All Reports, News & Insights Archives

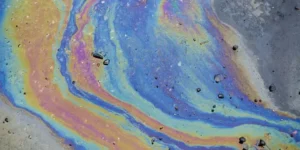

Credit Spotlight on Global Oil & Gas

Credit risk was volatile for Global Oil & Gas producers in 2024 and global supply is expected to exceed demand in 2025, subject to strong geopolitical influences. This analysis from Credit Benchmark reviews global credit trends across a range of Oil & Gas sectors with a view to the year ahead.

FILTER:

ARCHIVES:

SEARCH:

Who are the Winners and Losers in Retail & Consumer Goods?

Another day, another store closing – this is the current environment for UK retailers, with the Arcadia Group announcing this week the closure of 23

Political Tensions Create Uncertainty in Global Oil & Gas

Oil is a temperamental commodity at the best of times, with prices heavily influenced by the slightest fluctuations in supply. The US is currently acting

Risk.Net: Worrying Trends in Sovereign Risk

Sovereign credit risk is a complex beast. It is often country—specific, but can also be driven by regional and global themes. Currently, all three factors

Point-in-Time PD Curves: IFRS9 / CECL Applications

In the era of increased regulatory scrutiny, banks and other lenders have a growing need for Point-in-Time default risk estimates to satisfy IFRS9 and CECL

April Credit Update: Consensus Upgrades and Downgrades are in Balance

Credit Benchmark has published the latest monthly credit consensus data (from March 2019) based on contributions from 30+ financial institutions, covering over 27,400 separate legal

FOMC Meeting and Consensus Credit Views on US Financials

The Federal Reserve’s Federal Open Markets Committee is set to meet this week for the third time this year. Although no interest rate movements are