Bank stocks fell behind the main indices in 2017; but as interest rates rise they are now seeing renewed investor interest across the globe. In revenues and especially in profitability, US banks have dominated the global banking industry in recent years, but European banks are beginning to show signs of earnings improvements. Analysts are still concerned about restructuring, litigation and developing market headwinds in Europe, but this is now being mitigated by multiple rumours of mergers and acquisitions. European banks are particularly sensitive to a positively sloping yield curve, and the ECB is lagging behind the Fed in tightening short rates.

However, investors need to be selective: Dodd-Frank amendments and Basel 2017 rules have created an uneven transatlantic playing field, and both American and European banks have been lobbying regulators on competition issues. For European banks, a key challenge is the Dodd-Frank reform that can ease stress tests and capital requirements for US banks with assets of less than $250bn. This puts a number of medium to large European banks – Deutsche, Credit Suisse, Barclays, and most of the large French banks – at a potential disadvantage vs. their US competitors. Some Canadian and Japanese banks will also fall into this category.

But US banks face some competitive distortions in the Basel 2017 rules on RWA weights. European banks now enjoy considerable capital relief for lending to companies with low credit risk (AA, AA and A); which will encourage a much-needed skew towards improved loan book quality. US banks have a modest RWA advantage in the large BBB category, and have a strong incentive to lend to the low-quality B and C categories. It is only in the BB category that they compete on equal terms.

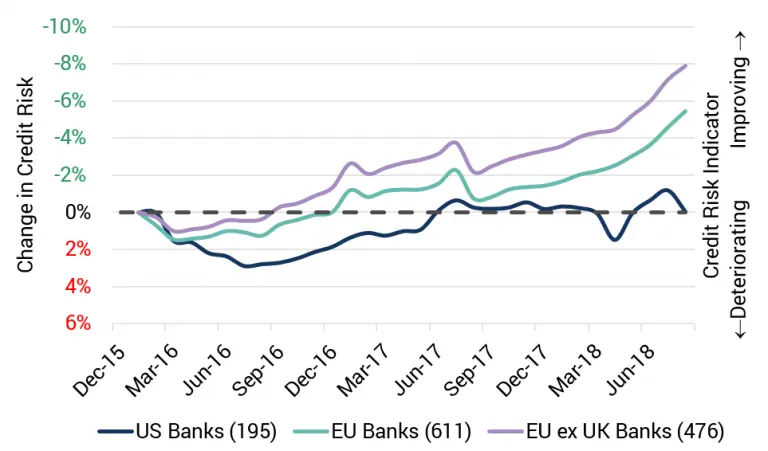

The chart below shows that the past 12 months have seen a modest improvement in global bank credit risk, and the EU (ex UK) is the main beneficiary.

Basel 2017 rules appear to be opening up opportunities for high quality balance sheet expansion in Europe. US banks are eyeing up opportunities in lower quality European borrowers, and the Dodd-Frank reforms will help them compete against medium to large European banks across the credit spectrum. With interest rate tightening still in its early stages and rumours of multiple mergers, the global banking sector is likely to see some dramatic changes over the next 12 months.

A recent Credit Benchmark report, “Wholesale Credit Regulations: An Uneven Playing Field for All” looks at the implications of these regulatory differences in detail, and uses bank-sourced credit data to highlight transatlantic differences in bank assessments of credit risk.