Looking beyond Thames: default risk for UK water companies set to rise by at least 10% in next 12 months

- Sector default risk set to rise by at least 10% in next 12 months, 20% chance it rises by more than 20%

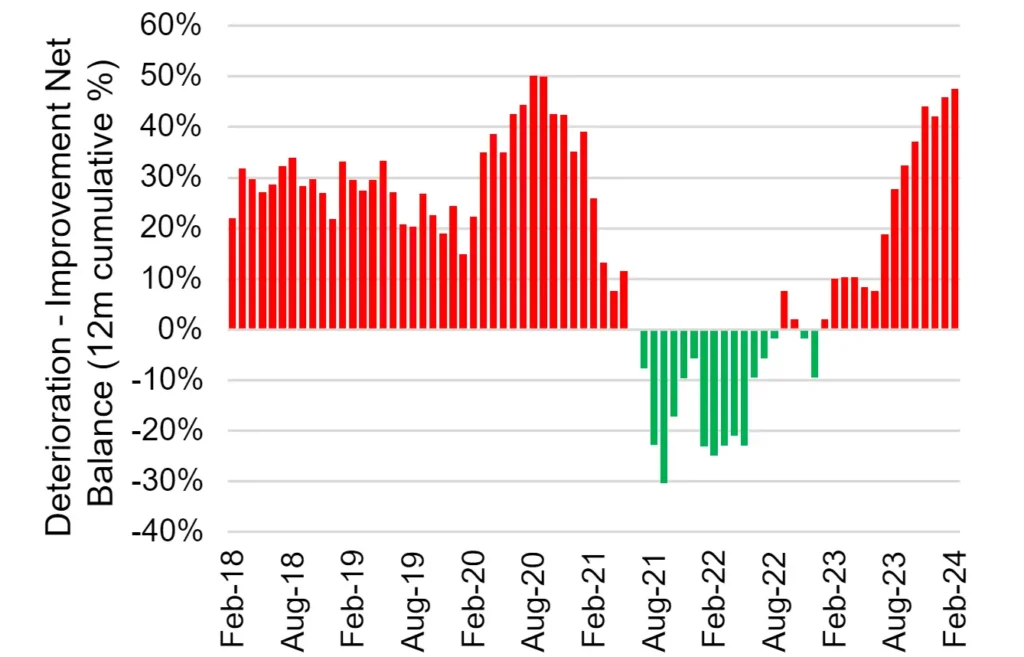

- Deteriorations outnumber Improvements; balance back to Covid high

- Credit downgrades for various subsidiaries of multiple parent firms

The Thames Water (Kemble) Finance bond default shows the fault lines in commercial public utilities and means that the UK’s unique experiment1 in 100% water privatisation may be ending.

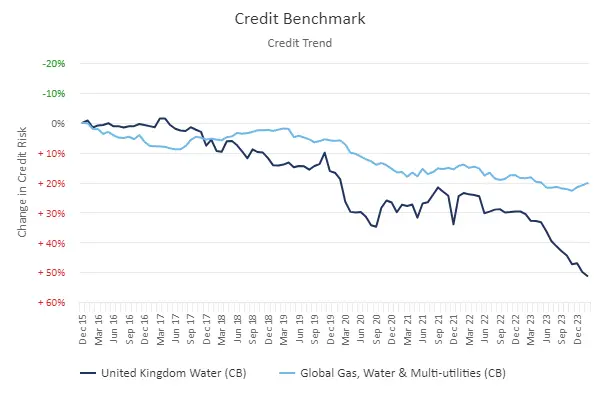

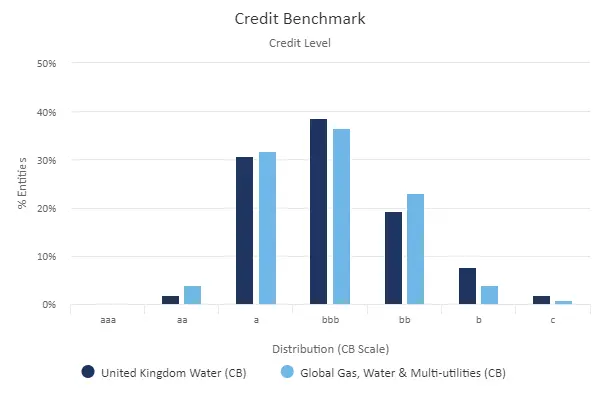

Credit Benchmark’s United Kingdom Water credit risk index covers 52 companies, and the Global Gas, Water and Multi-utilities index covers 505 companies. The charts below show credit trends and distributions for these two indices.

The steady erosion in UK Water credit quality accelerated during Covid, recovered slightly, and is now plumbing new depths. Global Multi-Utilities are broadly stable over the same period.

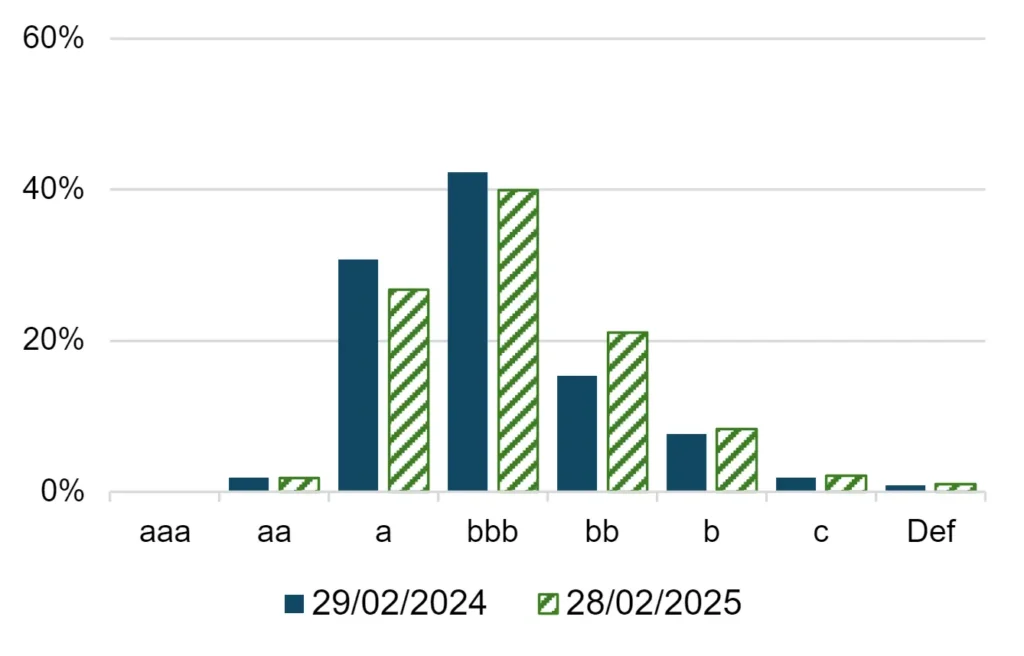

The UK Water sector has a higher proportion in the “b” and “c” categories, and slightly less in “aa”, but most of the UK Water companies are in the “a” and “bbb” categories. In other words, the deterioration in the trend chart is from a base of high credit quality.

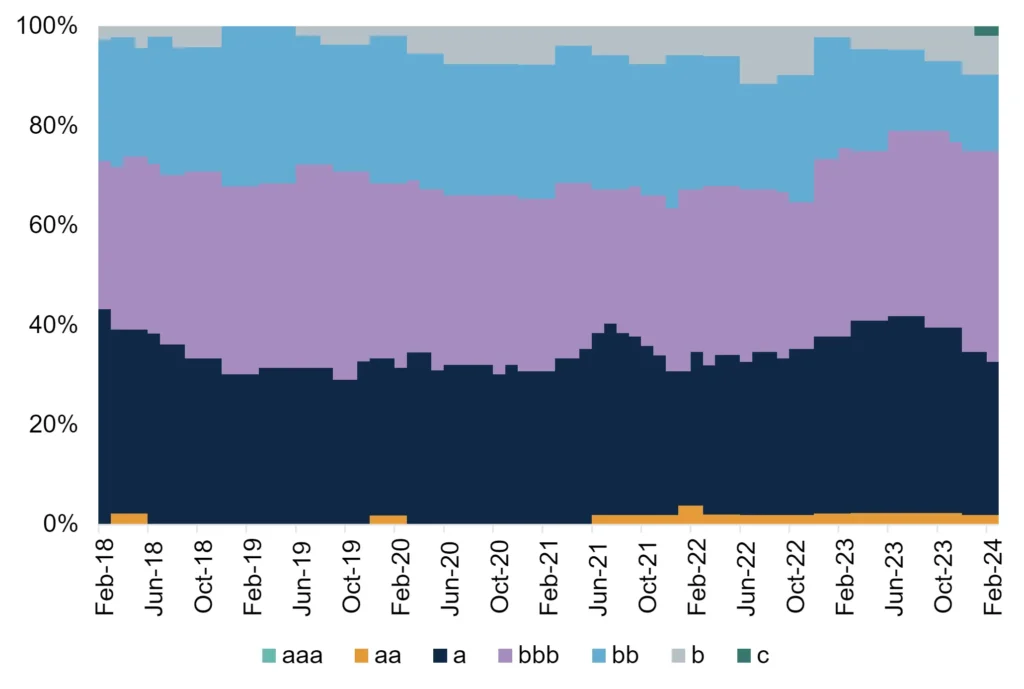

The chart below shows how the UK Water credit profile has changed over time.

The proportion in the “aa” category has been stable for nearly 3 years, but the “a” rating group has declined in the past 9 months, from nearly 40% to around 30%. Many of these have migrated to the “bbb” category, which has increased from a low of 29% in mid-2022 to around 40% currently.

The “bb” category has declined from 24% in Q3 2022 to about 15% now, while the “b” category has tripled in size from around 2.5% to more than 7% in the past 12 months. Kemble was downgraded to the “c” category a few months ago, and appears at the top right of the chart.

These credit migrations are driving the increase in default risk shown in the first chart of this note; they are spread across subsidiaries of multiple parent companies in the UK Water industry.

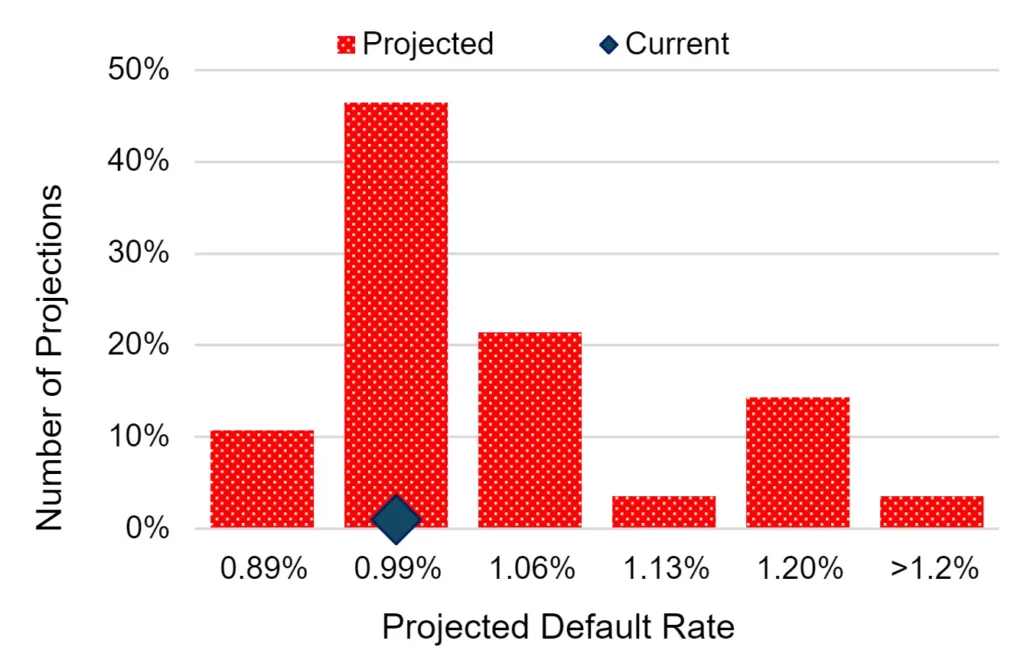

The four charts below show default risk projections for the UK Water sector for the next 12 months.

| United Kingdom Water – April 2024 | Default Rate Index | |

| 52 Constituents | Current | 0.90% |

| Projected 12m | 0.99% | |

| % Change | +10.7% |

The top right chart plots the UK Water sector credit cycle – the sector has been heavily biased to downgrades from at least 2018. There was a brief recovery after Covid, but the deterioration trend returned at the end of 2022. It is now close to the record peak seen during Covid, and if it continues to climb, the UK Water industry could see a spike in defaults over the next 12 months.

The range of projections in the top left chart shows that the 12-month projected default rate is likely to rise by at least 10%, but there is a 20% chance that it rises by 20% or more.

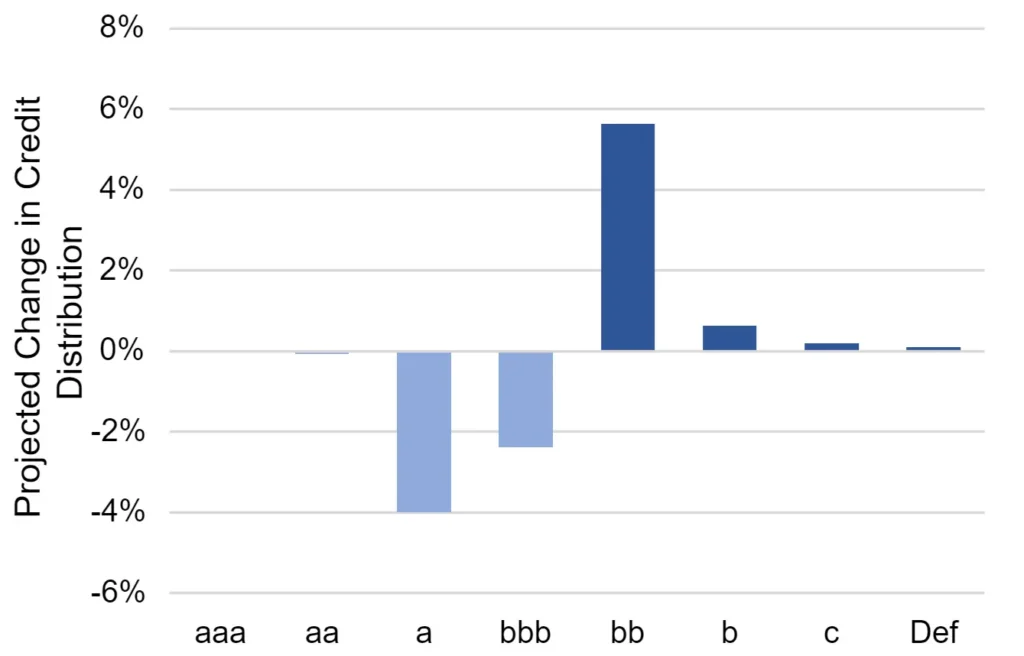

The lower charts show that the main driver of this is likely to be a shift from investment grade to high yield, with a small but important increase in the “b” and “c” categories that can easily lead to defaults.

These projections are based on the internal risk estimates of the banks that contribute data to the Credit Benchmark consensus view, which have been flagging potential problems in the Water sector for some time. The Kemble default is making bond investors nervous about the outlook for other firms in the sector; the bank consensus implies that they may be right.

Credit Benchmark will be releasing default projections on a range of UK industries and sectors this summer. Additionally, similar analyses are available for all 1,200 indices in the Credit Benchmark universe. Get in touch if you want to see this analysis for your sectors of interest or to discuss the wider implications for credit portfolio risk management.

Download

Please complete your details to download the PDF of this report:

- It was only rolled out in England and Wales, and Wales has largely reverted to a quasi-public structure. ↩︎