Credit Benchmark have released the September Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 20,000 credit analysts at 40 of the world’s leading financial institutions.

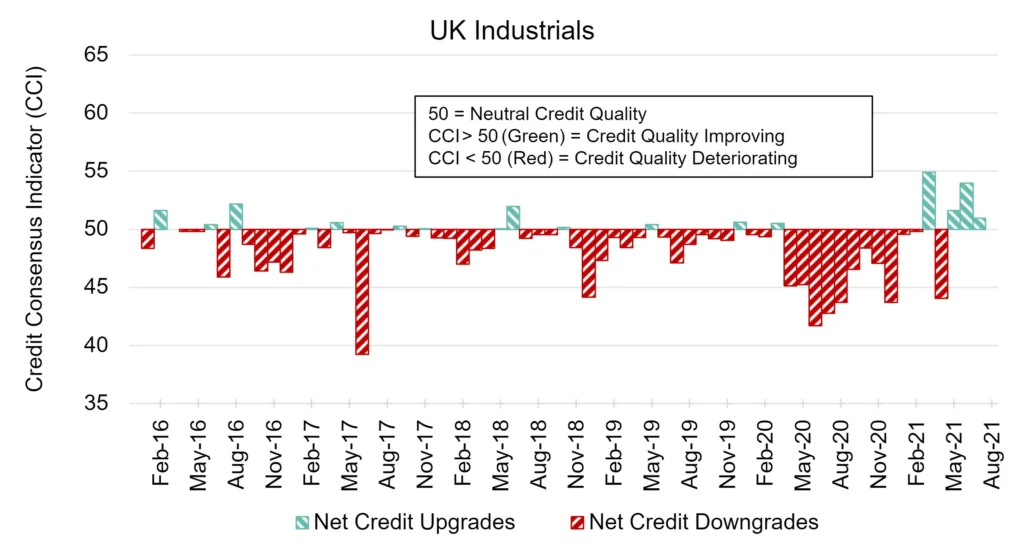

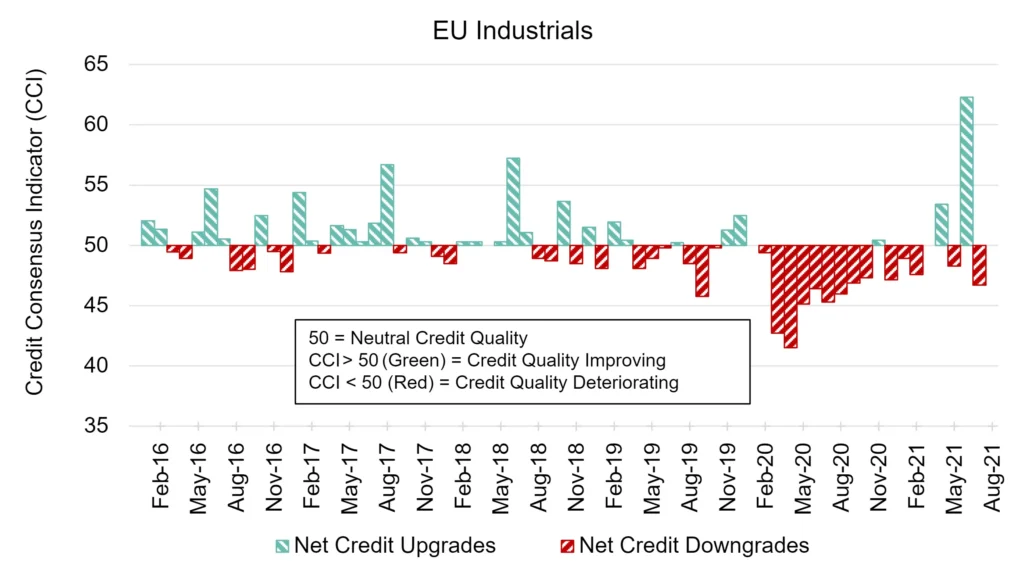

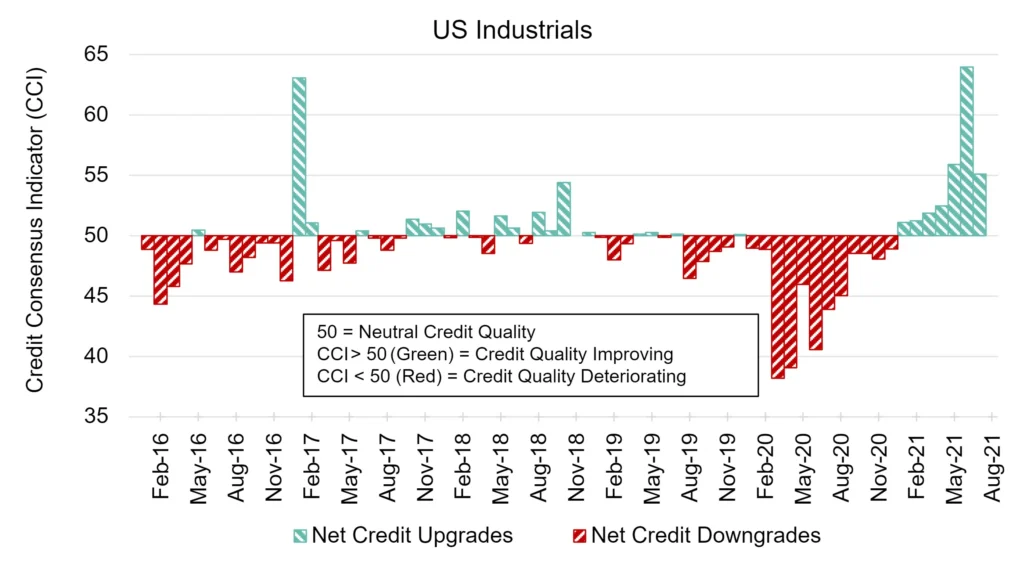

Drawn from more than 800,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

The latest forward-looking consensus data confirms the notion that an improving trend in industrials may be slower or more uneven than previously anticipated.

For US Industrial firms, the CCI score is above the neutral 50 line for the seventh month in a row, continuing the longest streak of upgrades. Though this momentum is good news, the downward shift from last month suggests continued uncertainty in the sector. Economic growth projections are strong for the US but have been adjusted downwards from a few months ago. New infrastructure is on the cards but spending may be less than originally proposed. Supply chain problems could easily drag on for longer than was anticipated earlier this year.

Much the same can be said for UK Industrial firms, whose score fell but remains within positive territory, or for the EU, where the CCI has experienced higher volatility in recent months and now sits in negative territory.

UK Industrials: Staying Positive

Consensus opinion on credit quality for UK Industrial firms is still in positive territory.

The UK CCI score is now 50.9, compared to 53.9 last month.

UK manufacturing activity is still growing even though it is down from a high point reached earlier this year amid ongoing supply pressures. The UK is facing a labor shortage across a variety of industries.

.

EU Industrials: Volatile

Consensus opinion for EU Industrial firms is proving to be volatile, with no consecutive run of improvement since late 2019.

The EU CCI score is now 46.7, compared to a high peak of 62.3 last month.

Eurozone manufacturing activity is still expanding even though it has slowed, in part due to supply chain problems.

.

US Industrials: Strong Despite Comedown

This month also suggests some volatility for US Industrials, however the general trend is comparatively strong against the other regions.

The US CCI score is now 55.1, compared to 63.9 last month, marking the seventh consecutive month consensus opinion has been in positive territory.

Once again, US manufacturing activity expanded robustly, but growth continues to be limited by supply chain issues. There’s also a labor shortage.

.

To download the full CCI tear sheets for UK, EU, and US Industrials, please enter your details below: