Private vs. Public Credit Risk

Home » Credit Risk IQ – Industry Reports » Private vs. Public Credit Risk

Introduction

The majority of Credit Benchmark’s consensus credit ratings are for non-public entities.

There is generally less readily available information on private companies. It can then be harder to form an opinion on their creditworthiness.

Credit risk teams will consider several factors related to a company’s ownership when determining the bank’s internal ratings.

How Do Banks Take Ownership into Account as Part of their Internal Credit Ratings?

There are important differences between the way private and public companies are managed and funded. Qualitative and quantitative factors used in banks’ internal rating systems can include components related to a company’s ownership.

Some of these differences are discussed below.

Access to Capital

- Publicly owned companies generally have greater access to capital markets through the issuance of publicly traded debt and equity.

- Broader access can provide them with more diverse funding sources and greater financial flexibility. This can reduce credit risk compared to privately owned companies relying on private financing.

- Banks’ credit risk officers will assess the funding strategy and debt structure when assigning internal credit ratings. This then feeds into consensus credit ratings.

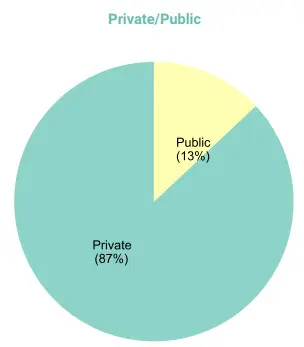

- Across Credit Benchmark’s Corporates and Financials, approximately 87% of the consensus credit ratings are for non-public companies.

Disclosure

- Publicly owned companies are subject to more stringent disclosure and reporting requirements imposed by regulatory bodies such as the Securities and Exchange Commission in the United States.

- This higher level of transparency provides investors and creditors with more comprehensive and timely information about the company’s financial health, operations, and risk factors, facilitating a more accurate assessment of credit risk.

- Private companies, in contrast, may disclose less information, making it challenging for external stakeholders to assess their credit risk.

- However, banks, through their lending processes, have access to companies’ non-public financial and lending circumstances. This unique information contributes to the robustness of the consensus credit ratings.

Market Confidence

- The market value of a publicly owned company’s equity can serve as a real-time indicator of market sentiment and confidence in the company’s credit risk.

- Private companies may face challenges in demonstrating market confidence.

- As banks lend across the spectrum, to both private and public companies, Credit Benchmark’s consensus credit ratings can help to fill that gap.

Ownership Structure

- Ownership structure is a very important qualitative factor used in banks’ internal credit ratings.

- Publicly owned companies often have a diverse ownership structure with a wide shareholder base.

- This structure contributes to greater stability and continuity, as opinions and changes are typically less concentrated.

- Privately owned companies, on the other hand, may face credit risk associated with less diversity, changes in ownership, and the potential for conflicts among a smaller group of owners.

If you are interested in seeing what Credit Consensus Ratings can offer, sign up here to access the Credit Risk IQ Reports for free.

Managing Credit Risk Differences Between Publicly and Privately Owned Companies

Because different market conditions can impact public and private companies differently, it can be useful to segment your portfolio accordingly for better credit risk monitoring.

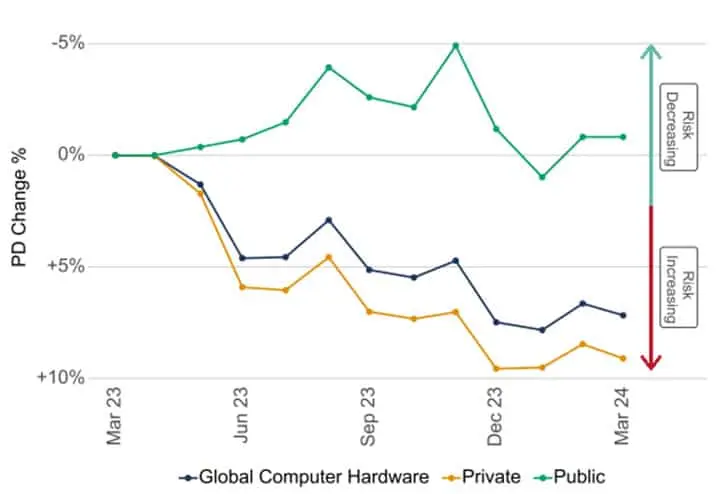

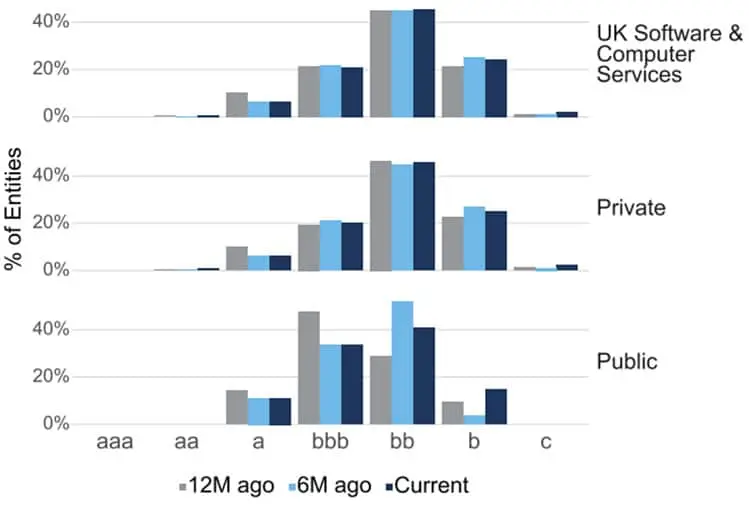

The below graphs show how credit risk has diverged between public and private companies within the Computer Hardware and Software sectors.