Credit Benchmark have released the July Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 20,000 credit analysts at 40+ of the world’s leading financial institutions.

Drawn from more than 950,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

EU and US Industrial firms continue their streaks of consistently positive CCI scores, with 10 months and 17 months of net credit improvement respectively. UK firms have travelled a bumpier road, with alternating positive and negative scores in recent months, ending on a positive in the most recent update.

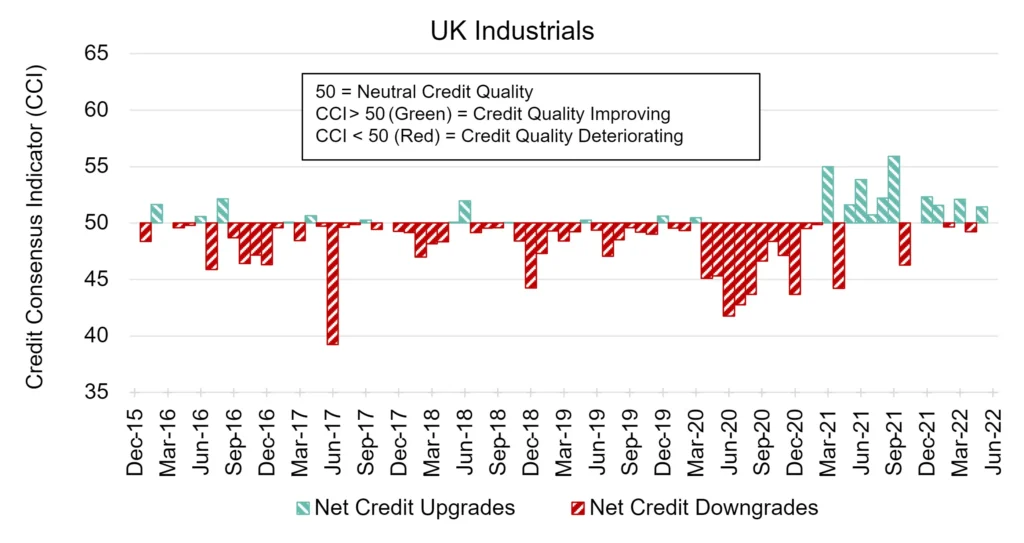

UK Industrials: Ups and Downs

UK Industrial firms are in a positive position this month but have been unable to maintain a consistent trend since mid-2021.

The UK CCI score is 51.4 this month; an improvement after another negative blip last month when the CCI registered at 49.2.

UK factory growth has slowed to its weakest in 18 months, with business optimism following suit amidst cost pressures and supply bottlenecks. However, with evidence of an increase in investment intentions in the region, the CCI may yet see strengthening credit quality longer term.

.

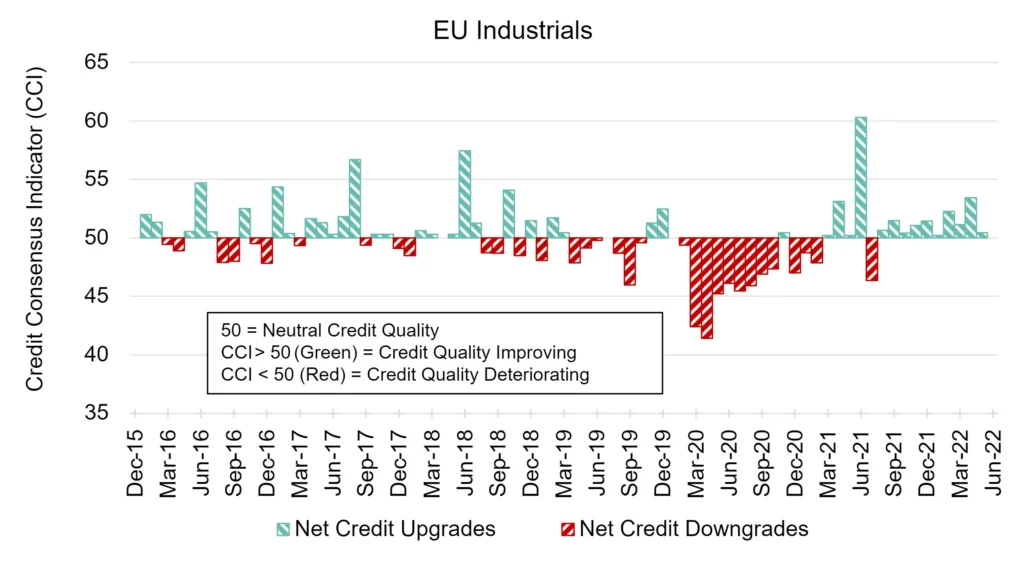

EU Industrials: Hanging On

EU Industrial firms have registered another positive CCI for this month, which is the tenth consecutive instance of a positive score.

The EU CCI score hovers above neutral at 50.5 this month, a decrease from last month’s score of 53.4. While the ongoing run of net positive scores bodes well for the group, the trend remains modest and has dipped close to neutral on several occasions.

EU factories are currently experiencing labour shortages as a result of tens of thousands of Ukrainian workers returning home to fight against the Russian invasion of their country. For firms struggling to recover from COVID and rising costs, this worker shortage may begin to impact Industry credit quality.

.

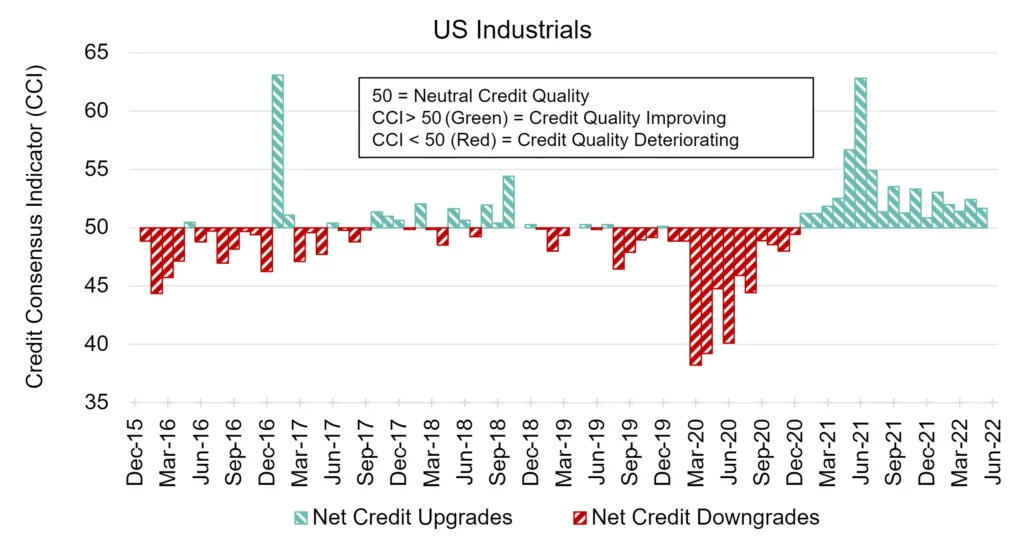

US Industrials: Level Trend

US Industrial firms show positive credit quality for another month, stretching the streak of good fortune to 17 consecutive months now.

The US CCI score this month is 51.7, registering slightly under last month’s CCI of 52.4. Similarly to the EU CCI, the US trend has remained reasonably modest in recent months, though with a degree less fluctuation.

Global chip shortages continue to affect manufacturing output in the US, but an expansion of local production capacity should ease this while also providing a boost to the industry. Rising interest rates may also hurt demand for the production of new goods, with a slight drop in output already seen in recent months.

.

To download the full CCI tear sheets for UK, EU, and US Industrials, please enter your details below: