Media Sector: Rising High Yield default risk brings widening gap vs. Investment Grade

- Credit Benchmark consensus credit data shows major credit downgrades across high yield US Media firms.

- Default risk for high yield UK Broadcasting & Entertainment firms has increased 40% in past 12 months.

- Credit Benchmark can now produce High Yield vs Investment Grade credit indices tracking real-world default risk on a range of geographies, industries and sectors.

The Hollywood dream is looking tarnished. After surviving a near total collapse in revenues during Covid, box-office takings more than quadrupled in 2 years. But the 2023 anti-AI writers’ strike halted that, and the industry has failed to make another comeback in the face of growing competition from existing and challenger streaming firms. Traditionally lucrative blockbusters are also struggling, with moviegoers showing fatigue with endless sequels, prequels and franchise spin-offs.

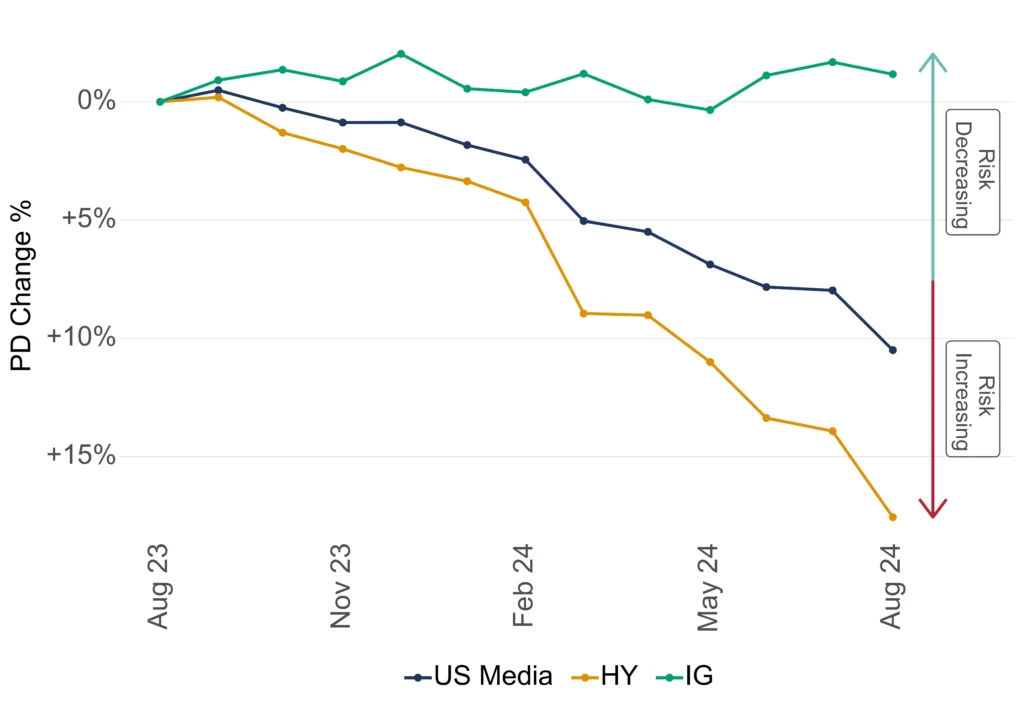

The current turmoil in the industry creates winners and losers, and favours those with deep pockets. Credit Benchmark’s consensus credit risk data shows that probability of default (PD) risk trends for High Yield (HY) and Investment Grade (IG) firms in the media sector are diverging with increasing velocity, according to the banks contributing risk views to the consensus dataset.

The Credit Benchmark HY index shows that probability of default risk for high yield US Media companies rose by more than 15% over the previous 12 months and continues to rapidly increase.

This contrasts with investment grade companies, where credit risk has stayed steady.

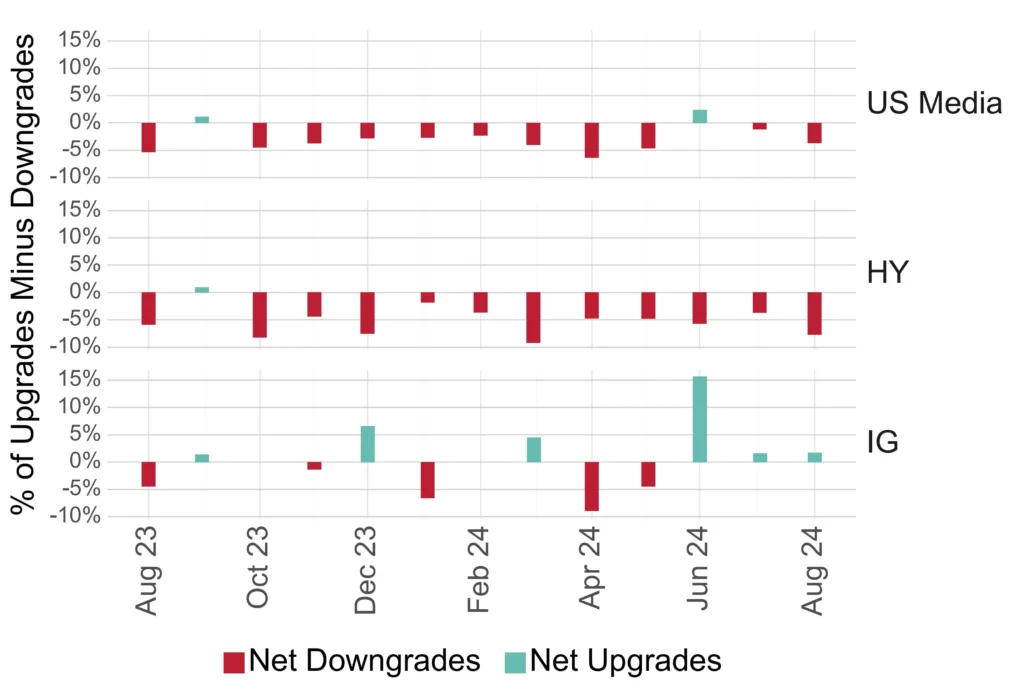

Looking at net credit upgrades vs credit downgrades month-by-month underlines the deterioration unfolding in high yield US media companies. Investment grade firms, by contrast, show an equal number of months where upgrades outnumbered downgrades.

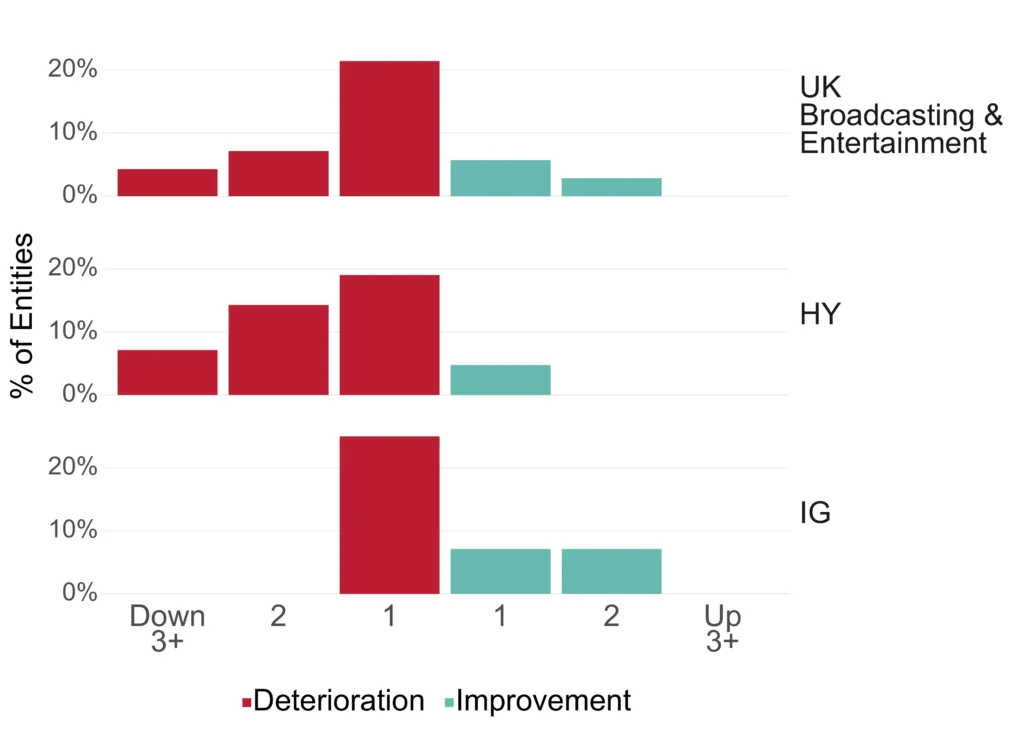

UK credit trends are similar and – as the chart to the left shows – even more dramatic in the Broadcasting & Entertainment segment, in the face of major programming budget cutbacks.

Credit risk in high yield UK Broadcasting & Entertainment increased by 40% over the last 12 months. This is drastically different from investment grade companies where, just like in the US Media companies, credit risk was stable.

Over the last 12 months, Credit Benchmark data shows that more than 20% of UK Broadcasting & Entertainment high yield entities were downgraded by two or more rating notches, whereas investment grade firms in this sector recorded no significant downgrades.

These divergences are likely to continue as the media landscape continues to shift, with increasing pressure on content delivery models and financial sustainability.

Methodology for tracking High Yield vs. Investment Grade credit risk indices

Typical bond indices and tracker funds (e.g. S&P U.S. High Yield Corporate Bond Index and the iShares iBoxx Investment Grade Corporate Bond ETF) are market price based, tracking divergences in market views of default or shifts in credit spreads. However, Credit Benchmark has developed a methodology utilising 110,000+ consensus credit ratings, sourced from leading global banks, to calculate pure default risk indices tracking high yield or investment grade credit. These types of indices are not typically available from rating agencies.

The bespoke methodology gives a consistent method for tracking ‘Real World’ default risk by accounting for (1) migrations between investment grade & high yield, (2) changes in constituents as coverage shifts, and (3) movements in consensus credit ratings.

Credit Benchmark consensus credit data is updated twice-monthly and delivered to our clients via our Web App, Excel add-in, flat-file download and third party channels including Bloomberg. Advanced analytics like those found within this report are now also available for free on the Credit Benchmark website via Credit Risk IQ. 5,500+ monthly geography-, industry- and sector-specific risk reports and transition matrices are available on Credit Risk IQ.