Energy Sector Credit Quality Maintains Stability: September 2021

The outlook for major energy sectors ranges from good to under-performing. The US energy sector is seeing improvement in its credit though with a small blip this month. Meanwhile, the UK has seen slight improvement, and the EU has seen slight deterioration.

September Credit Consensus Indicators (CCIs) – UK, EU and US Industrials

Credit Benchmark have released the September 2021 Credit Consensus Indicators (CCIs). The latest forward-looking consensus data confirms the notion that an improving trend in industrials may be slower or more uneven than previously anticipated.

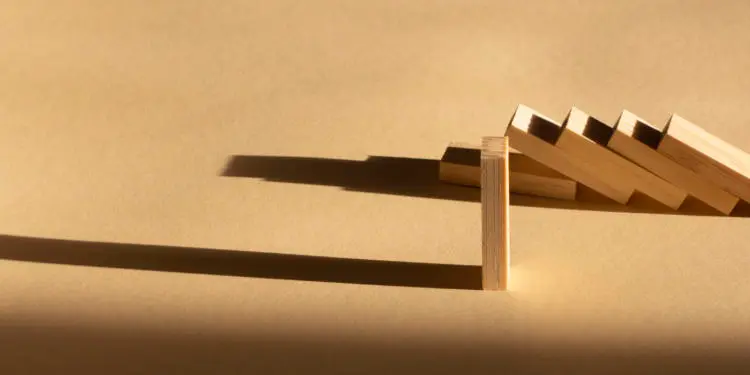

Survival of the Fittest in the Leveraged Loan Market

There are fears that investors in the broader high yield space are not being properly compensated for the risks. Though recent private equity investments have focused on firms that have weathered the pandemic with stable revenues and strong cash flows, which could boost the average credit quality of leveraged loan assets, the latest consensus credit data shows a more mixed picture.

September 2021 Industry Monitor

Credit Benchmark have released the latest end-month industry update, based on the final and complete set of the contributed credit risk estimates from 40+ global financial institutions.

Steady Improvement for US, UK Retail: September 2021

The retail sector is enjoying some long-awaited good fortune. According to the latest consensus data, credit risk has improved for both the US and UK retail sectors.

Marine Transportation: Turning the Credit Tide?

Shipping container unit costs have skyrocketed and delivery times doubled in the past 18 months, with the pandemic causing port closures, trade flow disruptions and capacity reductions. Consensus credit data tracks the credit trend of Global Marine Transportation companies and suggests that the sector may be a leading indicator for broader corporate credit risk.

Fallen Angels and Rising Stars: Shifting Corporate Credit

Credit volatility remains in the picture for global corporates. The latest consensus data show increases in both the number of Fallen Angels – companies that have seen their credit scores fall from investment-grade to high-yield status – and Rising Stars – companies that have risen from high-yield to investment grade.

Prolonged Credit Turbulence for Global Airlines

Air travel is currently running at about 50% of its pre-pandemic peak and the sector still faces uncertainty from new virus variants, patchy tourism traffic and a shift in business travel norms. While many Global Airlines are unrated by traditional agencies, consensus credit risk data shows that 80% of the sector is below investment grade – but some remain good credit risks.

August Credit Consensus Indicators (CCIs) – UK, EU and US Industrials

Credit Benchmark have released the August 2021 Credit Consensus Indicators (CCIs). There is reason for optimism in the latest CCI data. Scores for the UK, EU, and US are all above 50.

Credit Strength Dampens Wildfire Risk for US Electricity Firms

Wildfires are growing in intensity and frequency, and in the US are sometimes attributed to outdated electricity infrastructure, presenting a legal hurdle for companies in the sector. Addressing these issues requires investment, and companies with stronger credit ratings are better placed to fund the necessary capital spending. This note looks at the credit profile and recent trends for 371 US electricity companies.