Even if the war in Ukraine can be stopped soon, it has already had a dramatic impact on the global food trade. Russia and Ukraine are major and direct suppliers of grain (especially wheat and barley) to Africa and the Middle East, and Ukraine provides the majority of the world’s sunflower oil used in animal feed.

Even before the invasion, wheat prices had doubled from their lows of 2017 – the pandemic adding to the effect of trade tensions and the growing impact of climate change[1]. But Russian aggression has damaged global food supplies: wheat and sunflower oil prices are up more than 35% in the month; soy and palm oil up 15%; corn and rice up 7% and 3% respectively.

In a further twist, Russia recently agreed to supply China with grain “from anywhere within Russia” – presumably including Ukraine – and China has no plans to block those imports. This gives Russian some foreign exchange while other sources are sanctioned.

The war could hamper spring planting in western Ukraine; wheat futures for delivery as far out as two years have spiked to reflect this. But grain and plant oil are not the only issues. The war will severely restrict global fertilizer supplies from Russia, Belarus and Ukraine – all major producers.

The fertilizer industry has seen intense innovation in recent years in an attempt to meet inexorably growing demands for higher yields. Seaweed, food waste and microbial ammonia are just some of the alternatives. But there are no quick fixes, and natural gas shortages are a major limiting factor for nitrogen-based fertilizer.

The EU is expected to quickly amend rules on state aid to farmers to maintain production levels despite rising costs. And they are also likely to relax rules on pesticides and GMO content to admit meat supplies from the Americas – although markets seem to be anticipating a change in meat-eating habits: prices of live and feeder cattle are actually down on the month.

Detailed consensus credit data is available on Bloomberg or via the CB Web App, covering many otherwise unrated companies. Contact Credit Benchmark for a complimentary trial or coverage check.

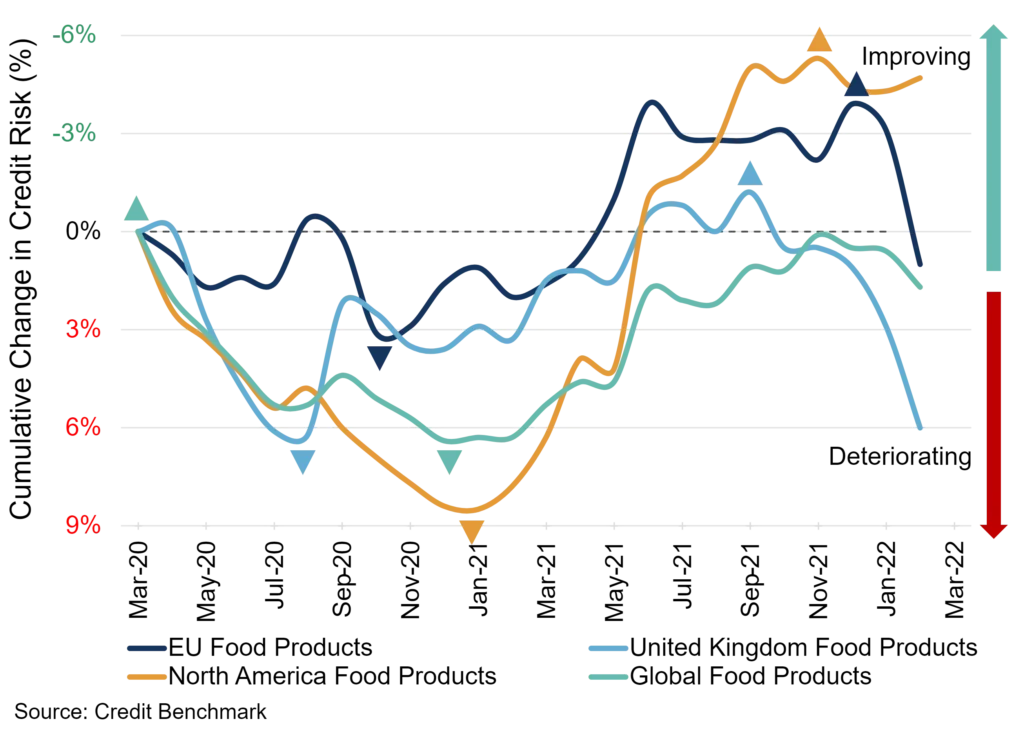

Figure 1: Credit Risk Trends

In the past month, the main impact is on EU Food Products companies, with a 4% deterioration in average credit risk. The UK is down about 3%, and the Global aggregate is down just over 1%. North American Food Products actually improved – up 0.3% over the month.

Some of the individual companies driving the deterioration include Unilever and Yara (fertilizers) in Europe; while Cargill in the US has improved.

Even if a peace deal can be brokered soon, the delay in spring planting and the disruption to supply networks means that these credit trends are likely to continue for some time.

Consensus data is updated twice per month, tracking the continuing effect of the war on sectors and companies, rated and unrated, across the globe. This data is now also available on Bloomberg or via the CB Web App – contact Credit Benchmark for a complimentary trial or coverage check.

Enjoyed this report? If you’d like to see more consensus-based credit ratings, mid-point probabilities of default and detailed analytics on 60,000+ public and private global entities, please complete your details to request a complimentary trial or coverage check:

[1] G20 and Oxfam have published a number of reports on the growing global food crisis. They cite climate change and water shortages, population expansion and the growing demand for (grain-intensive) meat as the systemic issues that will bring increasingly volatile food prices, food poverty and – in some countries – the risk of starvation.