Credit Benchmark have released the December Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for Global, UK & US Oil & Gas based on the consensus views of over 20,000 credit analysts at 40+ of the world’s leading financial institutions.

Drawn from more than 950,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for Oil & Gas. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

US Oil & Gas firms have put a recent negative blip behind them with another month of positive credit quality, while Global and UK firms also continue to enjoy net credit improvement.

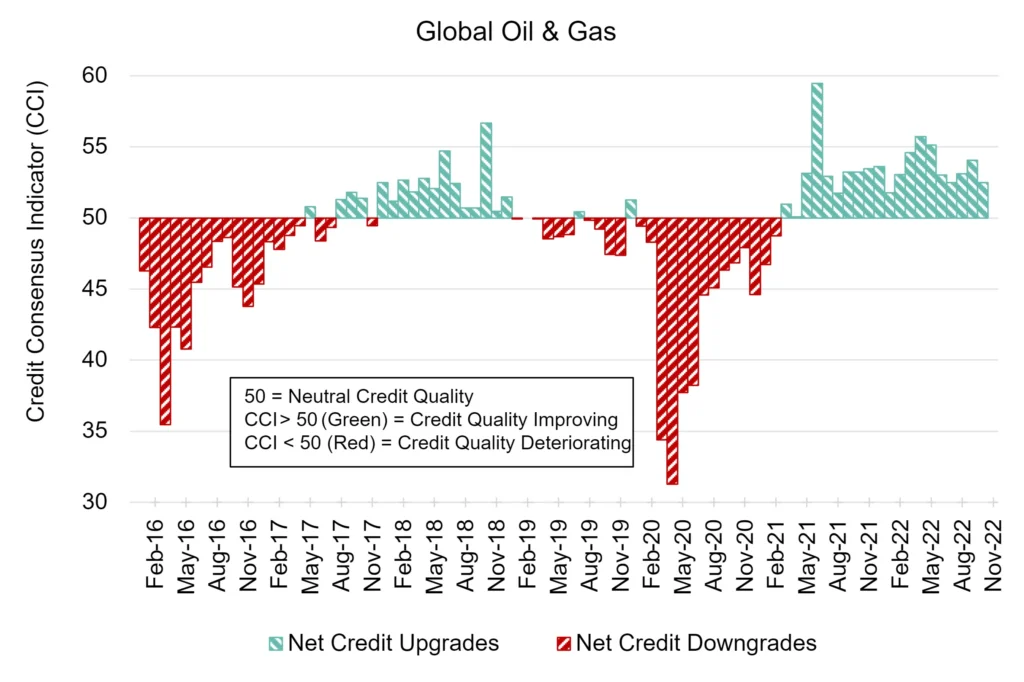

Global Oil & Gas: Improvement Persists

Global Oil & Gas firms have gone from strength to strength, boasting CCI scores above 50 for 20 consecutive months and maintaining long-term net positive credit quality.

The Global Oil & Gas CCI score is 52.5 this month, a slight decrease from last month’s CCI of 54.1.

5G to revolutionize the Global Oil & Gas industry in the next 7 years. The market is expected to grow more than 500% by 2030, due to digitization

.

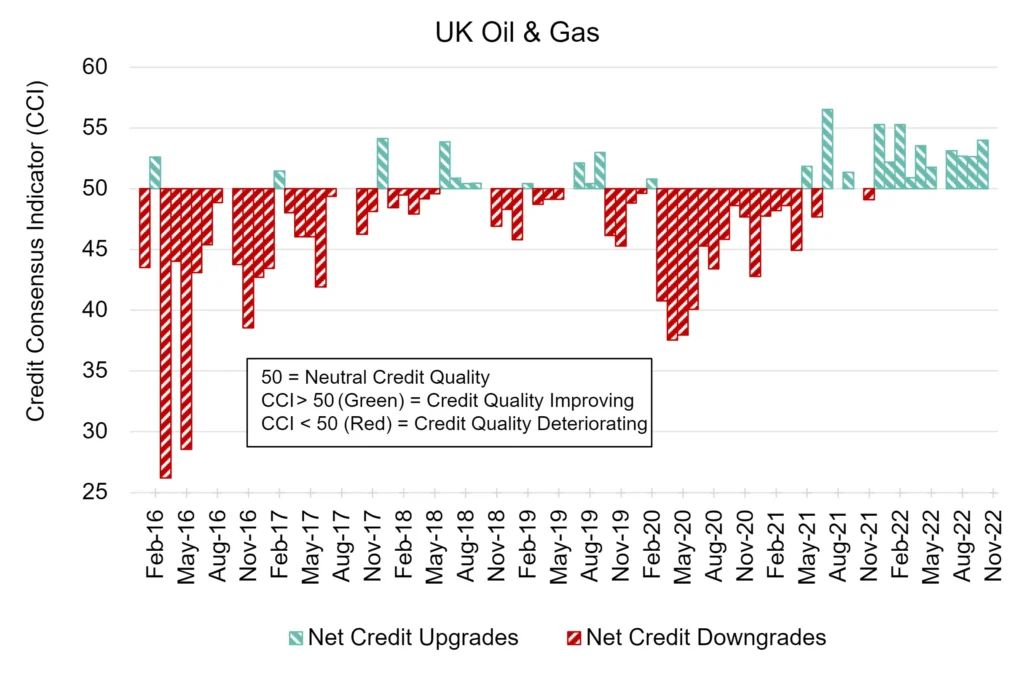

UK Oil & Gas: Increased Improvement

The improving trend for UK Oil & Gas firms continues, with a fourth consecutive month of credit quality in the green.

The UK Oil & Gas CCI score is 54.0 this month, a slight increase from last month’s CCI of 52.7.

The UK Oil and Gas sector faces a ~£20 billion bill to dismante over 2,000 unused wells and facilities in the ageing basin over the next decade.

.

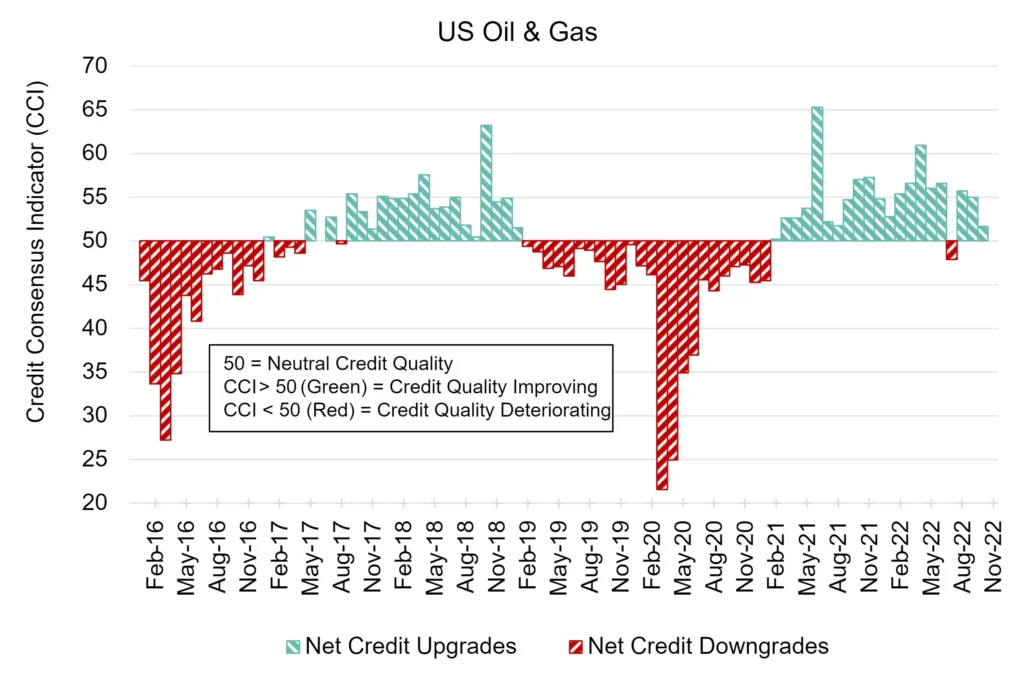

US Oil & Gas: Hanging On

After ended their streak of 17 consecutive months of positive credit quality in July-22, US Oil & Gas firms have maintained positive credit quality for the third month running.

This month, the US Oil & Gas CCI score is 51.7, a modest decrease from last month’s CCI of 55.0, but still hanging to credit positivity.

Oil stocks have continued to show a peculiar disconnect from the commodity they track, with oil equities staging a powerful rally even as oil prices have fallen sharply since the last OPEC meeting.

.

To download the full CCI tear sheets for Global, UK & US Oil & Gas, please enter your details below: