The invasion of Ukraine has shifted energy sector dynamics, with all energy sources (including non-renewables) back in scope. After describing themselves as “cash machines”, major oil companies are now trying to head off a windfall tax with promises of renewed investment – in fossil fuel extraction. The alternative is ongoing European dependence on Russian oil and gas – but the war has demonstrated that energy security may be more politically pressing than environmental worries.

US energy companies have had a bonanza as oil and gas prices have spiked, and this has been mirrored in share price performance with the sector up more than 30% while the broader market has lurched down.

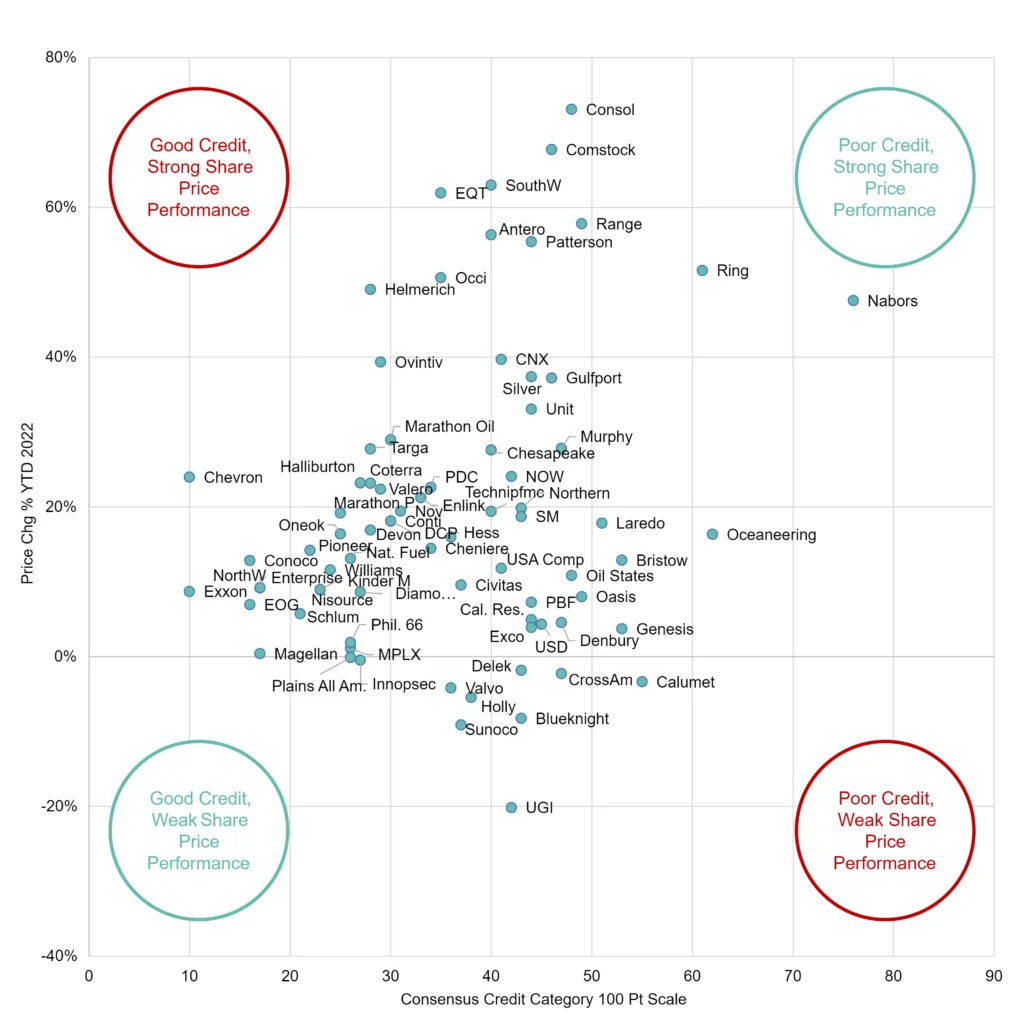

Figure 1 shows the relationship between Credit Consensus Ratings and US energy sector equity price changes in 2022.

Detailed consensus credit data is available on Bloomberg or via the CB Web App, covering many otherwise unrated companies. Contact Credit Benchmark to start a trial or to request a coverage check.

Figure 1: Consensus Credit and Equity Performance

Based on the 100-point credit scale (1 = Best, 100 = Worst), Nabors has the lowest Credit Consensus Rating (above 70), followed by Oceaneering and Ring (both above 60). Laredo, Bristow, Genesis and Calumet are above 50.

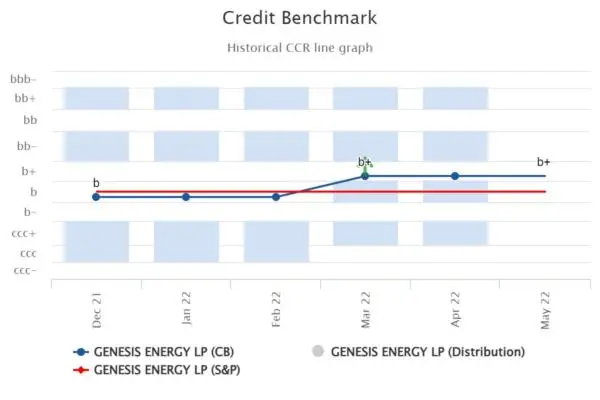

Of these, Ring and Nabors have been the best share price performers, both up by c50% since the start of the year. Oceaneering, Laredo and Bristow have lagged behind the sector with share prices up less than 20% this year. Genesis share price is only up slightly, despite recent credit improvement, whilst Calumet share price is slightly down.

Figure 2 shows the detailed credit trend for Genesis Energy since Dec-21.

Figure 2: Genesis Energy

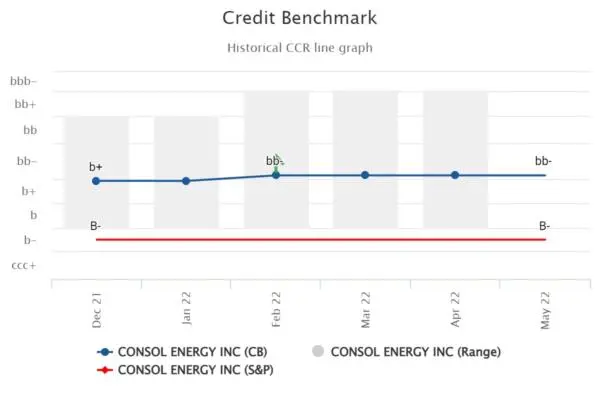

Across the full range of Credit Consensus Ratings in the US Energy sector, companies like Consol Energy, Comstock Resources and Range Resources stand out as strong equity performers. High quality firms that have lagged the equity market include Exxon, Magellan and Plains All American.

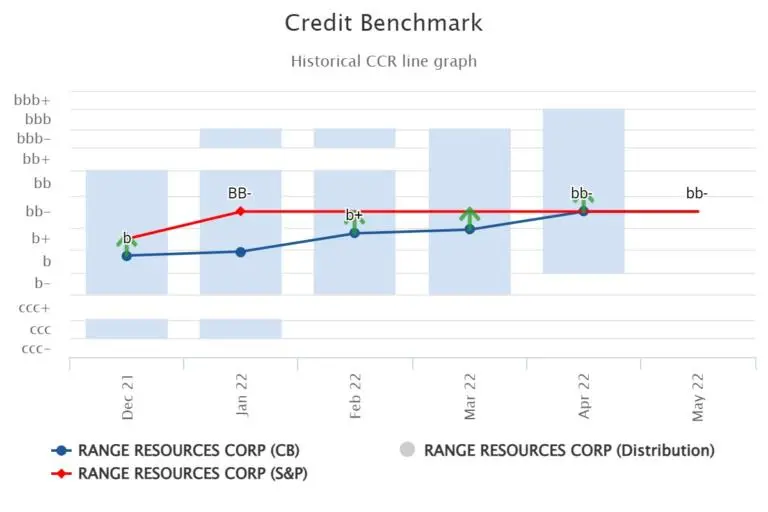

Figures 3 and 4 show the detailed credit trends for Consol Energy and Range Resources since Dec-21. Both companies have experienced recent credit improvement, moving from the b+ credit category to bb-.

Figure 3: Consol Energy

Figure 4: Range Resources