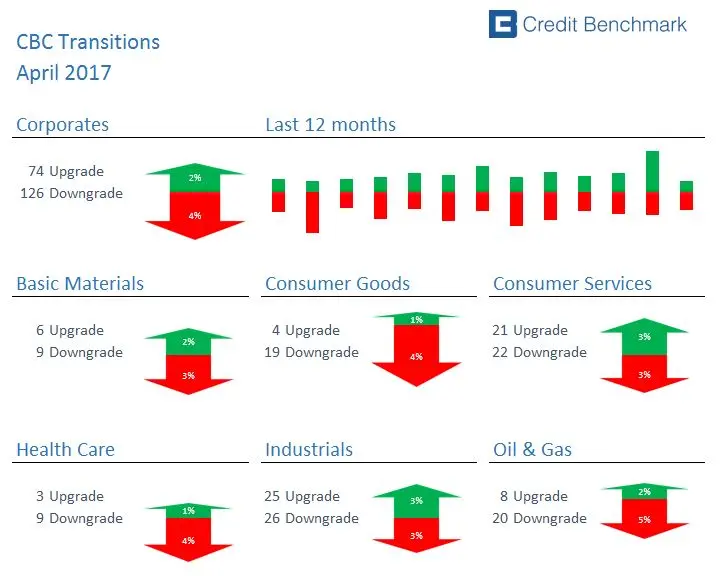

Transition matrices can provide considerable insight into the likely pattern of losses over various time horizons (see summary below) – providing support for compliance with the CECL and IFRS9 accounting rules that require banks and corporates to estimate potential downgrades over the entire life of a loan. A recent whitepaper published by Credit Benchmark, compares bank-sourced transition matrices with the traditional estimates published by the main credit rating agencies. The research, Crowd-Sourced Credit Transition Matrices, is available for instant download here.