The $1.2trn Leveraged Loan market continues to grow, with S&P showing new issuance in the sector running at double the volume recorded a year ago. Mergers and acquisitions are a key driver in this growth, especially driven by private equity buyouts of existing firms.

But there are fears that investors in the broader high yield space are not being properly compensated for the risks. Moody’s data shows that, compared with typical non-investment grade borrowers, the default rate for private equity backed firms was significantly higher in 2020-21; the pandemic has taken its toll on heavily indebted companies.

But recent private equity investments have focused on firms that have weathered the pandemic with stable revenues and strong cash flows. This could boost the average credit quality of leveraged loan assets, but the latest consensus credit data shows a more mixed picture.

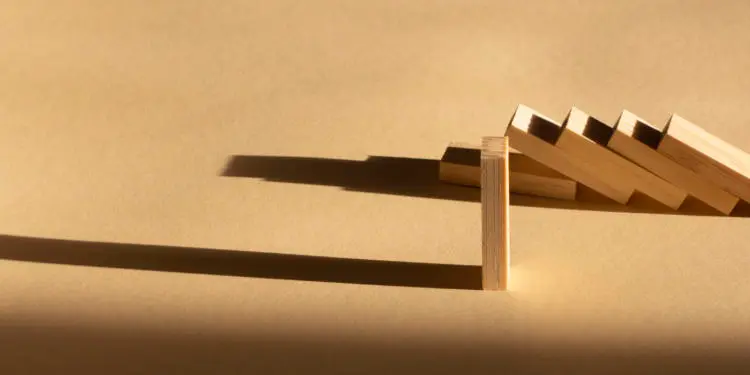

Figure 1 shows the 6M change in credit distribution for 154 companies in the leveraged loan sector.

Figure 1: 6M Change in Credit Distribution for 154 Companies in Leveraged Loans Sector

This year, there has been a modest decrease in the bb category, and a corresponding increase in the b category; but the c category has dropped while the bbb category shows a slight increase. This is consistent with the overall damage caused by the pandemic but shows signs that leveraged loan portfolios may be at the beginning of a credit upgrade.

Please complete your details to continue reading this report: