To download the June 2021 Oil & Gas Aggregate PDF, click here.

.

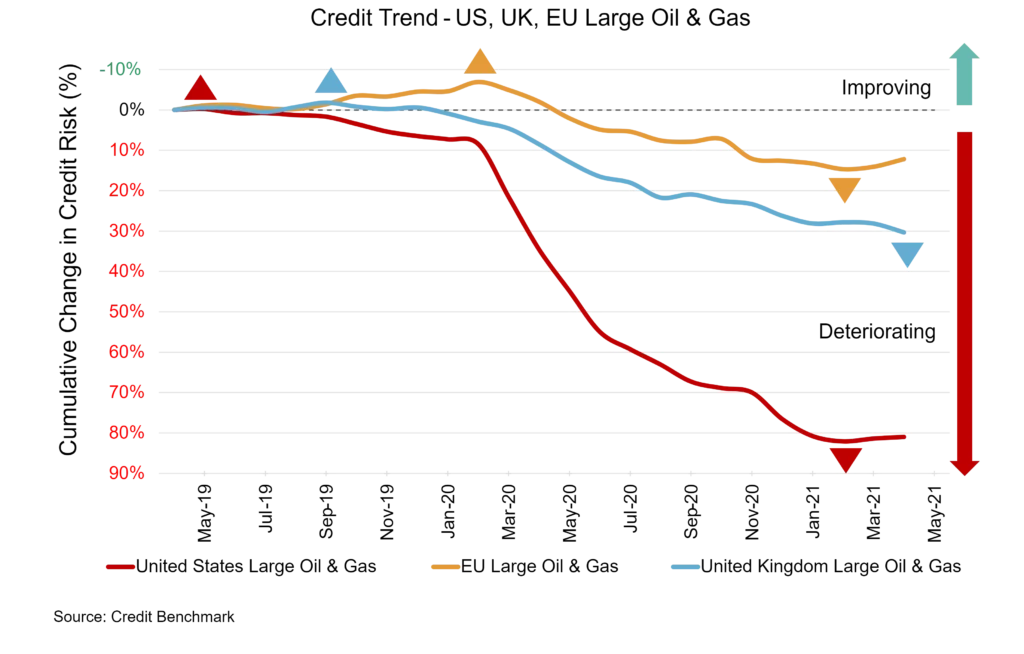

The energy industry is experiencing mixed fortunes, with the US sector holding steady and the EU seeing some improvement, whereas the UK sector showed deterioration from the prior month.

The underlying dynamics of the oil industry are relatively solid. Demand for oil is improving and could grow stronger still; it may be a hot summer for oil as economies continue to reopen and travel picks up. Additional lockdowns may delay the return to normal, but they won’t quash all hope.

With the effects of the pandemic slowly but surely receding, there’s reason for cautious optimism for energy firms.

The most serious challenge for oil and natural gas companies may be the transition to different, cleaner forms of energy, whether the pressure comes from outside activists or from regulatory changes.

.

US Oil & Gas

US energy gets a little more room to breathe. Credit quality is down 35% year-over-year and 7% over the last six months but remains largely unchanged from the prior month. Default risk remains at 71 bps, compared to 67 bps six months ago and 53 bps at the same point last year. Now this sector’s overall CCR rating is bb+ and 85% of firms are at bbb or lower. Overall Large US Corporate default risk is 56 bps, with a CCR of bb+ and 80% of firms at bbb or lower.

UK Oil & Gas

UK energy saw additional deterioration. Credit quality is down 20% year-over-year and 6% over the last six months; it fell another 2% from last month. Default risk is currently 51 bps, compared to 50 bps last month, 48 bps six months ago, and 42 bps at the same point last year. Now this sector’s overall CCR rating is bb+ and 75% of firms are at bbb or lower. Overall Large UK Corporate default risk is 64 bps, with a CCR of bb+ and 87% of firms at bbb or lower.

EU Oil & Gas

EU energy moved in the right direction. Credit quality is down 15% year-over-year and 5% over the last six months, yet the latest data show improvement of 2% from last month. Default risk remains at 32 bps; it was 30 bps six months ago and 28 bps at the same point last year. Now this sector’s overall CCR rating is bbb and 71% of firms are at bbb or lower. Overall Large EU Corporate default risk is 34 bps, with a CCR of bbb- and 72% of firms at bbb or lower.

.

About The Credit Benchmark Monthly Oil & Gas Aggregate

This monthly index reflects the aggregate credit risk for large US, UK, and EU firms in the oil & gas sector. It provides the average probability of default for oil & gas firms over time to illustrate the impact of industry trends on credit risk. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Consensus Rating (CCR) is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.