Global Oil & Gas: What’s Coming Down the Pipeline?

- Global supply likely to exceed global demand in 2025 subject to geopolitical developments.

- High Yield producers increasingly vulnerable if US competition grows.

- European firms may struggle to maintain positive momentum.

From a low of $40 per barrel in early 2020, West Texas oil hit $80 during the Ukraine war. Despite some pull-back it has stayed above $60, repeatedly testing $80 during 2024 as the Middle East conflict widened. But with Saudi Arabia building its post-oil economy, an expected boom in US drilling, a slowdown in China and possible ceasefire in Ukraine, 2025 may see an oil glut.

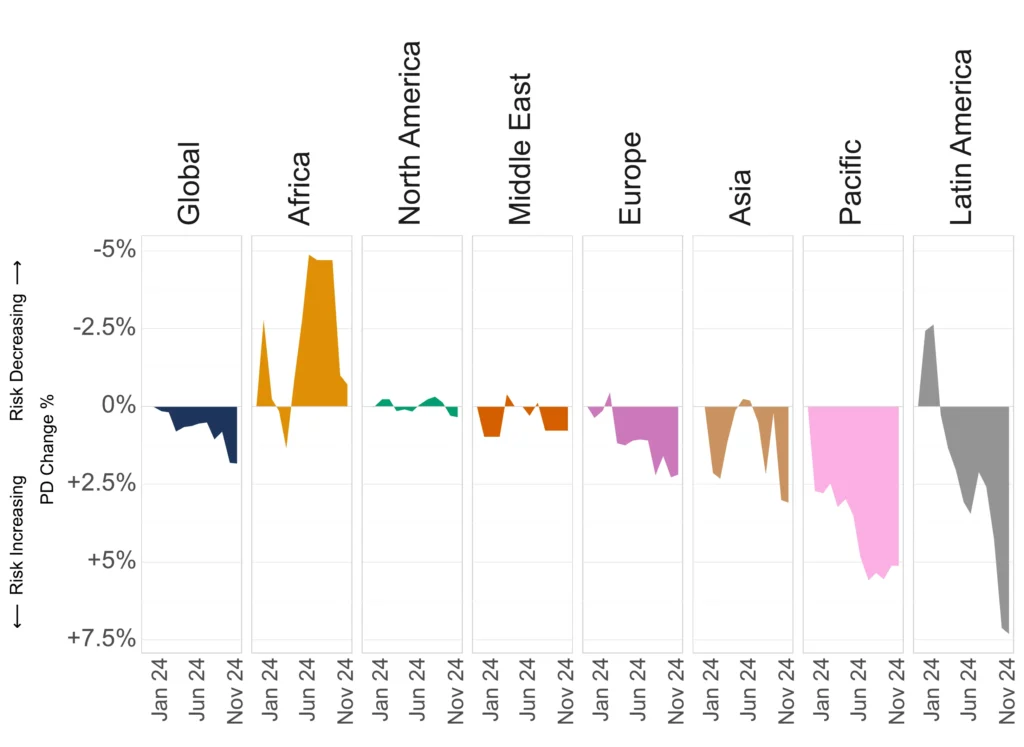

Credit Benchmark’s Credit Risk IQ reports show how credit risk is evolving across a wide range of dimensions, based on the internal credit ratings collected from 40+ global banks. For Oil & Gas Producers, credit has been volatile and generally deteriorating – only Africa currently shows a year-on-year improvement.

Oil & Gas Producers: Credit Trend by Region

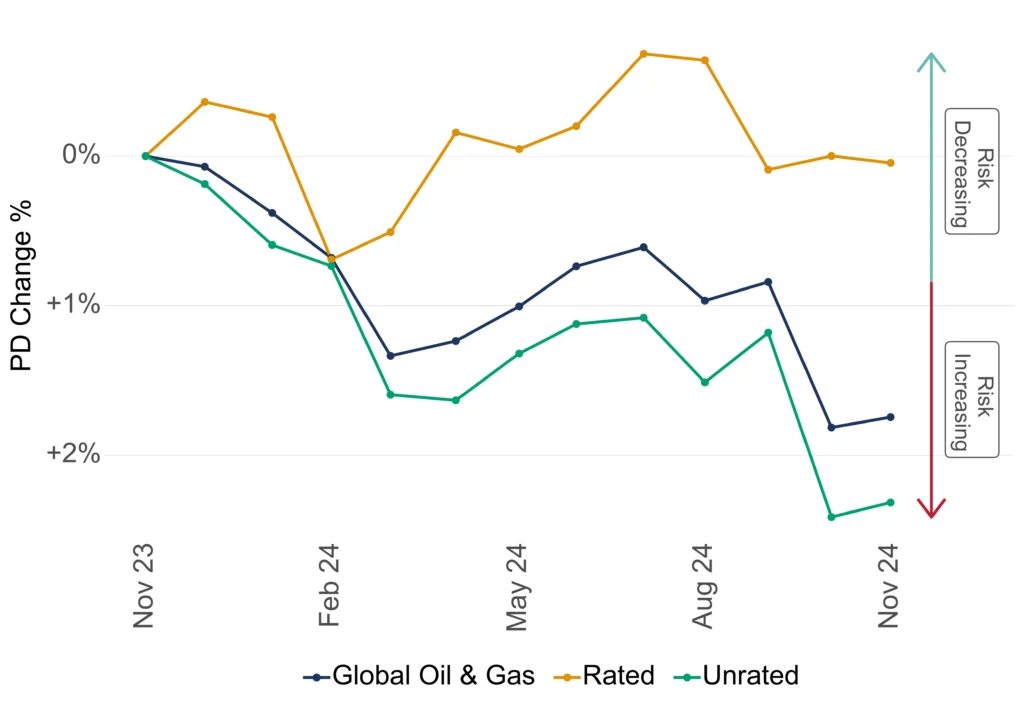

Global Oil & Gas: Rated vs. Unrated

Over the past year, Rated and Unrated Oil & Gas companies show consistently divergent trends, with unrated showing cumulative deterioration.

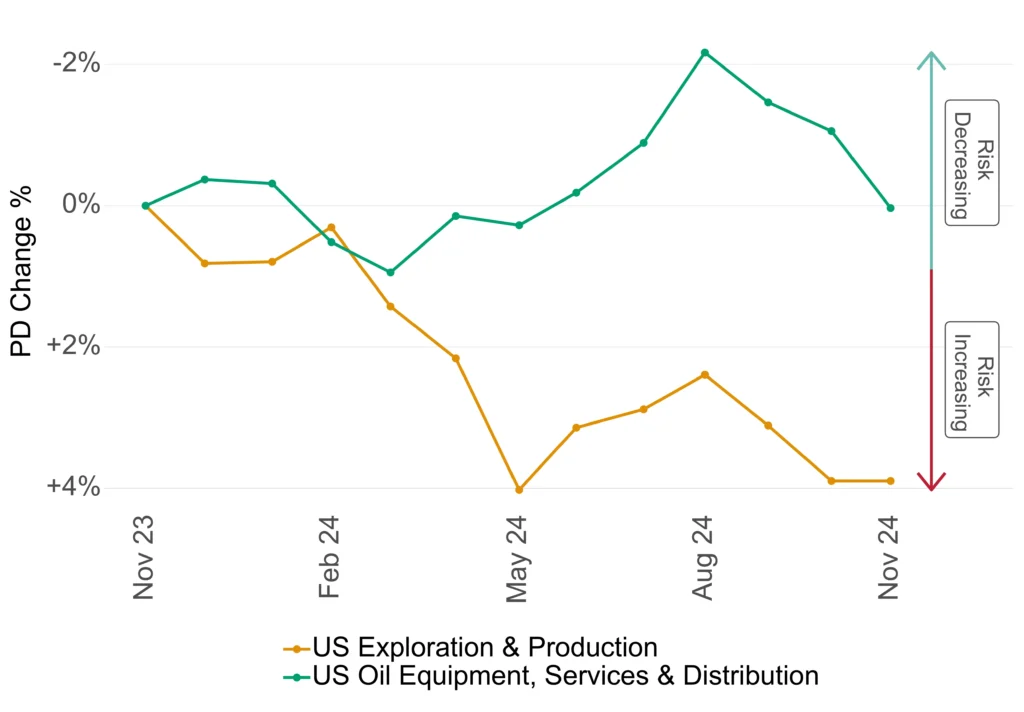

US Sectors: Exploration & Production vs. Oil Equipment, Services & Distribution

In the past year, US Exploration & Production default risk has slightly deteriorated while Equipment, Services and Distribution show little change.

With a possible global oil glut and US policy likely to swing in favour of new drilling, this gap is likely to increase after an initial boost for the Exploration & Production sector.

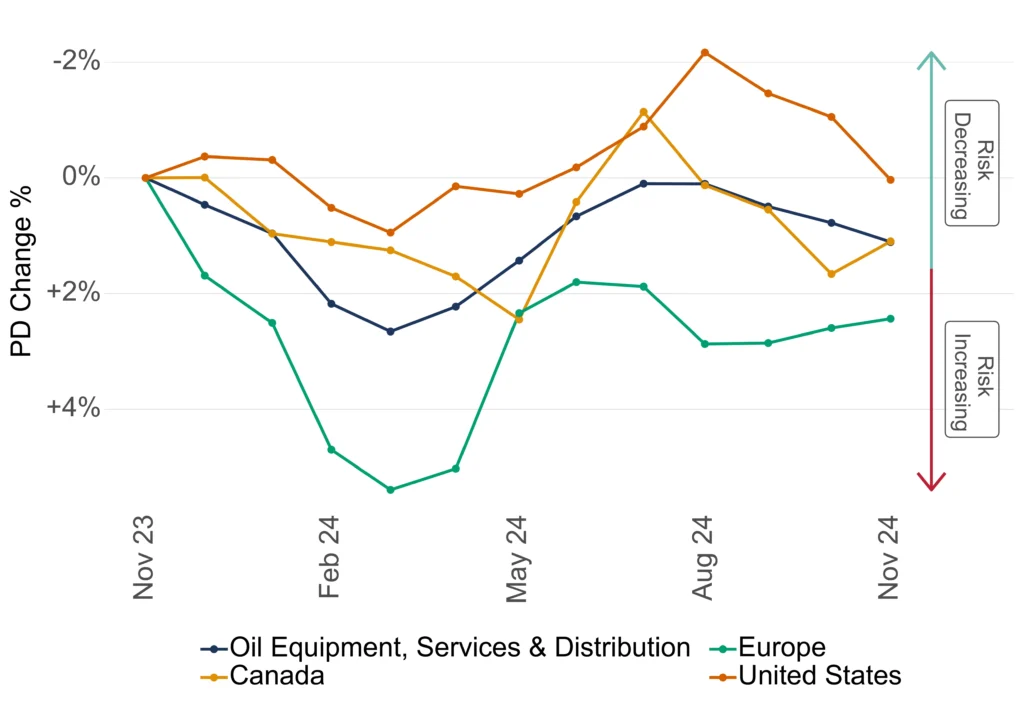

Oil Equipment, Services & Distribution: Europe vs. Canada vs. United States

In Equipment, Services & Distribution, the recent improvement in European default risk could continue as Europe swings away from Russian gas; the US could switch to improvement.

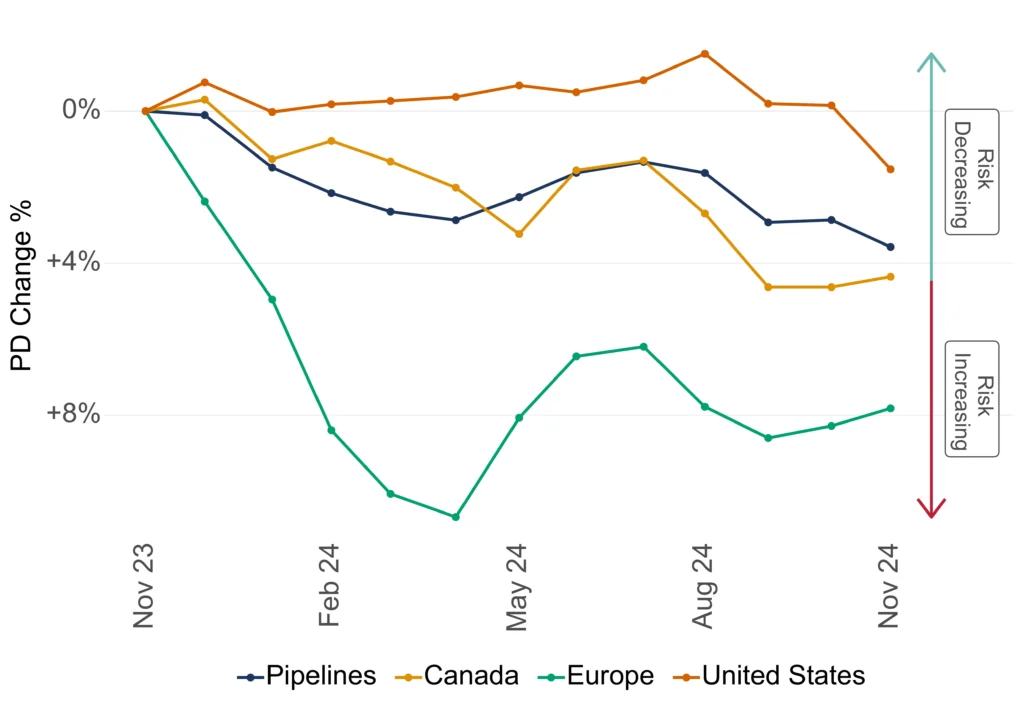

Pipelines: Canada vs Europe vs United States

For Pipelines, the current European improvement could continue given the major shift away from Russian energy sources and the risk of sabotage. Canada and the US have been deteriorating but the US may turn positive in 2025.

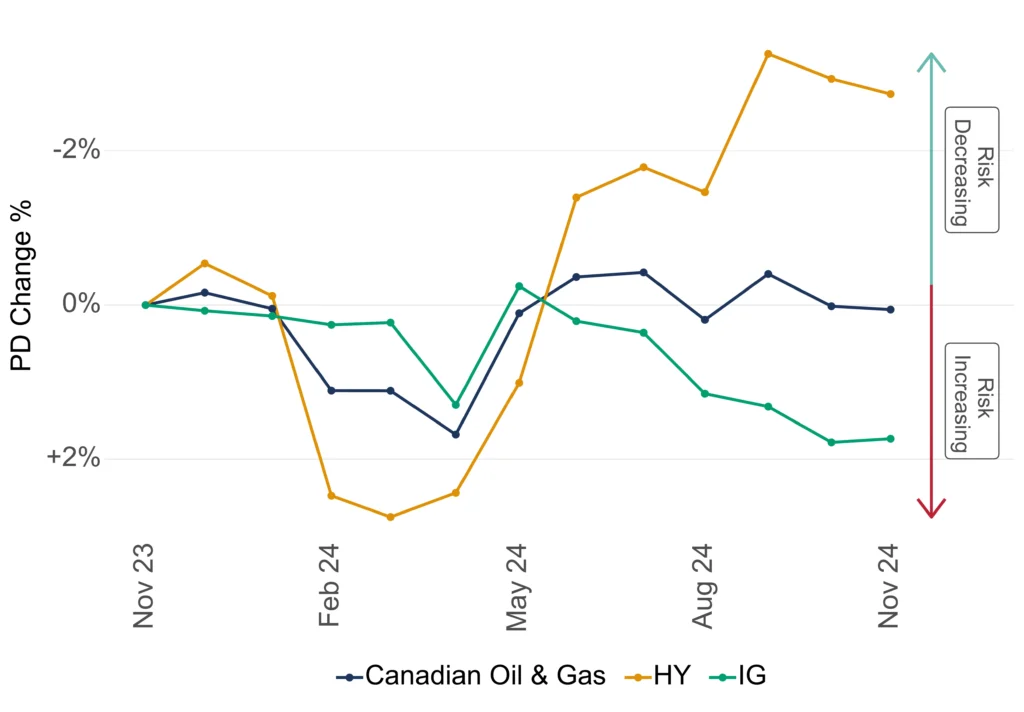

Canadian Oil & Gas: High Yield vs Investment Grade

Canadian Oil & Gas companies show a gap opening up between High Yield and Investment Grade trends. If competition from the US increases, High Yield producers in Canada may be vulnerable so the recent improving trend may reverse.

There are strong positive and negative influences on the oil price at the moment but on balance Global Supply is likely to exceed Global Demand in 2025. US policy is an important part of that, but geopolitical developments in Ukraine and the Middle East will be crucial against a backdrop of slow growth outside of the US.

Credit Benchmark consensus credit data is updated twice-monthly and delivered to our clients via our Web App, Excel add-in, flat-file download and third party channels including Bloomberg. Advanced analytics like those found within this report are now also available for free on the Credit Benchmark website via Credit Risk IQ. 10,000+ monthly geography-, industry- and sector-specific risk reports and transition matrices are available on Credit Risk IQ.