Download the June Industry Monitor infographic below.

Credit Benchmark have released the end-month industry update for end-May, based on the final and complete set of the contributed credit risk estimates from 40+ global financial institutions.

There’s reason for mild optimism, according to the latest consensus risk data.

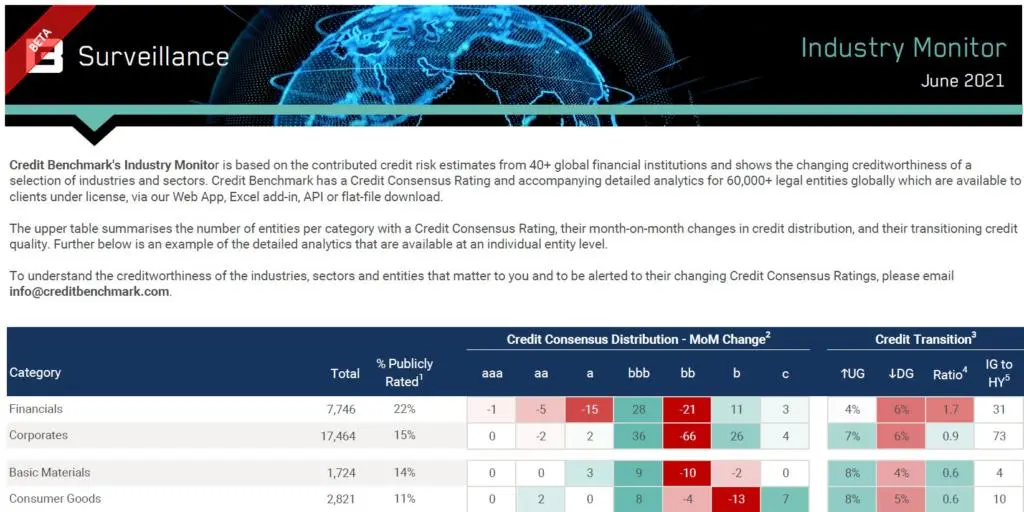

The broad category of Corporates saw more improvement than deterioration in the latest update, with a ratio of 0.9:1 deteriorating to improving. Within the industry categories, some of the notable improving groups included Basic Materials, Technology, Telecommunications, and Consumer Goods. Within the sectors, General Retailers also improved.

But not all industries and sectors saw improvement. Health Care saw mild deterioration. Travel & Leisure continues to bear the brunt of corporate downgrades, with a ratio of 2.4:1 deteriorating/improving this month.

Unlike Corporates, the Financials category saw overall deterioration, with a ratio of 1.7:1. deteriorating/improving.

According to David Carruthers, Head of Research at Credit Benchmark:

“Certain industries and sectors provide reasons to be hopeful, but it’s not universal. US corporate credit is improving, but UK corporate credit deteriorated. Something similar can be seen within different sectors, for example travel companies performing poorly while retail improves. The months ahead may provide more clarity as to which sectors are seeing gradual improvement, and which may have deeper underlying problems that could persevere even when pandemic pressures ease.”

In the update, you will find:

- Credit Consensus Distribution Changes: The net increase or decrease of entities in the given rating category since the last update.

- Credit Transition: Assesses the month-over-month observation-level net downgrades or upgrades, shown as a percentage of the total number of entities within each category.

- Ratio: Ratio of Deteriorations and Improvements in each category since last update, calculated as Deteriorations / Improvements

- IG to HY Migration: The number of companies which have migrated from investment-grade to high-yield since the last update (known as Fallen Angels).

Credit Benchmark will continue to provide regular reports on these migration rates. If you have any questions about the contents of this update, please get in touch.