Global Credit Chartbook

Download Chartbook Political and economic factors have driven some major changes in credit over the last year. Trade disputes, geopolitical tensions and climate change have

Follow:

Download Chartbook Political and economic factors have driven some major changes in credit over the last year. Trade disputes, geopolitical tensions and climate change have

Credit Benchmark, the leader in consensus based credit analytics, today announced the launch of a new monthly measure of credit risk for US and European

Download PDF Cracks are beginning to show in the foundations of the US Housing market, with the National Association of Realtors reporting a reduction of

Credit Benchmark has published the latest monthly credit consensus data (from April 2019) based on contributions from 30+ financial institutions, covering over 27,600 separate legal

The Brexit vote has had a major impact on the credit quality of British industry over the past three years. Credit Benchmark has regularly reported

The challenges facing the automotive industry are well known. Investment into electric and driverless vehicles presents a formidable looming cost for car manufacturers, and some

Another day, another store closing – this is the current environment for UK retailers, with the Arcadia Group announcing this week the closure of 23

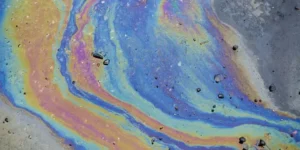

Oil is a temperamental commodity at the best of times, with prices heavily influenced by the slightest fluctuations in supply. The US is currently acting

Waters Technology reports that Credit Benchmark has appointed former Goldman Sachs chief risk officer Craig Broderick to set up and lead a new advisory board.

The UN recently released their 7th World Happiness Report, which ranks 156 countries by how happy their citizens perceive themselves to be. The results of

Credit Benchmark brings together internal credit risk views from over 40 leading global financial institutions. The contributions are anonymized, aggregated, and published in the form of consensus ratings and aggregate analytics to provide an independent, real-world perspective of credit risk. Risk and investment professionals at banks, insurance companies, asset managers and other financial firms use the data for insights into the unrated, monitoring and alerting within their portfolios, benchmarking, assessing and analyzing trends, and fulfilling regulatory requirements and capital.

Please complete the form below to arrange a demo.