At the recent RiskMinds Americas conference in Chicago, a number of presentations suggested that the banking industry is in better shape, overall, than it was in 2006-08. Withdrawal from non-core markets, a strong focus on cost control, and a rebuilding of capital reserves have eased concerns about the systemic impact of a future crisis.

Asian banks sustained less damage that their European and American counterparts in 2008. But while they avoided the worst of the securitization crises, they are not immune to credit cycles. Bad loans – in real estate, energy and shipping – are a growing problem across the region. And there are other issues, which are more specific to each country.

The Credit Benchmark dataset is quorate on nearly 200 banks across the region and portfolio data extends to thousands of obligors.

Some of the recent trends for the majors:

• Japanese banks are facing two main issues: negative interest rate margins and patches of deteriorating loan quality, especially in the energy sector. Moody’s recently assigned a ‘stable’ outlook but highlighted concerns over the impact of negative interest rates, especially on JGB holdings. Those holdings are one reason for the current negative view from Fitch, mainly because they downgraded the Japanese government earlier this year. The negative interest margin has led to losses in net interest income; European banks have a similar negative rate problem but the impact on their net interest income is smaller. Against this backdrop, a stable outlook is a significant achievement.

• Chinese banks were hit by commodity price volatility and an economic slowdown in late 2015, prompting the Chinese government to increase its stakes in a number of banks and force through some rule changes which require lenders to make provisions for bad debt transfers. Moodys’ have highlighted systemic risk due to overdependence on wholesale funding in the Chinese banking system, but the Government are clearly willing to stand behind the sector. Bloomberg report that, despite bad debts at an 11-year high, Chinese banks have continued to lend at record levels.

• Indian banks have issues which mirror those of Japan and China. The IMF and the main rating agencies have highlighted lack of provisioning for bad debts and falling net interest margins. Increased competition – ironically as part of the growth of the debt market overall – is causing further problems, particularly for incumbent, Government-controlled Indian banks. India is, however, seen as the key to the development of the entire Indian Ocean sphere of influence. If the largest banks can make the transition from a local to a regional role, then these issues may come to be seen as growing pains.

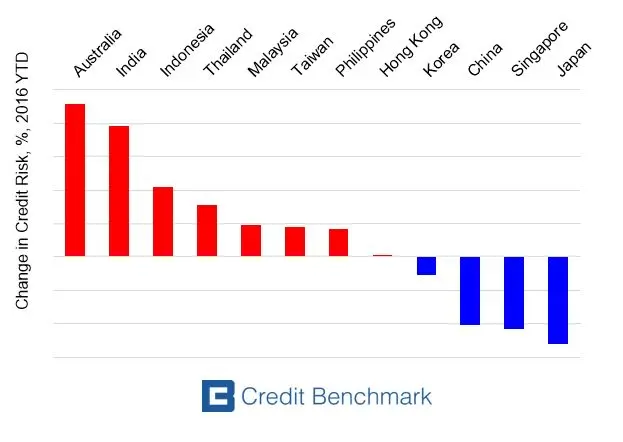

The chart shows the main changes in banking sector credit risk since the beginning of this year. This shows that, in general, countries with lower quality banking sectors have had the largest proportionate increase in credit risk; and countries with higher quality banking sectors have shown a proportionate decrease.

The main exception is Australia. This may seem surprising since Australian banks typically report healthy returns, mainly due to higher leverage in capital efficient residential mortgages. But this same exposure may now be driving a reassessment of risk as the outlook for global interest rates becomes more uncertain. UBS recently rated Sydney as one of the four cities in the world with a serious property bubble (along with Vancouver, Stockholm and London). Moodys’ have also voiced concerns about commercial property loans in Australia.

These trends suggest that Asian banking is entering a volatile phase, but the outlook for some of the majors may now be improving. Whether it is country-specific issues (like Duterte’s anti-US policies in the Philippines) or the general impact of a slowdown in global trade and a possible rise in the cost of borrowing, these changes in credit risk signal where further challenges may appear.