Credit Benchmark have released the April Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 20,000 credit analysts at 40 of the world’s leading financial institutions.

Drawn from more than 800,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

April showed similarly positive CCI readings for US and EU Industrial firms this month, both of which have enjoyed overall net improvement for several months now. The UK dropped into negative territory after three prior months of improvements, implying a shakier credit foundation.

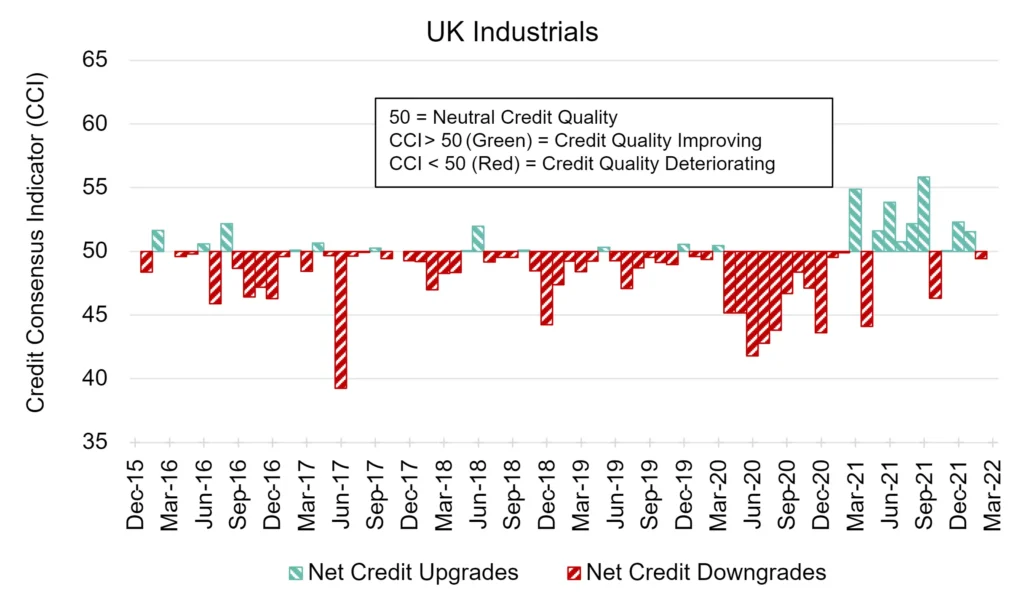

UK Industrials: Recurrent Setbacks

UK Industrial firms are struggling to remain in positive territory, with a return to net deterioration this month.

The UK CCI score is sitting just under neutral at 49.4, the first instance of a negative score since October 2021, and the third negative score in the last 12 months.

Manufacturing dropped by more than a third in the UK in March due to a shortage of semiconductors and other components, representing the worst March since 2009. With cost pressures remaining intense, these challenges are likely to be reflected in the coming months’ credit quality.

.

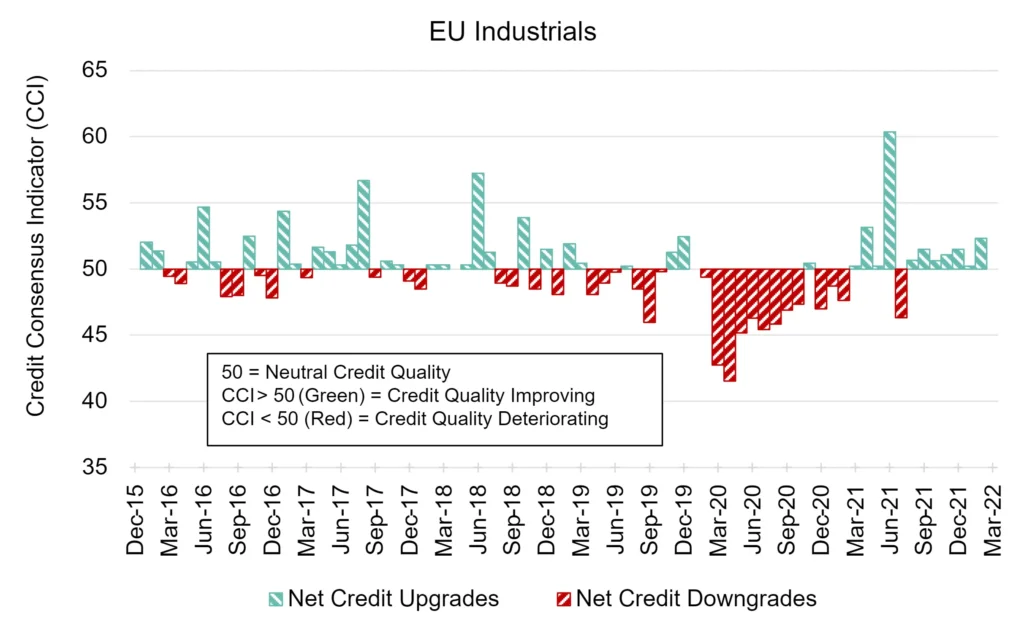

EU Industrials: Modest Growth

EU Industrial firms continue their run of improvements, registering the highest CCI score since June 2020 – though the net balance of improvements remains modest.

The EU CCI score sits at 52.3 this month, an increase from last month’s score of 50.2. The last instance of deterioration for the group was in July 2021; also the only instance within the past 12 months.

The region may see a boost in manufacturing fortunes as a result of efforts to cut reliance on Russian gas and rebuild Europe’s industry manufacturing of solar parts. The Union plans to reduce Russian gas use by two thirds this year and end it by 2027.

.

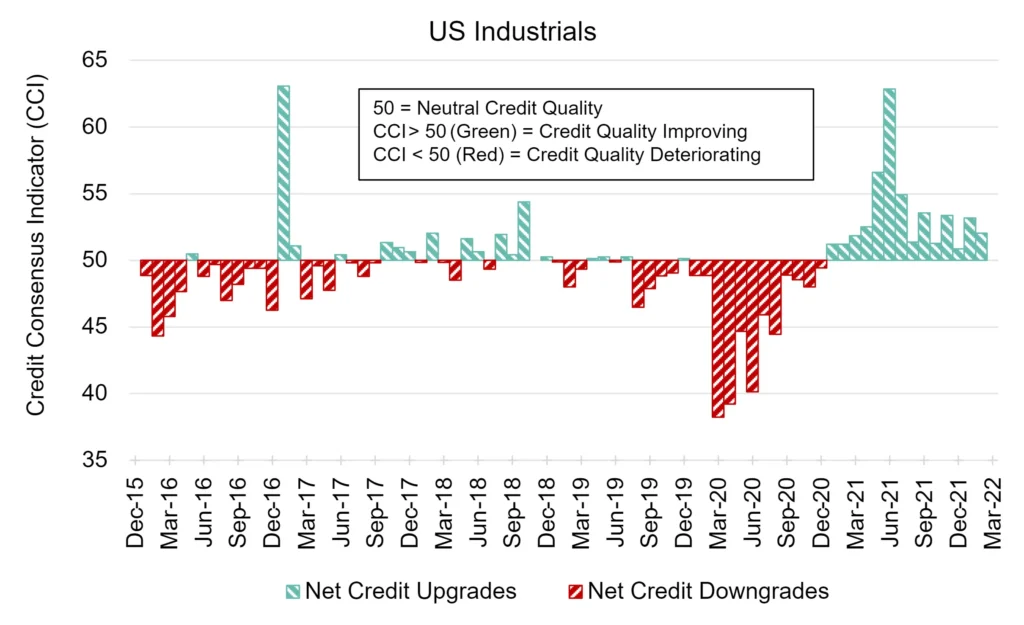

US Industrials: Trend of Net Improvement Persists

US Industrial firms have gone from strength to strength, boasting CCI scores above 50 for 14 consecutive months and maintaining long-term net positive credit quality.

The US CCI score this month is 52, a small drop from last month’s CCI of 53.2. While the long-term trend is positive, the individual scores have not gone above 55 for eight months, indicating some macro pressures on the industry.

Though a consumer spending shift from services to goods during the pandemic was beneficial to US manufacturers, labor markets have been tight and supply chain pressures have persisted due to China lockdowns and the war in Ukraine. Autos were hit particularly hard, but recent production figures are encouraging.

.

To download the full CCI tear sheets for UK, EU, and US Industrials, please enter your details below: