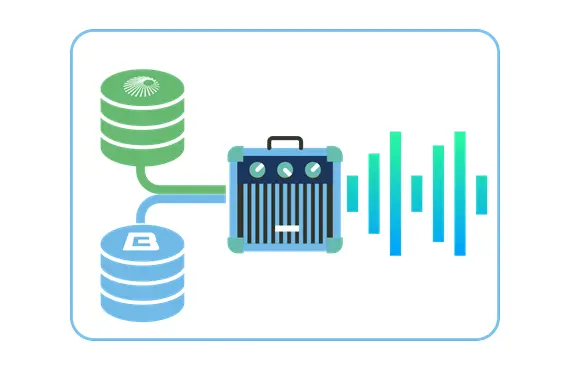

Predictive Information for Tradable Securities

Get unique additional factor model performance by integrating IHS Markit securities lending data with Credit Benchmark consensus credit risk data. Independent research shows that Credit Benchmark credit consensus data complements and enhances IHS Markit’s short factor data when combined in constructing portfolios. This combination provides enhanced signals in both US and European equity markets, and […]

February Credit Consensus Indicators (CCIs) – UK, EU and US Industrials

Credit Benchmark have released the February Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 20,000 credit analysts at 40 of the world’s leading financial institutions. Drawn from more than 800,000 contributed credit observations, the CCI tracks the […]

February 2021 Fund Monitor

Request your free copy of the latest Fund Monitor below. The lack of easily accessible, reliable credit rating information on the vast majority of Funds leads to missed commercial opportunities and frustrating backlogs in onboarding, Know Your Customer (KYC), Agency Lending Disclosure (ALD) and Operational Due Diligence (ODD) processes. Credit Benchmark Credit Consensus Ratings fill this important […]

Gap Widens Between US and UK Retail Risk: February 2021

To download the February 2021 Retail Aggregate PDF, click here. Will the Divide Between US and UK Retail Become a Chasm? A growing divide in credit quality and default risk for the US and UK retail sectors emerged in recent years. Since Credit Benchmark began tracking data on the retail sector, default risk has been […]

Oil & Gas Sector – Still Not Out of the Woods?

The Oil & Gas sector was in trouble even before the first Covid lockdown, and it was one of the worst credit performers in 2020. Recent credit agency downgrades for some of the US majors have brought these ratings into alignment with the more conservative bank consensus view.

End-January 2021 Financial Counterpart Monitor

The Financial Counterpart Monitor from Credit Benchmark provides a unique analysis of the changing creditworthiness of financial institutions. The report, which covers banks, intermediaries, buy-side managers, and buy-side owners, summarizes the changes in credit consensus of each group as well as their current credit distribution and count of entities that have migrated from Investment Grade […]