Rising food and energy prices are a global issue, but the UK also faces the major inflationary impact of a depreciating currency. Against the US Dollar, the British Pound is getting close to its lowest level for 40 years.

Last month, UK shoppers cut spending by the most since the country was in a COVID lockdown in early 2021. The British Retail Consortium reported that total retail spending is already down year-on-year.

And apart from a possible blip from the Jubilee celebrations, tighter household budgets will squeeze both non-essential and essential spending this year. Tesco is seeing early indications of the impact of inflation on consumer spending patterns with a greater-than-expected 1.5% year-on-year decline in like-for-like UK sales, and kitchenware retailer ProCook reported increasingly challenging market conditions.

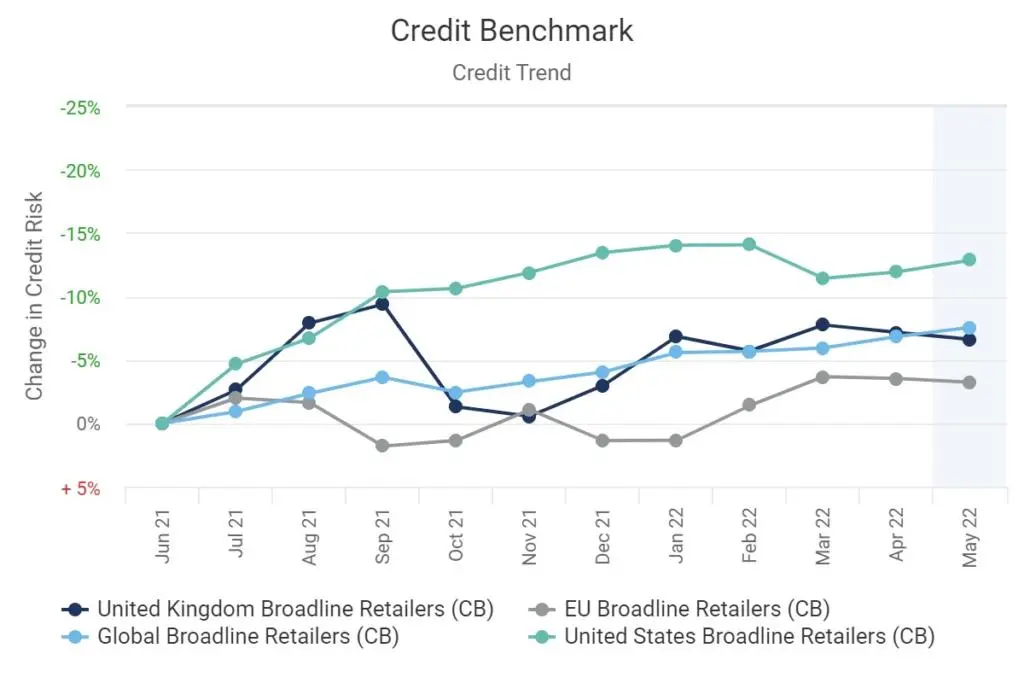

Figure 1 shows the credit trends for broadline retailers in the UK compared with the EU, Global and US.

Detailed consensus credit data is available on Bloomberg or via the CB Web App, covering many otherwise unrated companies. Contact Credit Benchmark to start a trial or to request a coverage check.

Figure 1: Credit Trend, UK, EU, Global and US Broadline Retailers; Jun-21 to May-22

UK and EU both show recent deterioration against a still-rising global trend. Imported inflation may be part of the issue – until April this year, the Euro was even weaker than Sterling, but a newly hawkish stance from the ECB is likely to see the gap close.

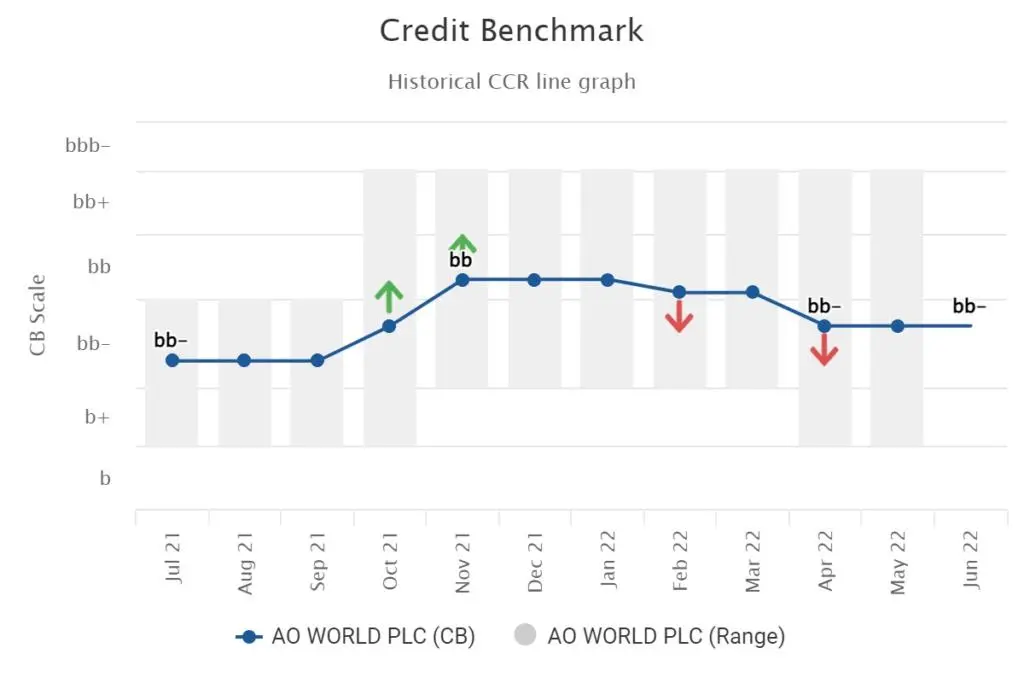

As consumers across the UK and the EU focus on essentials and spend less time at home there has been a reduction in white goods demand: for example AO, the electrical retailer, has cited a deterioration in their outlook and its shares are down more than 60% this year.

Figure 2 shows the AO credit trend, with the Credit Consensus Rating (CCR) recently downgraded from bb to bb-.

Figure 2: AO World PLC.

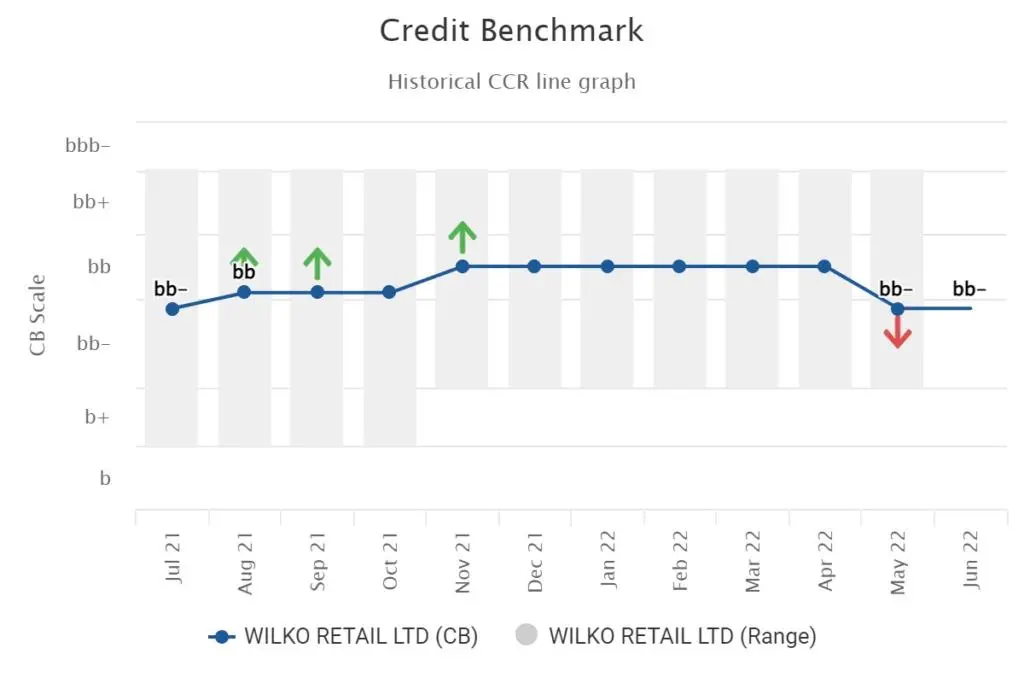

Figures 3-5 show credit trends for some other negatively impacted companies.

Figure 3: Wilko Retail Ltd, a ubiquitous presence in UK retail parks. The Wilko homeware range is cheap, but the UK DIY boom seems to be over. Wilko is unlisted, and limited CRA information is available, but the CCR is bb- and shows a recent deterioration.

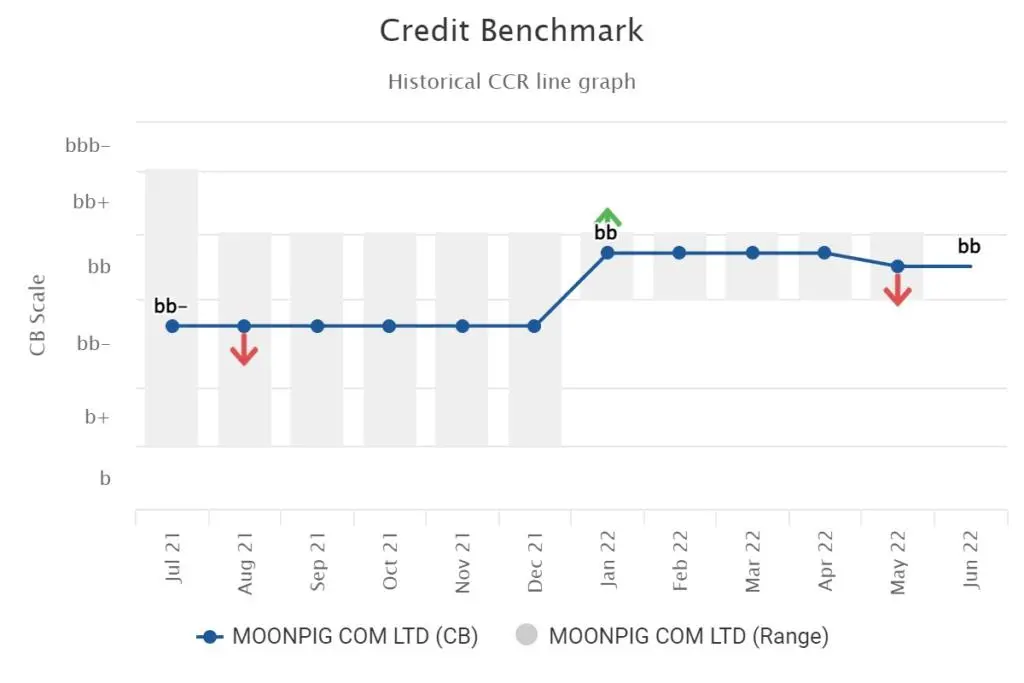

Figure 4: Moonpig Com Ltd, a dot-com survivor and online greetings card IPO success story in 2021; but carries high debt and has seen its share price drop 40% this year.

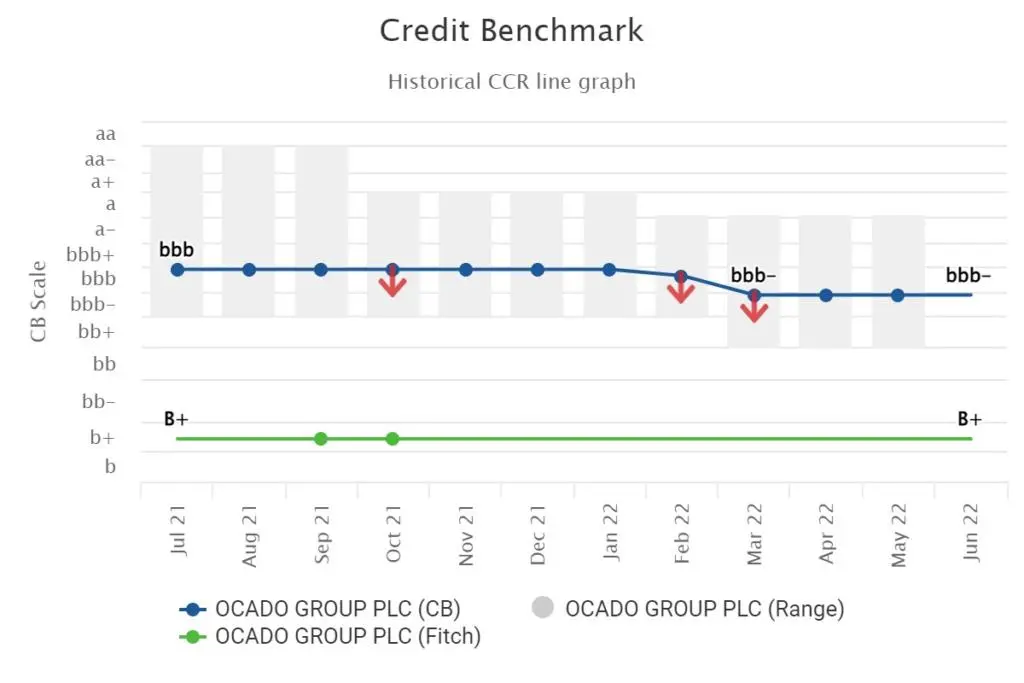

Figure 5: Ocado Group PLC, the lockdown lifeline, has seen its share price almost halve this year. The loss-making firm has raised funds for expansion despite analyst concerns about the negative impact of inflation on the on-line business model. The current CCR is bbb-, but the trend has been negative.

Enjoyed this report? If you’d like to see more consensus-based credit ratings, mid-point probabilities of default and detailed analytics on 60,000+ public and private global entities, please complete your details to start a trial or to request a coverage check: