Autos, forestry, trucking, soft drinks among sectors already facing internal bank downgrades

The global credit outlook is deteriorating for a range of industries as international trade confrontation heats up, according to a study by Credit Benchmark, a credit risk analytics firm that tracks internal bank credit assessments on more than 110,000 public and private entities globally.

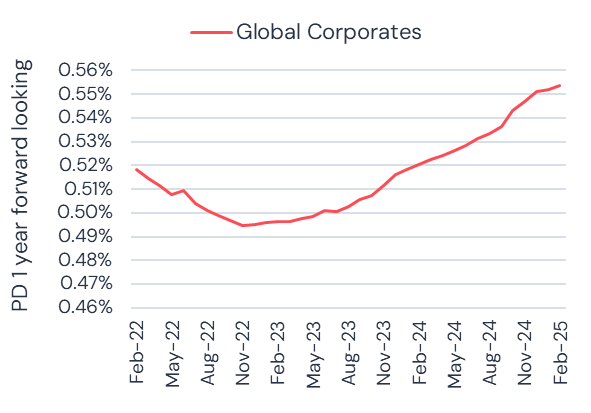

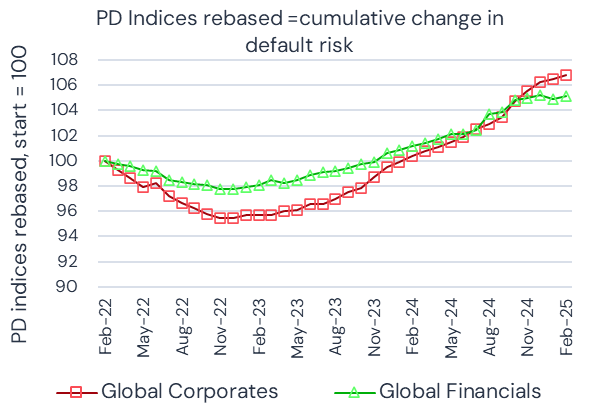

Credit Benchmark’s “DIN” ratio of internal bank downgrades to upgrades deteriorated globally for corporate credits over the past 27 straight months. Net downgrades exceeded upgrades by 4% in the last four months. Credit Benchmark’s estimate of the average probability of default in the next 12 months among global corporate borrowers, at 0.55%, was higher in February than at any point in 2020 when the Covid pandemic disrupted the global economy.

Banks have shifted their credit outlooks in many industries, including a number with highly integrated global supply chains, such as autos, transportation and building materials. Tariffs could disrupt these supply chains, weaken demand and squeeze business profit margins. Though global economic growth has generally been robust during the past few years, rising interest rates, high inflation and regional conflicts contributed to deteriorating credit outlooks in 2023 and 2024. It is evident that banks started to anticipate stress from trade confrontation in recent months.

“Credit risk was rising across the globe before the trade war started,” said Michael Crumpler, Credit Benchmark CEO. “Those headwinds could now get stronger, especially in trade-exposed industries.”

Global Corporate Probability of Default

Credit Benchmark’s dataset provides risk professionals with unique, easily tailored insight into the credit landscape. Credit Benchmark uses internal bank ratings from a panel of dozens of large global banks and mid-sized banks to assess credit risk across their portfolios, including downgrade ratios and probability of default across a vast landscape of markets and industries. The study was conducted with Jon Hilsenrath, former Wall Street Journal economics editor and chief economics correspondent.

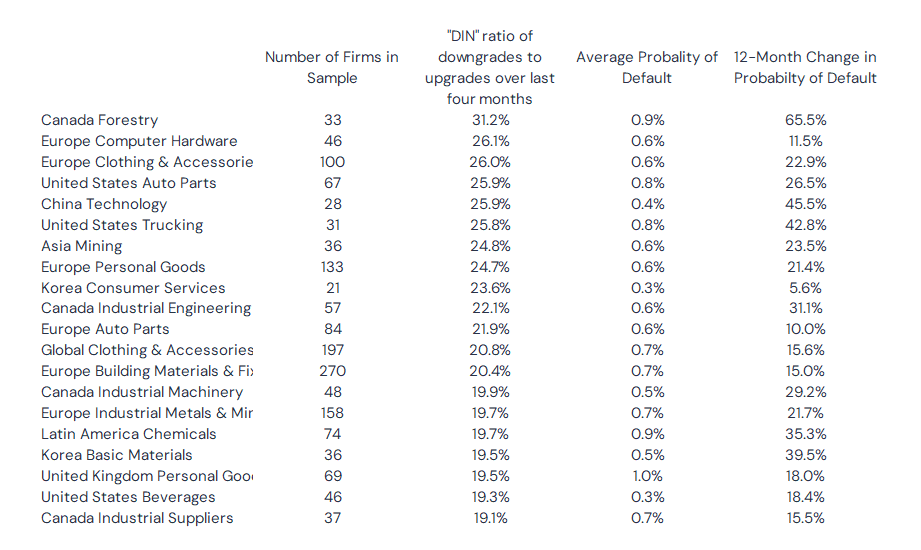

Broad Regional Deterioration, Concentrated by Sector

Deterioration in the credit outlook has affected many regions globally and has been concentrated in real economy sectors exposed to restraints on global trade, including autos & parts, forestry & paper, iron & steel, transportation, building materials, clothing manufacturing, retailing, furnishing and personal goods. The DIN ratio for Canadian forestry firms tracked by Credit Benchmark increased to 31.2% for the past four months, reflecting a strong bias in banks to downgrade firms in that sector. DIN ratios increased to 25.9% for U.S. auto and parts producers, 25.9% for Chinese technology firms, 25.8% for U.S. trucking companies, 25.5% for EU paper businesses, and 22.1% for Canadian industrial engineering business.

20 Global Sectors Experiencing Rising Credit Risk

Many firms entered the period on relatively sound economic footing, having benefited from firm global growth. In addition, the financial sector is well capitalized. Probability of default for global financial firms, at 0.3% in February, was lower than for global corporates. However, the data do point to the risk of financial stress if global growth slows substantially or if the world economy enters recession.

Stress in Canada, but the U.S. Is Also Exposed

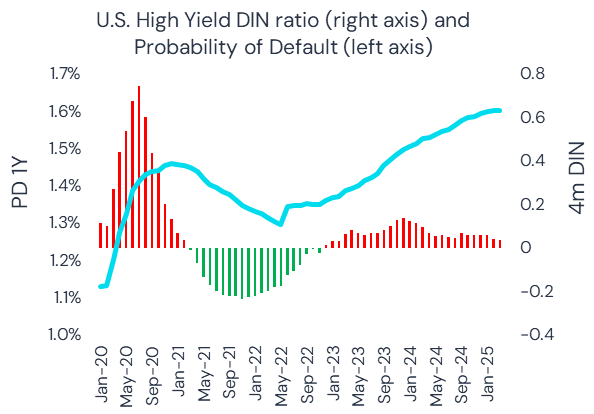

Canada was an early target of U.S. tariffs. Rising credit risk is evident for both U.S. and Canadian credit. For U.S. high-yield borrowers, probability of default is now higher than it was at any point during the Covid crisis of 2020 and downgrades have steadily outpaced upgrades. In the chart below, red bars signal rising downgrade ratios and green bars signal falling downgrades (i.e. improvement).

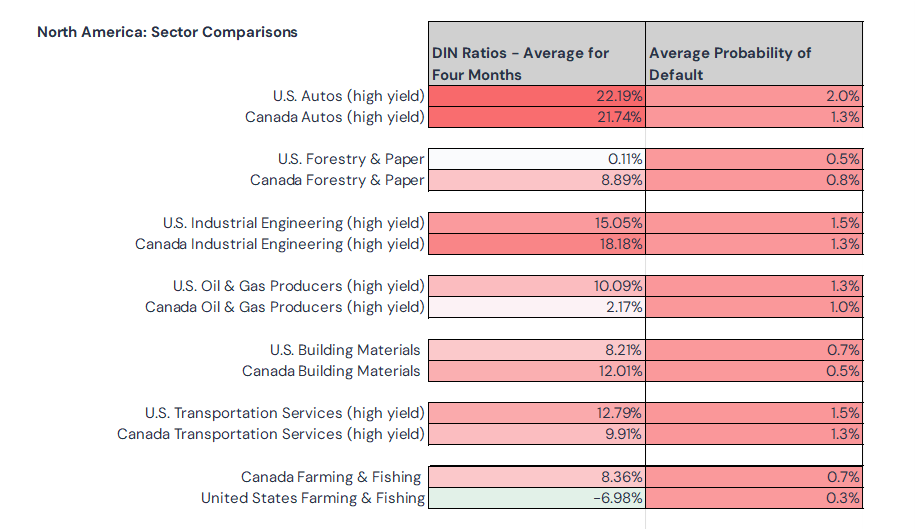

A U.S.-Canada trade confrontation could negatively affect industries on both sides of the border. The DIN ratio for high yield Canadian auto suppliers is up to 21.7% over four months, with average probability of default in the next year rising to 1.3%. Over the same period, U.S. automobile suppliers have experienced a 22.2% net DIN ratio and an increase in probability of default to 2%. Other industries – including oil & gas, forestry and farming & fishing — have experienced more lopsided changes in the credit outlook. For instance, conditions have worsened more rapidly for Canadian foresters than U.S. foresters, but more rapidly for U.S. oil producers than Canadian.

The Cost of Hedging Credit Risk Is Rising

It paid for banks to be ahead of the curve hedging their portfolios for the worsening risk environment. Research by Credit Benchmark shows that for US Corporate sectors, the cost of hedging versus real world credit risk has shifted up by about 40 basis points in April versus January 2025. The cost of hedging an additional 100 basis points of default risk has increased from about 60 basis points to 110 basis points.

Credit Benchmark consensus credit data is updated twice-monthly and delivered to our clients via our Web App, Excel add-in, flat-file download and third party channels including Bloomberg, Snowflake and AWS. Advanced analytics like those found within this report are now also available for free on the Credit Benchmark website via Credit Risk IQ. 10,000+ monthly geography-, industry- and sector-specific risk reports and transition matrices are available on Credit Risk IQ.