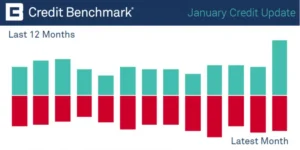

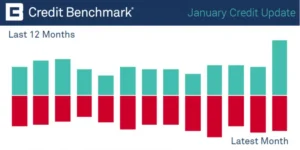

January Credit Update: Consensus Upgrades Outweigh Downgrades

Download PDF Credit Benchmark has published the latest monthly credit consensus data (from December 2019) based on contributions from 40+ financial institutions, covering 50,000 separate

Follow:

Download PDF Credit Benchmark has published the latest monthly credit consensus data (from December 2019) based on contributions from 40+ financial institutions, covering 50,000 separate

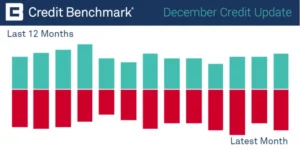

Credit Benchmark has published the latest monthly credit consensus data (from November 2019) based on contributions from 40+ financial institutions, covering 50,000 separate legal entities.

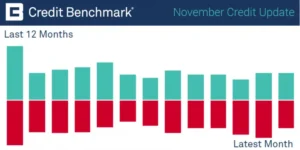

Credit Benchmark has published the latest monthly credit consensus data (from October 2019) based on contributions from 40+ financial institutions, covering 50,000 separate legal entities.

The value of leveraged loans outstanding has more than doubled in recent years, from $600bn in 2012 to $1.4tn in 2018. This jump in issuance

Download PDF Credit Benchmark has published the latest monthly credit consensus data (from September 2019) based on contributions from 40+ financial institutions, covering 50,000 separate

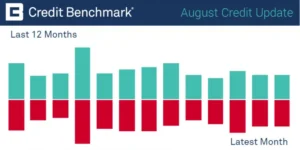

Download PDF Credit Benchmark has published the latest monthly credit consensus data (from August 2019) based on contributions from 40+ financial institutions, covering 50,000 separate

Download PDF Credit Benchmark has published the latest monthly credit consensus data (from July 2019) based on contributions from 40+ financial institutions, covering 50,000 separate

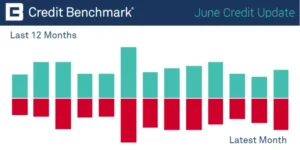

Download PDF Credit Benchmark has published the latest monthly credit consensus data (from June 2019) based on contributions from 40+ financial institutions, covering 50,000 separate

Credit Benchmark has published the latest monthly credit consensus data (from May 2019) based on contributions from 40+ financial institutions, covering 50,000 separate legal entities.

Credit Benchmark has published the latest monthly credit consensus data (from March 2019) based on contributions from 30+ financial institutions, covering over 27,400 separate legal

Credit Benchmark brings together internal credit risk views from over 40 leading global financial institutions. The contributions are anonymized, aggregated, and published in the form of consensus ratings and aggregate analytics to provide an independent, real-world perspective of credit risk. Risk and investment professionals at banks, insurance companies, asset managers and other financial firms use the data for insights into the unrated, monitoring and alerting within their portfolios, benchmarking, assessing and analyzing trends, and fulfilling regulatory requirements and capital.

Please complete the form below to arrange a demo.