Goldman Sachs forecast an AI benefit of 7% pa growth in Global GDP – and with powerful innovations appearing almost daily, this seems possible. But The Economist quotes Robert Solow who in 1987 said the computer age is …“everywhere except for the productivity statistics”. They also suggest that equity markets are unconvinced – a basket of “Implementing or Pursuing AI technology” firms has underperformed the MSCI World index by more than 20% in the past year.

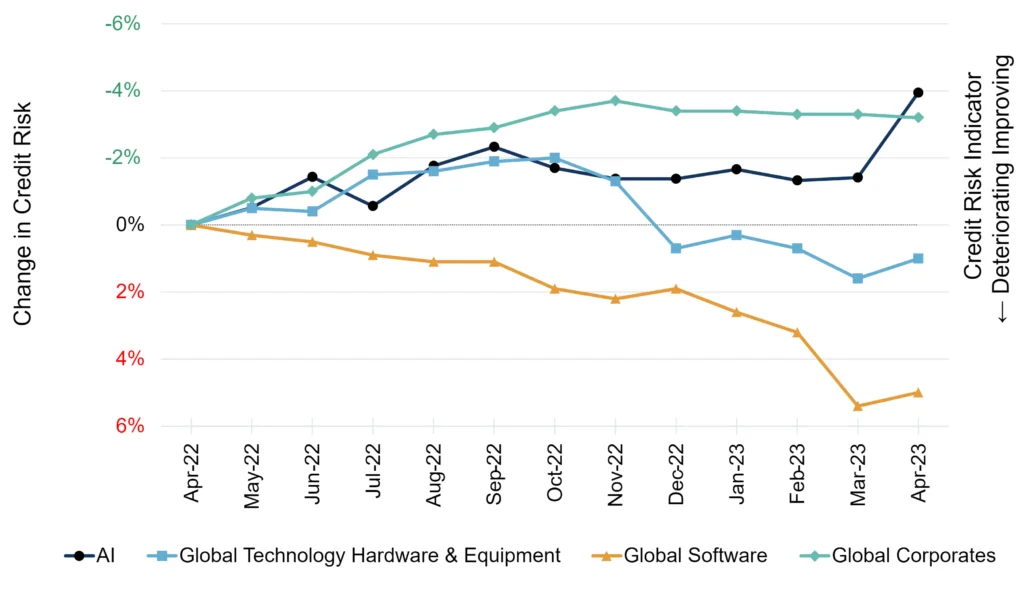

In credit terms, the Credit Benchmark universe of around 70 AI-focused or AI-driven companies is keeping pace with Global Corporates, while Software and Hardware have slipped behind, with Software showing a steep decline in Q1 2023 months. Latest data show across the board technology credit improvements, led by AI companies. The Economist AI basket underperformance suggests immediate earnings growth will be elusive, but credit data suggests that AI firms have stronger prospective balance sheets than tech companies generally.

Generative AI is profoundly disruptive – huge opportunities for some, existential threats for other, and Big Tech sees it as a winner-takes-all arms race. Some roles, like teaching, copywriting, customer support and even song writing are at immediate risk; but scope for self-replicating malicious software, DIY legal documents and new forms of spam could bury some of the compensating benefits. AI may both free up and absorb time – the latest GPT release includes plagiarism detection, an AI solution to a problem that AI created.

Large-language model AI is only part of the picture; forms of AI for data analysis has been in use for years, but as technology develops it is likely that combined language and data models will provide the same functions as doctors, engineers, and scientists. Markets may be sceptical, but consensus credit trends support the idea that if AI frees up more resource in some fundamental areas, then Goldman’s projections may be achievable.