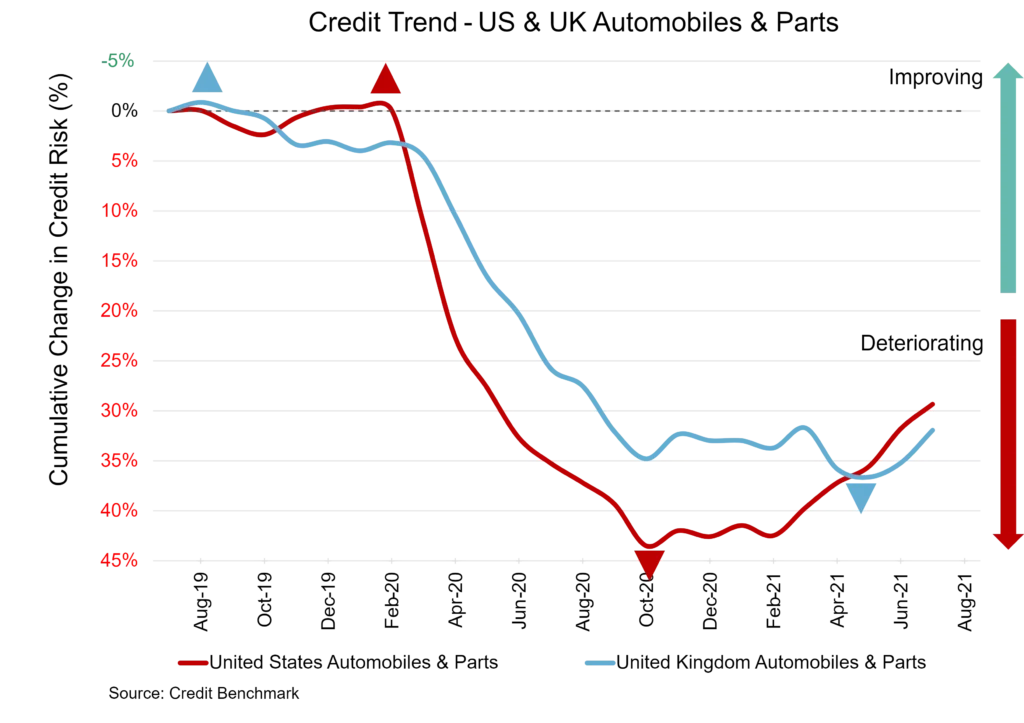

The positive credit movement witnessed in other industries like retail and energy can also be seen in the US auto sector. Credit quality continues to improve and risk continues to decline. In addition to the overall economic picture improving, demand remains robust. The same is largely true for the UK sector.

The biggest obstacles to further growth continue to be supply chain and logistics, with auto makers unable to get the parts they need, especially semiconductor chips. The problems have gotten so bad that GM is idling some of its plants until supply flows recover. While individual firms and the sector overall should weather these challenges, full potential is temporarily curtailed.

US Auto and Auto Parts Industry

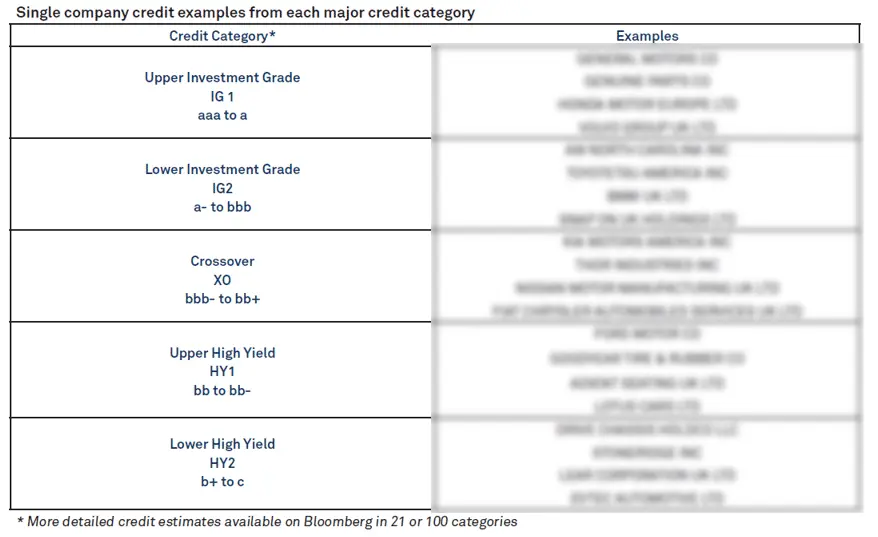

The US auto sector continues to trend in the right direction. The latest data show improvement in credit quality of 2% from last month, 9% from six months ago, and 4% year-over-year. Default risk is now 45 bps, compared to 46 bps last month, 49 bps six months ago, and 47 bps at the same point last year. This sector’s current overall CCR rating is bbb- and 77% of firms are at bbb or lower. Overall US corporate default risk is 62 bps, with a CCR of bb+ and 80% of firms at bbb or lower.

UK Auto and Auto Parts Industry

After a long period of deterioration, the UK auto sector is now seeing improvement. In the latest data, credit quality is still down 5% year-over-year. However, it has improved by 2% from last month and 1% from six months ago. Default risk is now 90 bps, compared to 92 bps last month, 90 bps six months ago, and 86 bps at the same point last year. This sector’s current overall CCR rating is bb and 88% of the firms are at bbb or lower. Overall UK corporate default risk is 80 bps, with a CCR of bb and 90% of firms at bbb or lower.

Please complete your details to continue reading this report and to access the single name credit matrix:

About Credit Benchmark Monthly Auto Industry Aggregate

This monthly index reflects the aggregate credit risk for US and UK firms in the automobile and auto parts sectors. It illustrates the average probability of default for auto firms as well as parts suppliers to achieve a comprehensive view of how sector risk will be impacted by trends in the auto industry. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Consensus Rating (CCR) is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.