Download the full whitepaper below.

After two tumultuous years, the global insurance market has proven its resilience. The sector has weathered COVID and ongoing trade and supply chain disruptions to emerge with stronger credit quality and recovery patterns than those of banks and other financial counterparts.

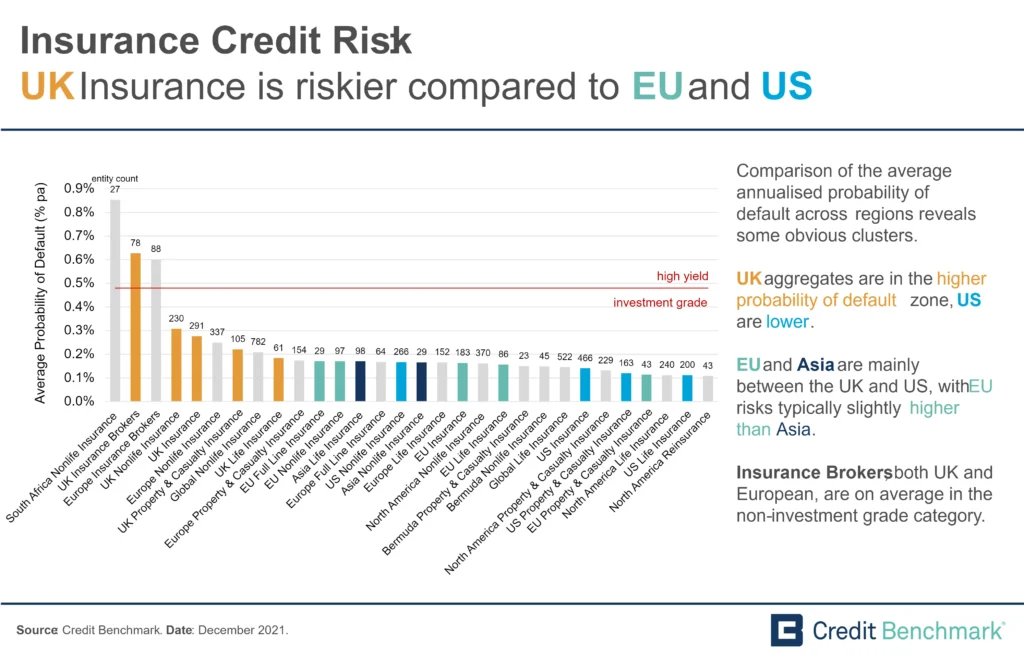

The storm clouds have not fully dissipated for the industry however, with regional advantages apparent. Where North American firms have rebounded to and, in some cases, surpassed pre-COVID credit quality levels, European companies show higher rates of deterioration or stagnation.

Climate change risk may prompt more frequent and larger claims, but also creates an opportunity for business generation and product development. As society adapts to an era of increased risk, insurers must keep pace to ensure premiums exceed pay-outs. While the ‘new normal’ presents challenges, the insurance industry is well-placed to face the unexpected.

A new whitepaper examines the state of global insurance in this climate of heightened risk, focusing on regional and sector trends alongside single company examples. Topics covered in the whitepaper include:

- Insurance credit trends during COVID

- Regional insurance credit trends

- Credit trends of corporate insurance buyers

- Counterparties and credit portfolios

- Insurance companies: single name examples

- Climate risk and insurance

Download the whitepaper below for the full analysis.

The data is available via the Credit Benchmark Web App, Excel add-in, flat file download, and third-party platforms including Bloomberg. Get in touch with us to request your free trial of Credit Benchmark Credit Consensus Ratings and Analytics.