To download the June 2021 Retail Aggregate PDF, click here.

The outlook continues to brighten for the US retail sector.

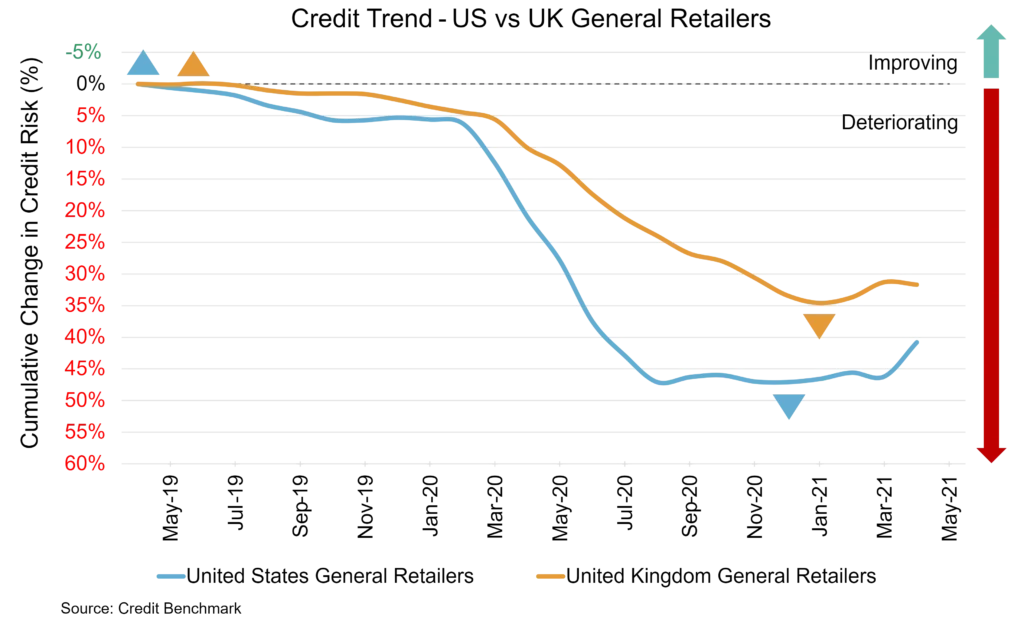

The US retail sector’s improvement aligns with the US economy being in a relatively strong position. Job growth may not be as robust as anticipated, but it’s still positive. Consumers are still flush with savings. Monetary policy will remain accommodative. Overall growth forecasts have improved in recent months.

The UK retail sector did not improve but default risk didn’t get any worse. The UK economy continues to move in the right direction, yet the reopening of hospitality has had a weaker knock on effect to retail than originally expected and a full reopening has been delayed once more. But job growth remains strong and monetary policy will remain loose.

Neither the US or UK retail sectors are out of the woods just yet. The biggest obstacle in the near future may be supply chain issues that are limiting inventory now as well as months down the line; US retailers have seen a declining inventory-to-sales ratio, and retailers like Dollar General, Best Buy, and Costco have highlighted this issue on earnings calls. Inflation may also be problem in the months ahead. But for now at least, neither sector is seeing huge declines the likes of which were witnessed during the height of COVID.

US General Retail Firms

US retail is moving in the right direction. Credit quality is still down 16% year-over-year but, according to the latest data, has improved by 4% over the last six months. Default risk is still higher than it was before the pandemic but is trending down. It’s now 67 bps, compared to 69 bps last month and six months ago and 57 bps at the same point last year. Now this sector’s overall CCR rating is bb+ and 82% of firms are at bbb or lower. Overall US corporate default risk is 65 bps, with a CCR of bb+ and 82% of firms at bbb or lower.

UK General Retail Firms

UK retail is looking relatively steady. Credit quality is down 20% over the last year and 3% over the last six months but has stabilized compared to last month. Default risk remains very high at 101 bps, but that is largely unchanged compared to last month; it was 98 bps six months ago and 85 bps at the same point last year. Now this sector’s overall CCR rating is bb and 93% of firms are at bbb or lower. Overall UK corporate default risk is 81 bps, with a CCR of bb and 91% of firms at bbb or lower.

About Credit Benchmark Monthly Retail Aggregate

This monthly index reflects the aggregate credit risk for US and UK General Retailers. It illustrates the average probability of default for companies in the sector to achieve a comprehensive view of how sector risk will be impacted by trends in the retail industry. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Consensus Rating (CCR) is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.

Credit Benchmark brings together internal credit risk views from 40+ of the world’s leading financial institutions. The contributions are anonymized, aggregated, and published in the form of entity-level consensus ratings and aggregate analytics to provide an independent, real-world perspective of risk. Consensus ratings are available for 55,000+ financials, corporate, funds, and sovereign entities globally across emerging and developed markets, and 90% of the entities covered are otherwise unrated.