Home » Credit Risk IQ – Industry Reports » Industry Credit Risk

In addition to their internal ratings, banks also include their internal industry classifications for each entity. Credit Benchmark has developed an industry schema into which the banks’ industry categories are mapped.

The Credit Benchmark industry schema provides a hierarchical taxonomy going from broad categorisations (such as the Industry or Super Sector) down to the most granular one (Sub Sector).

To illustrate this, a portion of the hierarchy for Corporate Industrials is shown.

For example, Trucking (Sub Sector) is a more granular segment within Industrial Transportation (Sector), which is more granular than Industrial Goods & Services (Super Sector), which itself is a more granular categorisation of Industrials (Industry). Industrials falls within the wider classification of Corporates (Entity Type).

| Entity Type | Industry | Super Sector | Sector | Sub Sector |

|---|---|---|---|---|

| Corporates | Industrials | Industrial Goods & Services | Industrial Transportation | Delivery Services |

| Corporates | Industrials | Industrial Goods & Services | Industrial Transportation | Marine Transportation |

| Corporates | Industrials | Industrial Goods & Services | Industrial Transportation | Railroads |

| Corporates | Industrials | Industrial Goods & Services | Industrial Transportation | Transportation Services |

| Corporates | Industrials | Industrial Goods & Services | Industrial Transportation | Trucking |

Here, 3 banks submit their internal credit rating and metadata for an entity. One bank sends a NAICS code, another a SIC code and the third one an ANZSIC code.

Credit Benchmark has developed and maintains mappings from these and other industry classifications to the common Credit Benchmark schema.

The entity is then mapped to the Credit Benchmark Sub Sector Trucking.

| Bank Contributed Code |

|---|

| NAICS 484000 |

| SIC 4213 |

| ANZSIC 4610 |

| Credit Benchmark Sub Sector |

|---|

| Trucking |

If you are interested in seeing what Credit Consensus Ratings can offer, sign up here to access the Credit Risk IQ Reports for free.

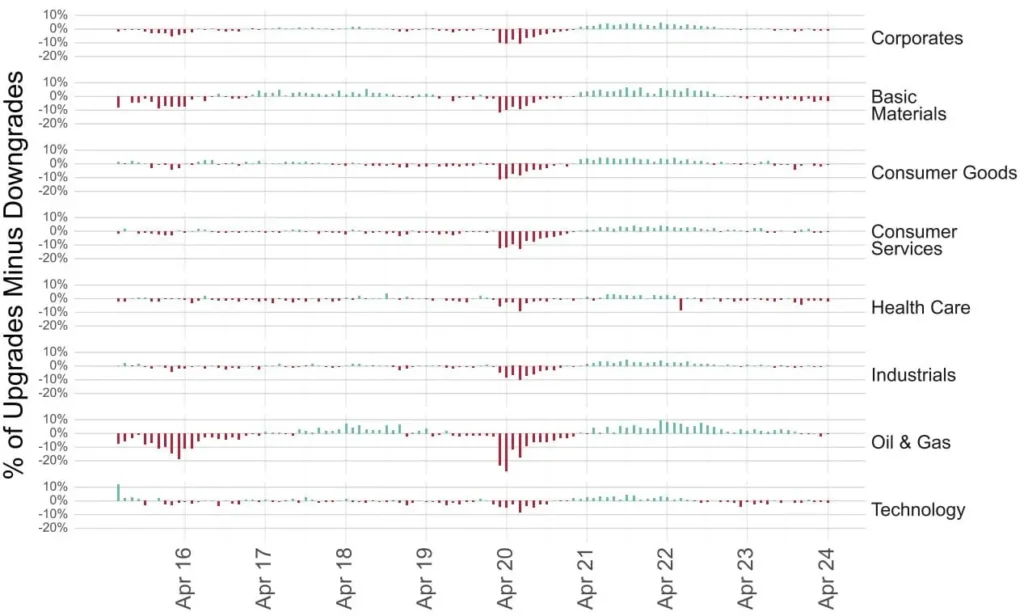

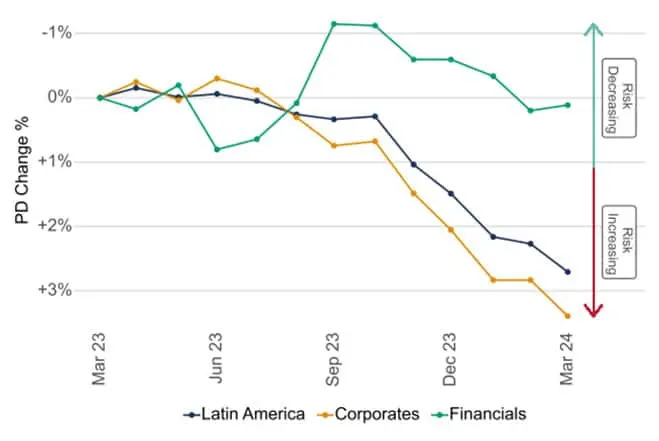

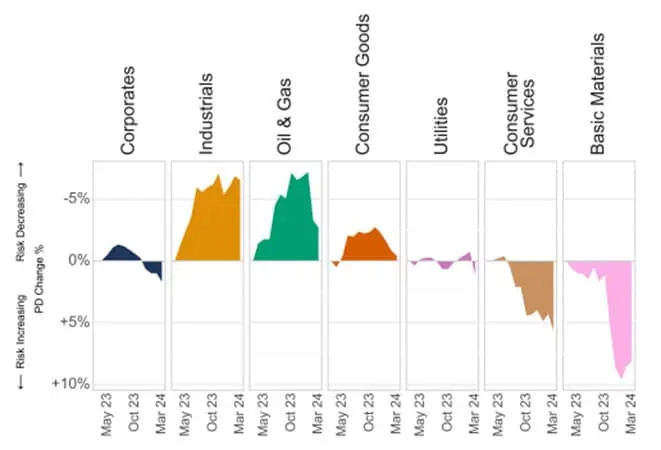

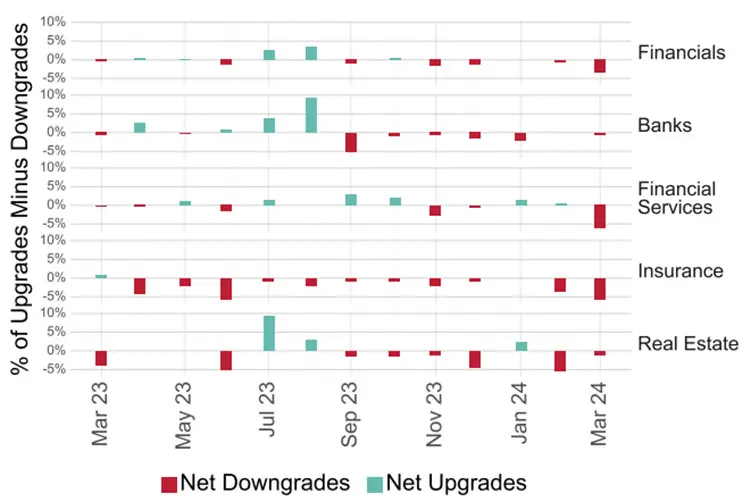

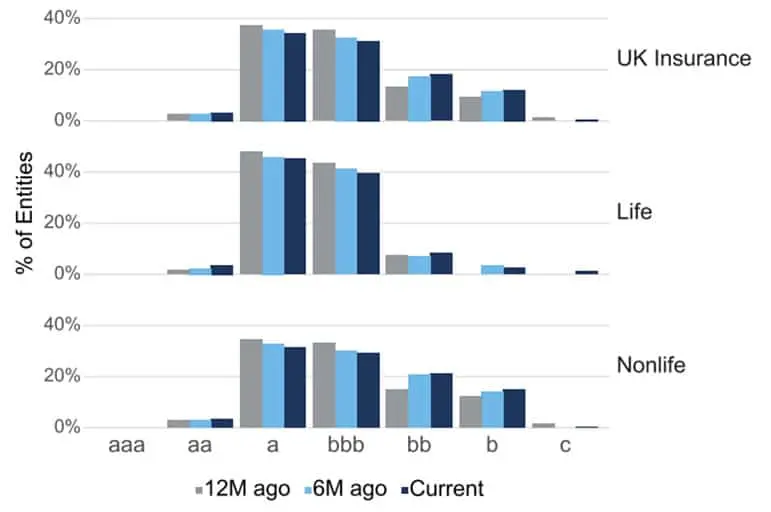

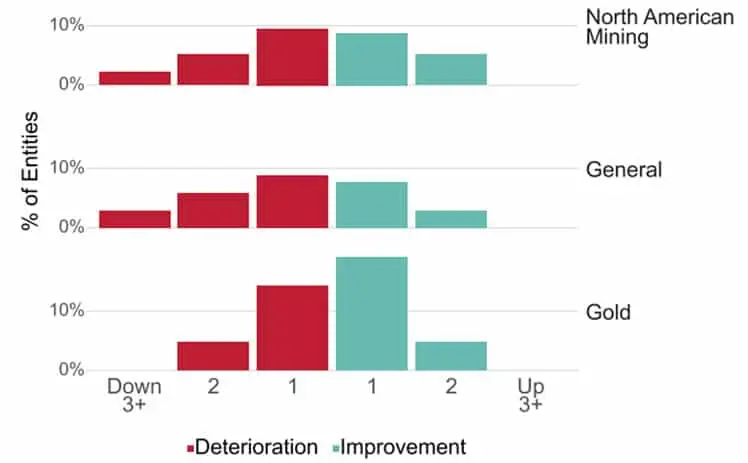

Given the diverse nature of credit risk factors impacting different industries, reviewing trends and relationships between industries is an important part of managing a portfolio.

In addition, industry consensus data can be used to calculate correlations between different industries and assess concentration risk.

The below examples highlight the types of analyses that can be used to manage the risk of a portfolio.

Contact us for a free coverage check to see how these analyses can enhance your portfolio’s credit risk reporting.

Credit Benchmark brings together internal credit risk views from over 40 leading global financial institutions. The contributions are anonymized, aggregated, and published in the form of consensus ratings and aggregate analytics to provide an independent, real-world perspective of credit risk. Risk and investment professionals at banks, insurance companies, asset managers and other financial firms use the data for insights into the unrated, monitoring and alerting within their portfolios, benchmarking, assessing and analyzing trends, and fulfilling regulatory requirements and capital.

Please complete the form below to arrange a demo.