Air travel is currently running at about 50% of its pre-pandemic peak and the JETS Global Airline equity ETF is about 20% down from its recent high in March 2021. The sector still faces uncertainty from new virus variants, a patchy recovery in tourist traffic and a possibly permanent shift in business travel norms.

Airlines are now setting out their post-pandemic strategies – some are launching new low-cost carriers to compensate for the lack of business traffic; those with strong balance sheets are looking to acquire fleets and slots from weaker competitors.

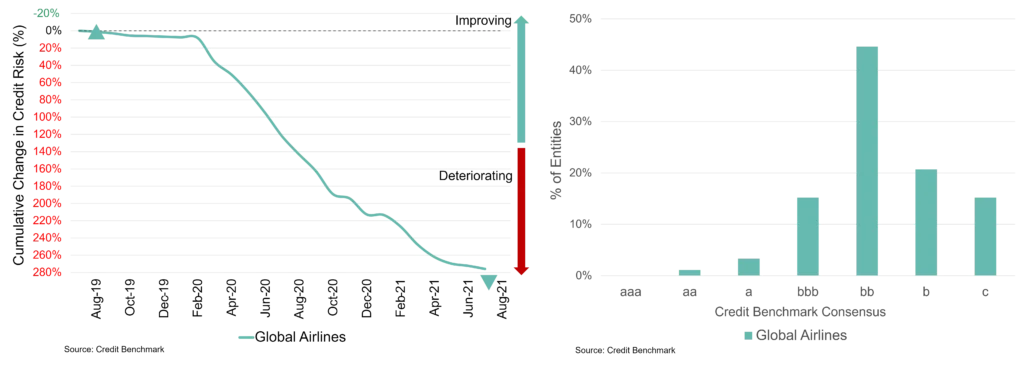

Figure 1 shows the two-year trend and consensus credit distribution for more than 100 airlines and related businesses.

Figure 1: Credit trends and distribution for Global Airlines and related companies

During the pandemic, global airline credit risk more than tripled from 48 Bps in February 2020 to 165 Bps in July 2021. This steady decline in credit quality shows tentative signs of stabilising, but 80% of the sector is now below investment grade. The b category represents 20% of all firms with 15% in the c category.

Most of the companies in this universe are unrated by traditional agencies. There are many agency ratings for individual bonds and notes, with a number of national carrier issues underwritten by their governments. But these guarantees only apply to note holders and bond investors – suppliers and trade creditors take credit risk directly with the issuer.

Figure 2 shows a comparison between agency ratings and consensus for 12 major airlines. [please continue below to access full report].