Download the latest Financial Counterpart Monitor below.

The latest Credit Benchmark consensus data offer up good news for some types of financial counterparts.

Three classes of intermediaries saw more improvement than deterioration in this month’s update. The category with the best ratio was Prime Brokers at 2:1 improving to deteriorating, followed by CCP Members at 1.5:1 and Broker Dealers at 1.4:1. Central Clearing Counterparts was steady with neither improvement not deterioration at 1:1. Only Custodians and Sub Custodians moved in the wrong direction.

The news was even better for the buy side. Asset Managers led the pack with a ratio of 1.7:1, followed Mutual Funds at 1.5:1, Pension Funds at 1.4:1, and Insurance Companies at 1.2:1. Only Sovereign Wealth Funds saw more deterioration than improvement.

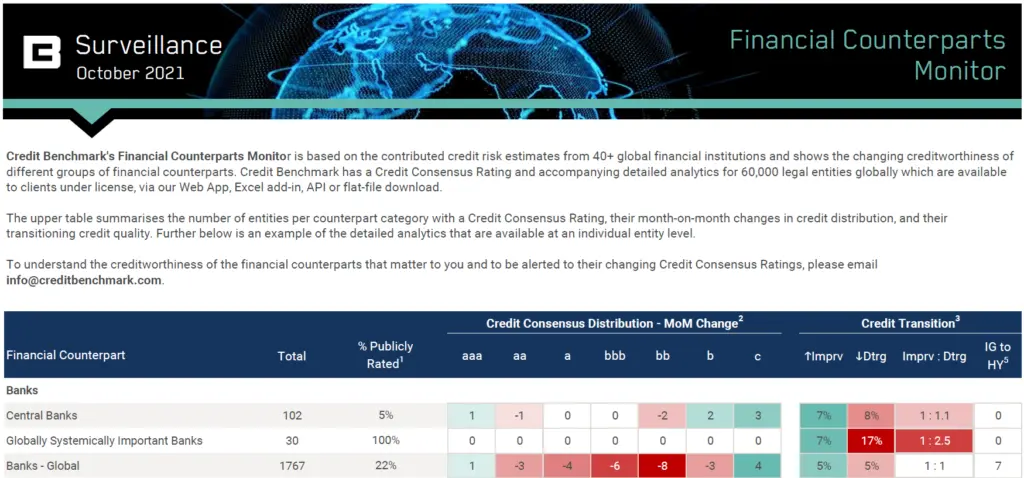

The news was more mixed for banks, with some categories seeing improvement and others seeing deterioration, but the broad category of Global Banks was even at 1:1.

According to David Carruthers, Head of Research at Credit Benchmark:

“Overall improvement is always welcome, even if moves are minor. As important as banks are to the real economy, entities like clearers and custodians are the backbone of the financial system.”

Previous research from Credit Benchmark has highlighted the interconnectedness and importance of Custodians and Sub Custodians and Central Clearing Counterparts.

The collapse of Archegos Capital Management earlier this year highlights how one firm’s troubles might spread to many different firms. The problems with Archegos were so severe, Man Group suggested the number of prime brokers may shrink, as reported by Bloomberg.

Note that with the exception of Prime Brokers (and to a lesser extent, Custodians and Sub Custodians), a significant percentage of intermediaries are unrated by the main ratings agencies, which may allow for festering credit problems to go unnoticed.

As for insurance companies, the Financial Times describes how US firms have managed disasters well this year, despite massive insured losses, because of reinsurance. However, an earlier piece cites S&P saying reinsurers could be underestimating their exposure to natural disasters by as much as 50%. Meanwhile, Bloomberg citing AXA notes that climate change is back at the top of the agenda for insurers around the world.

The Financial Counterpart Monitor from Credit Benchmark provides a unique analysis of the changing creditworthiness of financial institutions. The report, which covers banks, intermediaries, buy-side managers, and buy-side owners, summarizes the changes in credit consensus of each group as well as their current credit distribution and count of entities that have migrated from Investment Grade to High Yield.

The data, which is based on the credit risk views of Credit Benchmark’s contributing financial institutions, is also available at the legal entity level. Users of the data can monitor and be alerted to the changing credit consensus of their financial counterparts.