Global Corporates, Financials and Sovereigns Trends Still Negative

Table of Contents

Introduction

Key Findings

- Global Corporates vs. Global Financials vs. Global Sovereigns: Trends Still Negative

- Industry and Sector Turning Points: Negatives Outnumber Positives

- US Sector PD Comparisons: US Aerospace & Defense Is Largest Monthly Drop

- Credit Volatility: Equity VIX Down, Credit Volatility Still Ticking Up

- Leveraged Loans: Gap Between Index Value and Credit Downturn

- Economic Growth in China: Asia Corporates in the Red for Two Consecutive Months, China Falters

- Food Production: Net Deterioration for Majority of Food Producers

- Climate Change, Record Temperatures & Wildfires: Negative Impact on Insurance & Airlines

- US Mortgage Finance: Sustained Net Deterioration

The US downgrade by Fitch to AA+ highlights the political and fiscal challenges facing most Governments as they grapple with post-Covid higher inflation and slower growth. Current global economic data is mixed – growth is stronger than the gloomiest predictions, but slowing in many economies. The current bout of global inflation is like a partly contained wildfire – still smouldering in one country, then flaming up somewhere else. The Ukraine war shock has dropped from annual comparisons, but core rates look stubbornly high and various countries – including the US – could see headline inflation tick up again. Most central banks are giving versions of the same message: inflation has not been tamed and “higher for longer” interest rates are the main policy tool.

Bad news for highly leveraged companies, good news for savers turned spenders who may now be key drivers of global economic growth. Data from China shows major commercial property-driven downturn, while US Office property is top of the real estate distressed debt list (over $60bn of loans, according to Cushman & Wakefield). The expiry of the Black Sea Grain Deal is bad news for food and fertilizer prices, already destabilized by El Nino, record heat in the Northern Hemisphere and extreme weather events globally.

Insolvencies are rising as higher rates and supply chain issues take their toll. Consensus credit data shows modest but sustained deterioration, in contrast with bullish equity markets and unfazed credit spreads.

This month’s report includes special sections on China, Food, and the wider impact of climate change. Macro credit trends and industry / sector turning points indicate a continued negative bias, and credit volatility is still creeping up. The regular leveraged loan section shows a widening gap between still positive investment returns and deteriorating credit.

Global Corporates vs. Global Financials vs. Global Sovereigns

Trends Still Negative

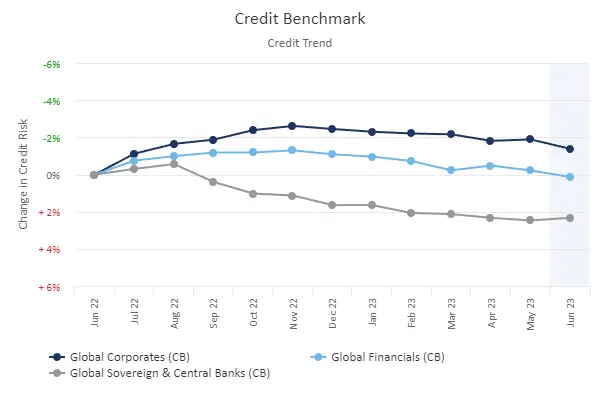

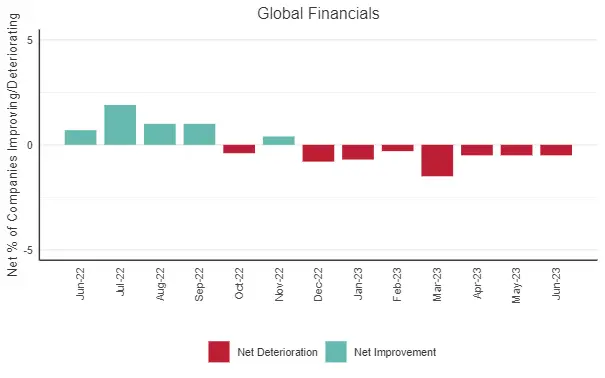

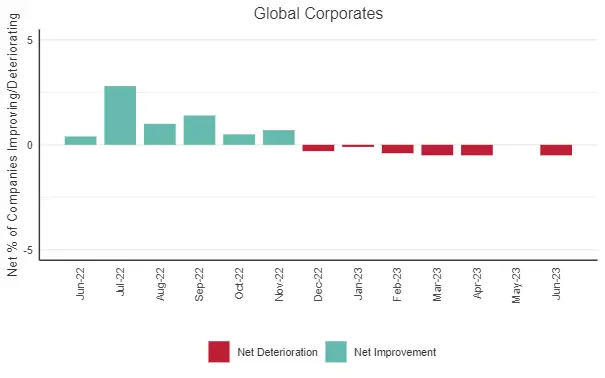

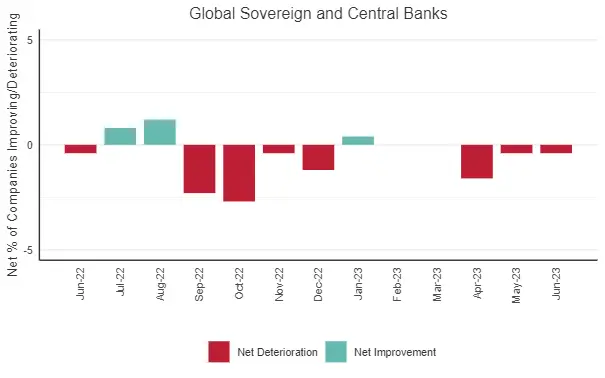

The following charts show global trends for average Probability of Default (PDs) and % balances between improving and deteriorating companies, for the past 12 months.

Globally, Corporates, Financials and Sovereigns all continue to deteriorate; for Financials this is the seventh consecutive month of negative credit outlook.

Industry and Sector Turning Points

Negatives Outnumber Positives

The lists below shows detailed global industries and sectors that may be at turning points. These have either started to show negative balances after a run of positives, or vice versa.

Positive Turning Point: Previous 3M Negative, Current 1M Improving

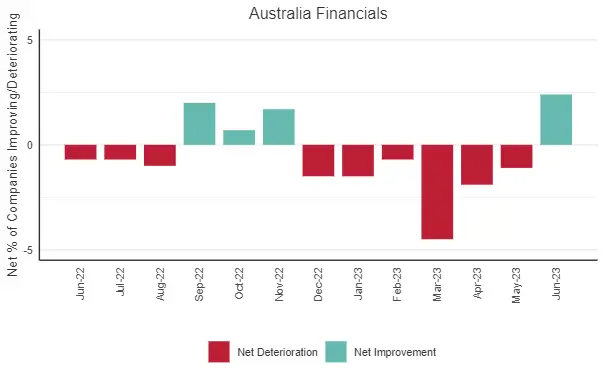

- Australia Financial Services

- Australia Financials

- EU Support Services

- Europe Computer Services

- Europe Construction and Materials

- Europe Home Construction

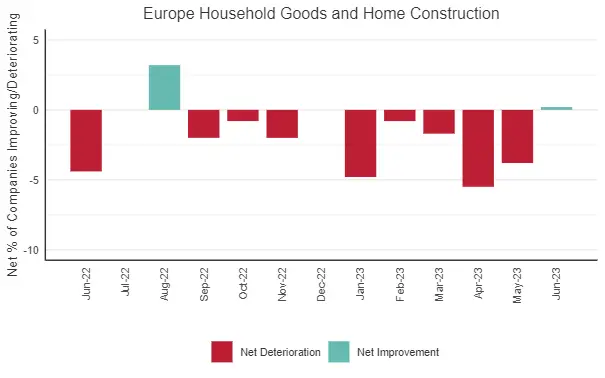

- Europe Household Goods and Home Construction

- France Consumer Services

- Global Drug Retailers

- Global General Industrials

- Global Household Goods and Home Construction

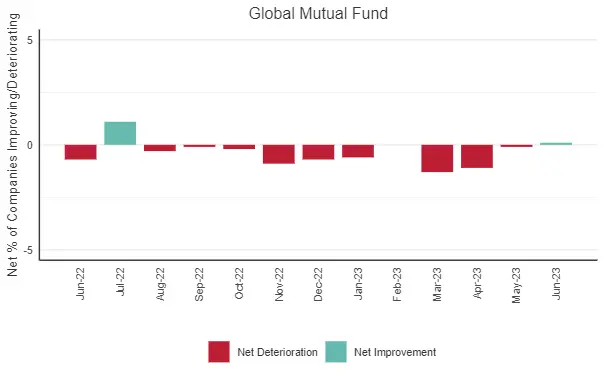

- Global Mutual Fund

- Global NPO or Foundation

- Netherlands Mutual Fund

- North America General Industrials

- North America Household Goods and Home Construction

- North America Software

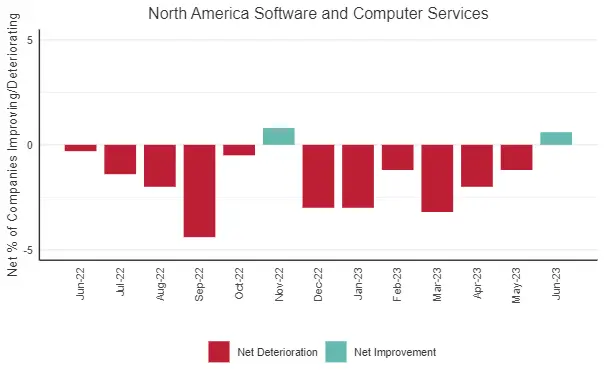

- North America Software and Computer Services

- North America Specialty Retailers

- Pacific Financial Services

- Pacific Financials

- United Kingdom General Industrials

- United Kingdom Heavy Construction

- United Kingdom Home Construction

- United Kingdom Large Financials

- United Kingdom NPO Foundation

- United States General Retailers

- United States Publishing

- United States Software

- United States Software and Computer Services

- United States Specialized Consumer Services

- United States Specialty Retailers

Negative Turning Point: Previous 3M Improving, Current 1M Negative

- Asia Automobiles

- Asia Automobiles and Parts

- Asia Consumer Finance

- Asia Financial Services

- Asia General Retailers

- Asia Industrials

- Asia Specialty Retailers

- Canada Automobiles

- Canada Automobiles and Parts

- Canada Chemicals

- Canada Gas, Water and Multi-utilities

- Canada Nonlife Insurance

- Canada Property and Casualty Insurance

- China Automobiles and Parts

- China Consumer Goods

- EU Pharmaceuticals

- Europe Conventional Electricity

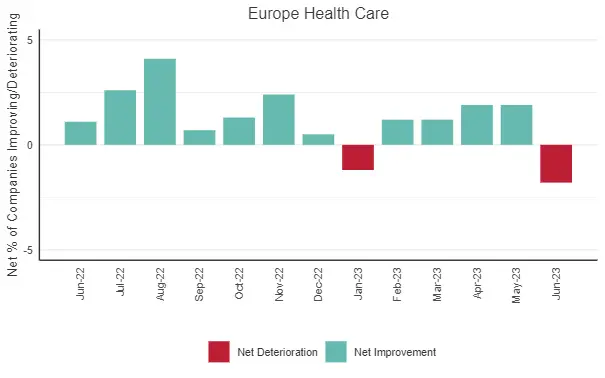

- Europe Health Care

- Europe Nondurable Household Products

- Europe Pharmaceuticals and Biotechnology

- Europe Travel and Tourism

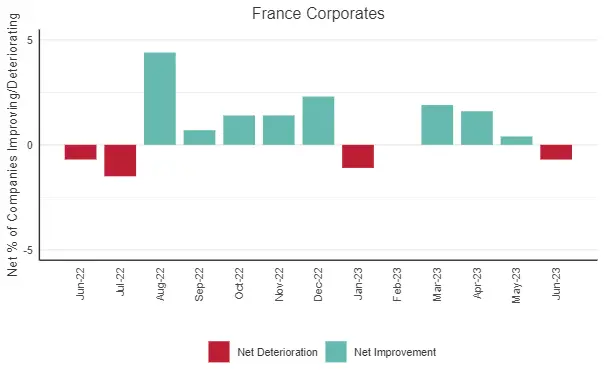

- France Corporates

- Global Automobiles

- Global Consumer Finance

- India Financials

- Ireland Financial Services

- North America Automobiles

- North America Trucking

- Singapore Industrials

- Thailand Financials

- United Kingdom Conventional Electricity

- United Kingdom Electricity

- United Kingdom Fixed Line Telecommunications

- United Kingdom Health Care

- United Kingdom Integrated Oil and Gas

- United Kingdom Large Telecommunications

- United Kingdom Large Utilities

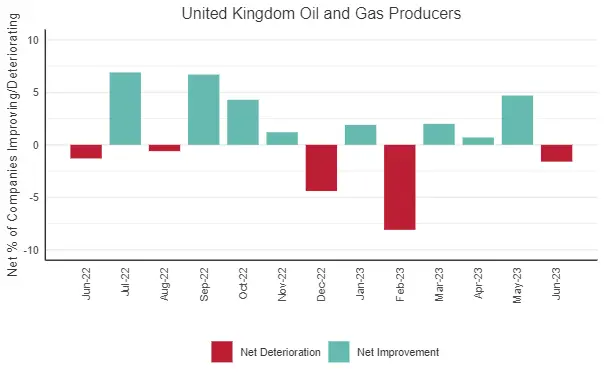

- United Kingdom Oil and Gas Producers

- United Kingdom Travel and Tourism

- United Kingdom Utilities

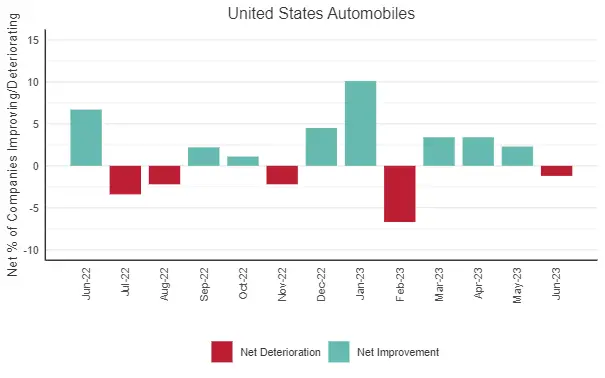

- United States Automobiles

- United States Industrial Transportation

- United States Pension Fund

- United States Trucking

These trend shifts are spread across diverse sectors and this month there are more negative turning points than positive turning points. Industrials and Construction feature heavily in the positive turning point list (top), across Europe, UK, North America and Globally. Software and Computer Services also appear in the positive turning point column, especially in the US and North America.

Autos feature heavily in the negative turning point list (bottom), across Asia, Canada, US and Globally. China Autos and Consumer Goods are also in the negative column, reflecting a stream of recent negative economic data.

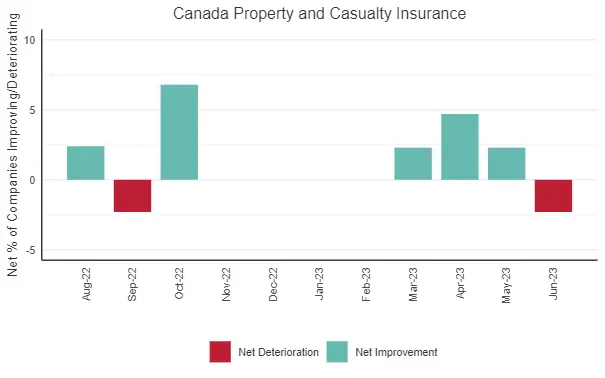

Europe Travel & Tourism and Canada Property & Casualty Insurance appear in the negative turning point column, possibly partly due to the growing impact of climate change related claims.

The following charts show highlights from the Industry and Sector Turning Points lists – these are based on the % of improving vs. deteriorating credit estimates across each sector universe.

Positive Turning Point

Negative Turning Point

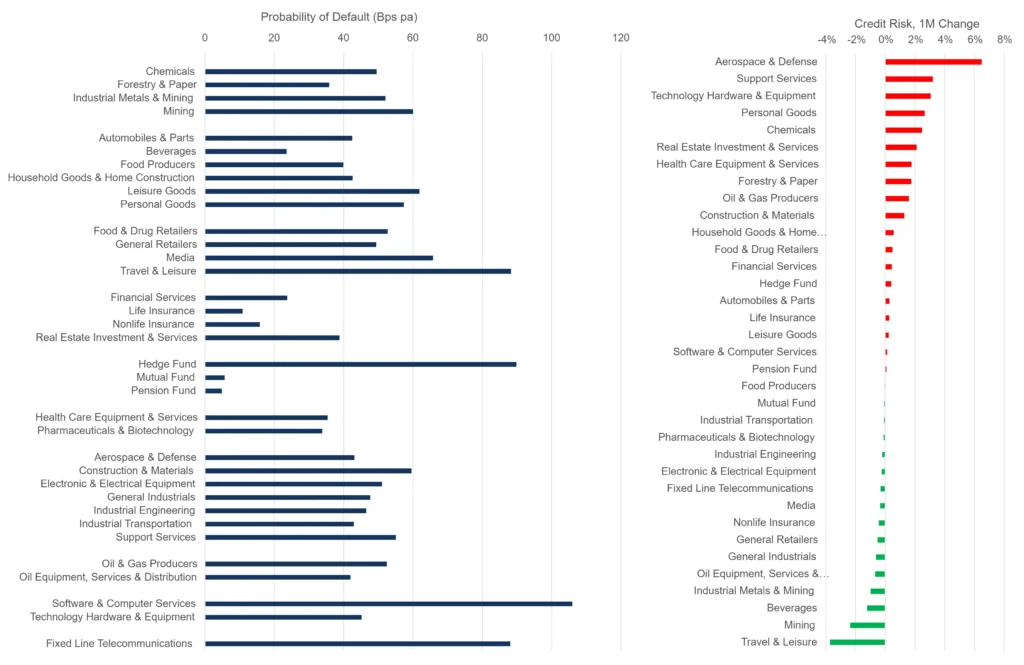

US Sector PD Comparisons

US Aerospace & Defense Is Largest Monthly Drop

With economies and markets giving mixed signals, there is a lot of uncertainty about 2023 default rates. The table below compares average consensus default probabilities for a range of US sectors.

Insurance and Funds – apart from Hedge Funds – are very low risk. Travel & Leisure, Hedge Funds, Software, and Fixed Line Telecomms are highest in the 80 -120 Bps range. The mid-range includes Mining, Leisure Goods and Media.

Large sector increases this month include Aerospace & Defense, Support Services, Technology Hardware & Equipment, Personal Goods and Chemicals. Improvements include Travel & Leisure, Mining and Beverages.

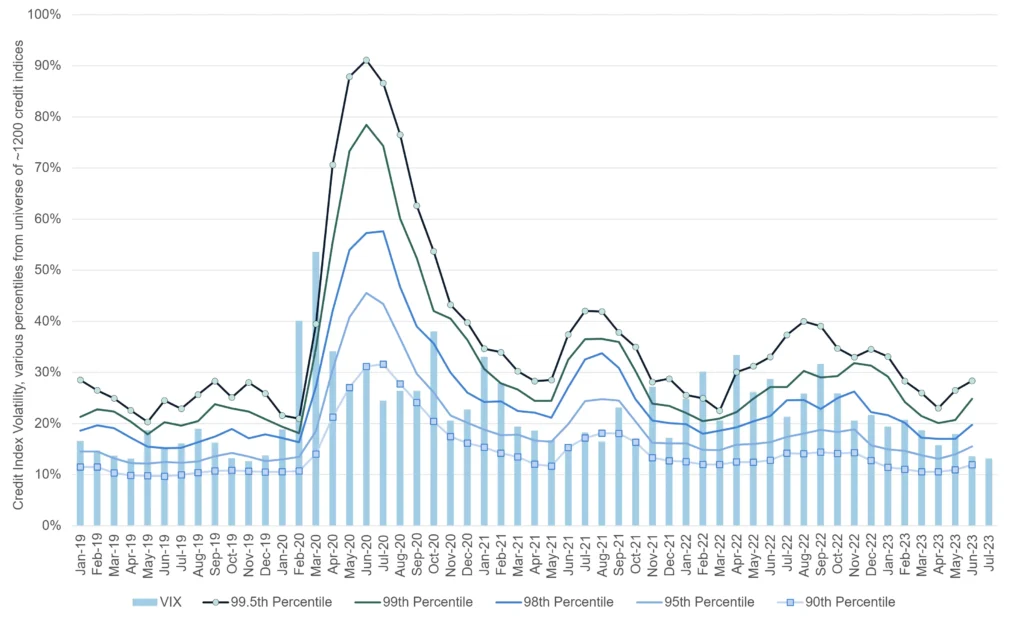

Credit Volatility

Equity VIX Down, Credit Volatility Still Ticking Up

VIX

The following chart shows percentiles for credit index 6-month rolling volatility. For approximately 1,200 indices, rolling volatility shows the speed and scale of PD changes; these can give advance warning of changes in transition rates. The percentiles plotted here are the most sensitive to turning points in PD volatility.

Across the CB index universe, all percentiles are continuing to move up this month – the first time in nearly a year that volatility has risen for two consecutive months. However, the Equity VIX has dipped to its lowest level since 2020.

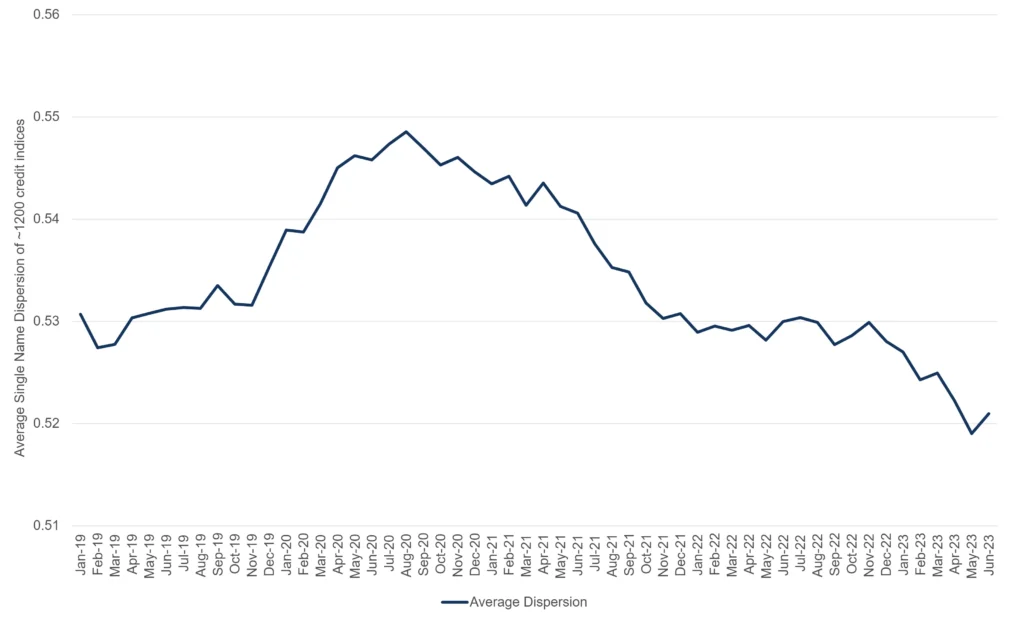

Dispersion

The next chart is based on cross sectional volatility (“dispersion”) i.e., the average range of estimates for single name estimates. (A high value implies widespread uncertainty about individual firm credit ratings, probably around a key turning point; a low value implies a tight consensus and probably indicates that current trends will continue.)

This again shows a trend decline[1] since the start of the pandemic, consistent with the drop in rolling volatility plotted above; but latest data shows an uptick. The next few months will be critical; if dispersion continues to rise it will indicate growing uncertainty about credit risk, suggesting a higher future default rate.

[1] The actual plotted range is small (about 4% of the average value). Changes in dispersion are more marked at the single name level – for example, when a legal entity is downgraded, the range of PD estimates usually increases.

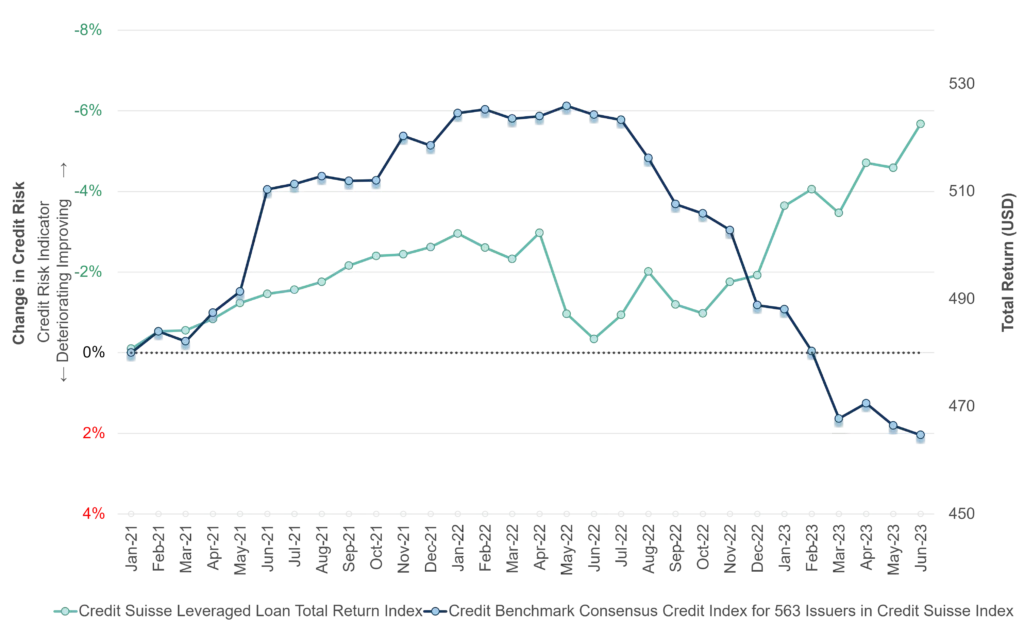

Leveraged Loans

Gap Between Index Value and Credit Downturn

The chart below plots the credit trend of the Credit Benchmark Leveraged Loan Index, made up of 563 issuers in the Credit Suisse Leveraged Loan Index.

The credit index tracked the Credit Suisse Leveraged Loan Total Return in 2021 to early 2022. However, credit has deteriorated by approximately 8% in the past year while total return is up nearly 6%.

Economic Growth in China

Asia Corporates in the Red for Two Consecutive Months, China Falters

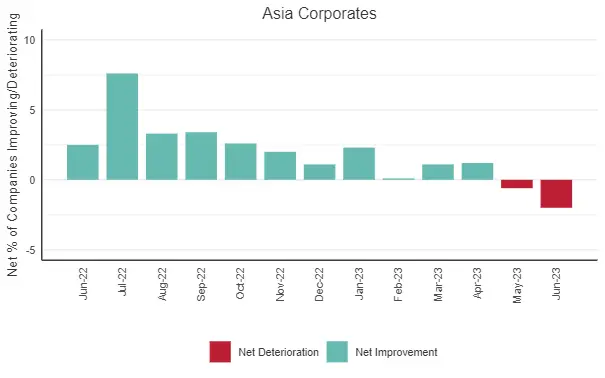

Asia Corporates have now posted two consecutive months where companies showing credit deterioration outnumber improvements. The chart below shows the % net balance; the latest month shows a deeper move into the red.

Across Asian credit indices, there are currently no positive turning points. Those with negative turning points are listed below:

- Asia Automobiles and Parts

- Asia Automobiles

- Asia General Retailers

- Asia Specialty Retailers

- Asia Industrials

- Asia Financial Services

- Asia Consumer Finance

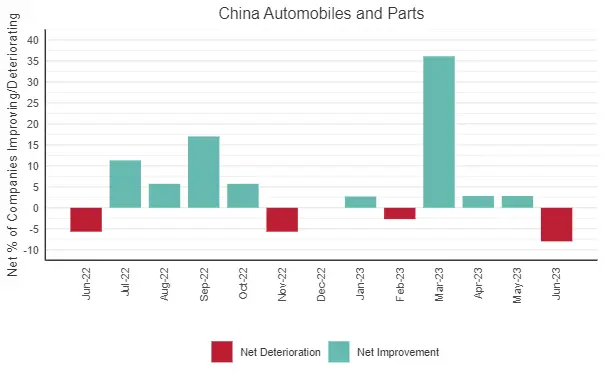

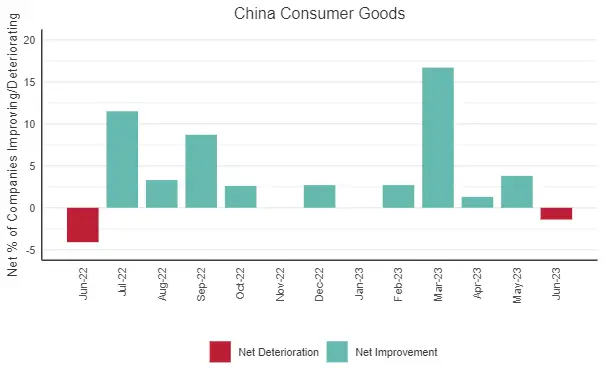

Economic growth in China slowed in the second quarter, and current forecasts for the full year are likely to be revised down. While most of the world grapples with inflation, the main risk in China is deflation while youth unemployment reaches record highs. The following charts highlight two sectors – Autos and Consumer Goods.

China may be the world’s second-largest automotive exporter, but post-Covid headwinds are taking their toll: the China Automobile and Parts credit outlook is now turning negative with 8% more China Automobiles and Parts companies showing deterioration than improvement. China Consumer Goods have also posted a negative turning point as Chinese retail sales growth slows.

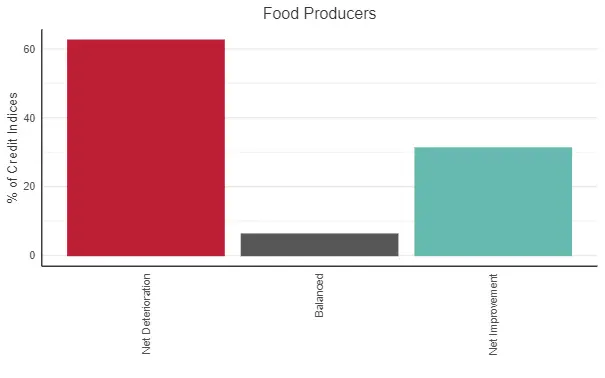

Food Producers

Net Deterioration for Majority of Food Producers

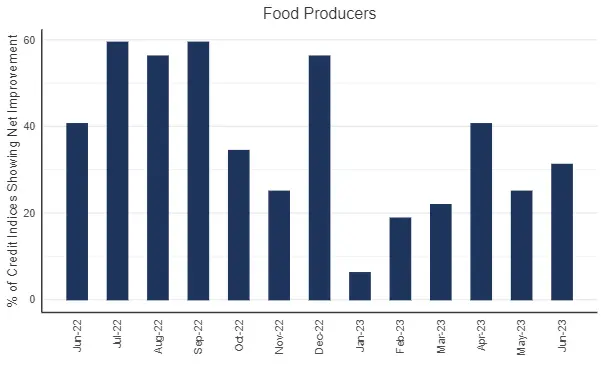

Following the Russian withdrawal from the Black Sea Grain Deal, food and fertilizer prices – already grappling with supply issues – are expected to spike further.

The following chart covers a universe of approximately 32 Food Producers credit indices, tracking the proportion with net credit upgrades. This remains well below the neutral 50% line.

The chart below shows the current Food Producers credit indices split between Net Deterioration, Balanced, and Net Improvement. The majority (62.5%) of Food Producers indices are showing a Net Deterioration credit outlook.

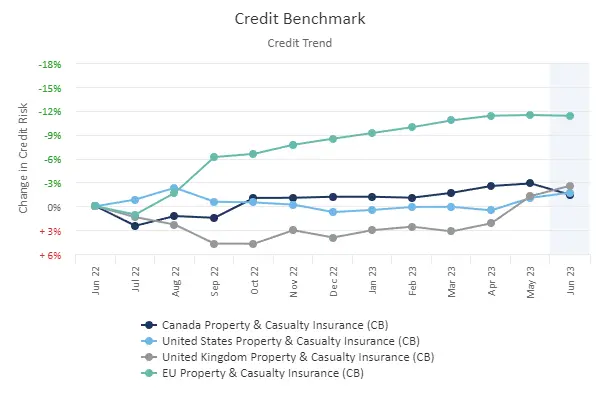

Climate Change, Record Temperatures and Wildfires

Negative Impact on Insurance & Airlines

Insurance Impact

Temperature records are being shattered across Europe as well as the Globe. The insurance industry faces a lengthening list of claims as homes and businesses are devastated. Insurance rates are rising as capacity drops – partly due to rising interest rates – but the eventual scale of climate-linked losses remains unknown.

The following chart shows 1Y credit trends for the Property and Casualty Insurance sector in Canada, US, UK and the EU.

The chart below is based on the net balance between improving and deteriorating companies within the Canada Property and Casualty Insurance Credit Benchmark Index.

The Canada Property and Casualty Insurance sector has turned negative for the first time in nearly a year – and other countries and regions are expected to follow.

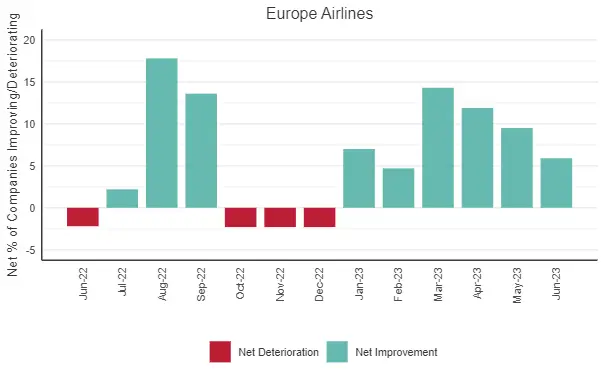

Airlines Impact

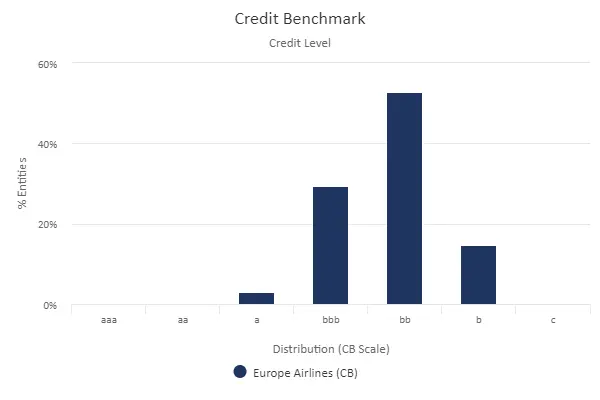

Share prices of European holiday airlines have been hit by European wildfires with cancelled flights, tourist evacuations, and holiday plans thrown into disarray. The following chart shows that the net proportion of companies with credit improvement in the European Airlines index has been steadily decreasing for the last 4-months.

The current 7-category credit distribution chart, below, shows that over 50% of European Airline companies are rated bb or lower.

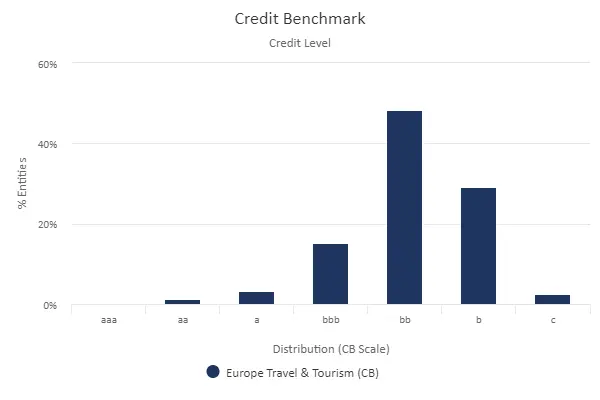

In general, Europe Travel and Tourism is suffering. The following chart shows the first negative credit outlook since Dec-22.

The below chart shows that currently 80% of European Travel and Tourism companies are rated high yield.

US Mortgage Finance

Sustained Net Deterioration

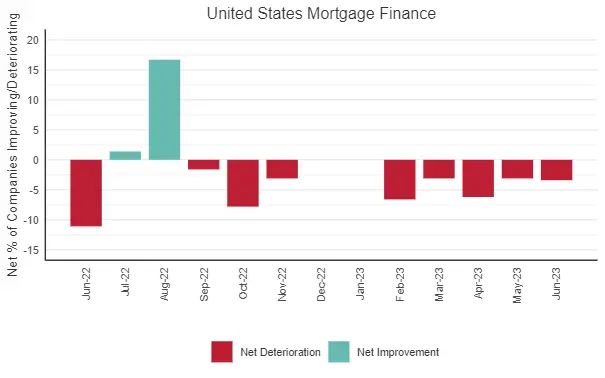

The US housing market faces a long recovery from the steep increase in mortgage rates over the past year.

The following chart is based on the net balance between improving and deteriorating companies within the US Mortgage Finance Credit Benchmark Index.

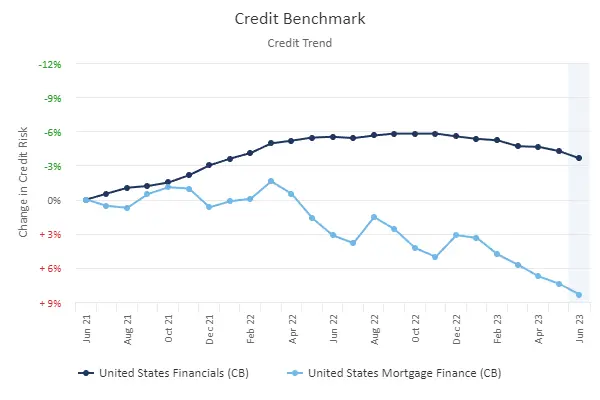

US Mortgage Finance companies have posted a fifth consecutive month of net deterioration. The balance is currently 3.3%, but the chart below shows that the US Mortgage Finance credit index has deteriorated by approximately 9% in the past 2-years.

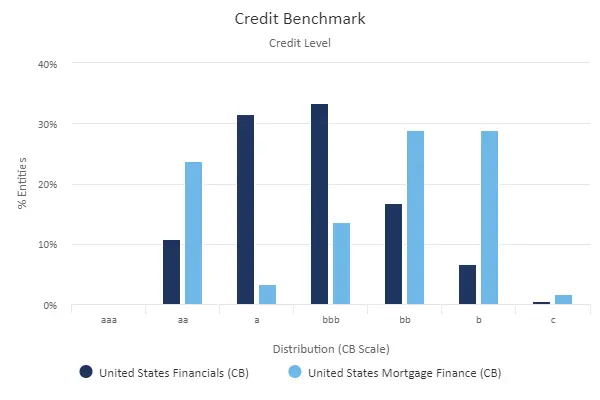

The following chart compares US Mortgage Finance with US Financials generally; the mortgage sector has a higher proportion of entities in bb and b credit categories. (The aa segment is Federal Home Loan providers).

Conclusion

Global credit trends continue to be negative. Interest rate cuts seem unlikely this year, but real interest rates are arguably still low unless inflation shows a sustained global drop. Leveraged firms are feeling the credit pain, and loan providers are suffering from a drop in volumes. Major banks have seen windfalls from higher loan rates that have not been passed on to savers, but specialised lenders are finding the new environment more difficult. Insurers are benefitting from higher underwriting rates but they face growing and uncertain climate-related losses. Climate change and the continued war in Ukraine are weighing heavily on Food sector credit. China’s cooling property market has hit the wider economy and is now affecting the rest of Asia.

Download

Please complete your details to download the full Monthly Credit Outlook :