Download the July Industry Monitor infographic below.

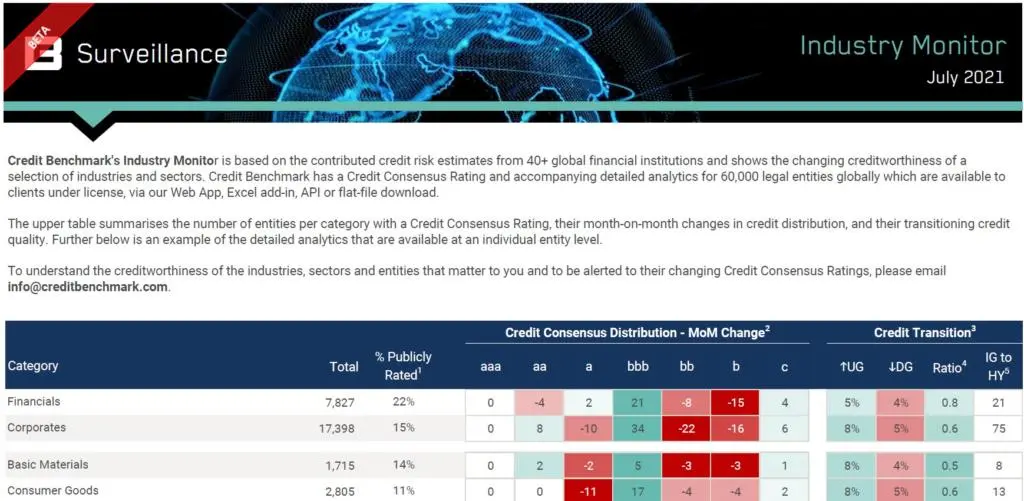

Credit Benchmark have released the end-month industry update for end-June, based on the final and complete set of the contributed credit risk estimates from 40+ global financial institutions.

The latest consensus data provide even more reason for optimism, with widespread improvement in credit risk.

The broad category of Corporates once again saw a dominance of upgrades, with an overall deterioration-to-improvement ratio of 0.6:1. This improvement translated to individual categories, like Consumer Goods and Consumer Services which had ratios of 0.6:1 and 0.7:1, respectively. Health Care and Industrials performed equally well, with ratios of 0.7:1 and 0.6:1. Even beleaguered Oil & Gas firms saw an overall credit improvement this month.

Unfortunately, Travel & Leisure firms remain languishing in net deterioration, but to a less severe extent than previous months, with a ratio of 1.4:1. Utilities saw the highest rate of deterioration this month, at 1.5:1.

Perhaps most notable is the improvement seen in Financials, which has jumped from a deteriorating ratio of 1.7:1, to an improving ratio of 0.8:1

According to David Carruthers, Head of Research at Credit Benchmark:

“The upgrades seen across financial firms is a positive development, as this category has seen a dominance of deterioration in recent months. The sector faces obstacles ahead, like loan quality and stunted economic growth in the face of a fresh increase in Covid cases, but at the moment, credit for financial companies isn’t getting worse. A strong financial sector from a credit perspective is to the benefit of the overall economy.”

In the update, you will find:

- Credit Consensus Distribution Changes: The net increase or decrease of entities in the given rating category since the last update.

- Credit Transition: Assesses the month-over-month observation-level net downgrades or upgrades, shown as a percentage of the total number of entities within each category.

- Ratio: Ratio of Deteriorations and Improvements in each category since last update, calculated as Deteriorations / Improvements

- IG to HY Migration: The number of companies which have migrated from investment-grade to high-yield since the last update (known as Fallen Angels).

Credit Benchmark will continue to provide regular reports on these migration rates. If you have any questions about the contents of this update, please get in touch.