The challenges facing the automotive industry are well known. Investment into electric and driverless vehicles presents a formidable looming cost for car manufacturers, and some companies have announced partnerships in order to manage the enormous sums required for future development. Fiat-Chrysler and Renault have recently proposed a €36.2bn transformative merger, while Daimler and BMW have signed a memorandum of understanding to develop autonomous-driving technology together.

The German automotive industry is determined not to be left in the dust cloud of US technological innovation, with plans to invest around €60bn into electric vehicles over the next 3 years. Estimates place US maker Tesla 2-3 years ahead of their German rivals, with electric vehicle sales reflecting their competitive edge – Tesla even outsells some of the luxury combustion engine models made by BMW and Lexus.

Tech revolution aside, the ripple of unease caused by ongoing US trade conflict has not left Global Auto unaffected. Firms like BMW who manufacture in the US and export to China are seeing their sales suffer as a result of trade sanctions, and car makers are eying off alternative parts producers in countries like Mexico in the event that tariffs for Chinese suppliers persist.

Despite the daunting outlook, auto sales have been quite robust in recent years, with sales from the combined top 17 global manufacturers hitting a record €107bn in 2017. Even Volkswagen has weathered their diesel emissions scandal better than expected, announcing a 3.1% rise in revenues in Q1 2019. But the bubble is showing signs of deflation – the May J.D. Power and LMC Automotive Forecast reported that US sales have declined for a fifth consecutive month, down 5.2% compared to May 2018.

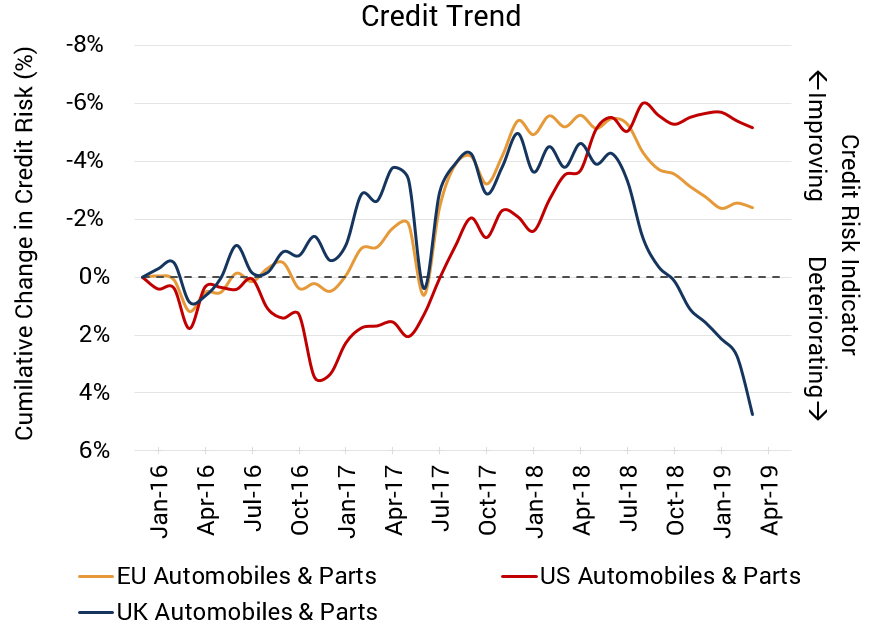

Credit Benchmark consensus credit risk data, sourced from 40+ of the world’s leading financial institutions, supports this hint of pessimism. The credit trend for US Automobiles & Parts companies has been stagnant over the past year, following a steep ascent towards improvement between late 2016-mid 2018. European companies saw growth over the same period as their US counterparts, but their decline in credit quality starting in April 2018 has been more pronounced. UK auto companies, much like many of their corporate compatriots, have not fared well with Brexit pressures adding to the aforementioned Auto climate – a sharp descent in credit quality can be observed from early 2018 and persists today.

.