To download the May 2021 Retail Aggregate PDF, click here.

Consensus data may be providing some hope for the beleaguered UK and US retail sectors.

The UK retail sector remains in worse shape than the overall UK corporate sector. However, retail sales are growing more than expected with a potential spending boom on the horizon, overall economic activity is robust with improving forecasts, and the Bank of England is so optimistic that it’s slowing its bond purchases. The situation may improve with strong underlying dynamics.

The US retail sector is also in worse shape than the overall US corporate sector, but risk has levelled off in recent months. Like in the UK, there are plenty of signs, like improving retail sales or flush consumers, that the sector has the wind at its back.

Inflation may be a concern in both the UK and US, including as it relates to supply chains, although recent increases may be transitory.

Still, the future is now looking at least a little bit brighter for the UK and the US.

US General Retail Firms

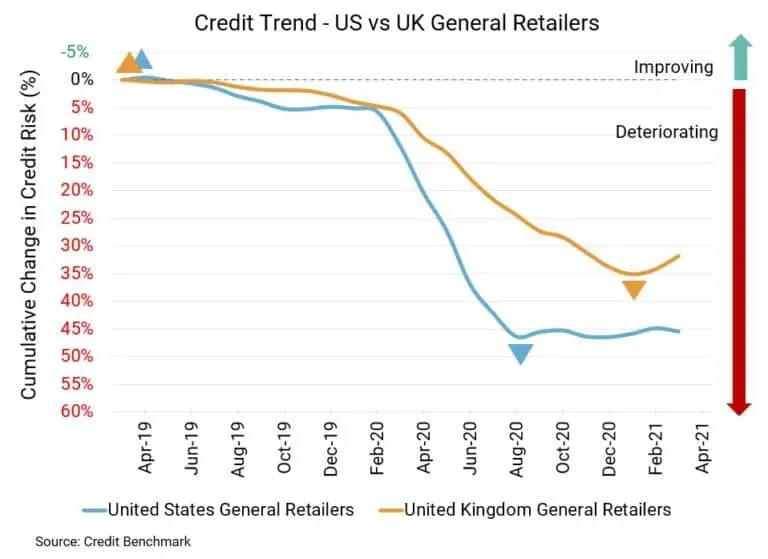

US retail remains stable. Although credit quality is down 30% year-over-year, it’s largely unchanged from last month and from six months ago. Default risk is 70 bps, compared to 69 bps last month, 70 bps six months ago, and 54 bps at the same point last year. Now this sector’s overall rating is bb+ and82% of firms have a CCR rating of bbb or lower. Overall US corporate default risk is 66 bps, with a CCR of bb+ and 82% firms at bbb or lower.

UK General Retail Firms

Prospects for UK retail may be getting better. While still down 24% year-over-year and 4% from six months ago, credit quality improved by 2% in the latest update. Default risk is 101 bps, compared to 103 bps last month, 98 bps six months ago, and 81 bps at the same point last year. Now this sector’s overall rating is bb and 92% of firms have a CCR rating of bbb or lower. Overall UK corporate default risk is 80 bps, with a CCR of bb and 91% firms at bbb or lower.

About Credit Benchmark Monthly Retail Aggregate

This monthly index reflects the aggregate credit risk for US and UK General Retailers. It illustrates the average probability of default for companies in the sector to achieve a comprehensive view of how sector risk will be impacted by trends in the retail industry. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Consensus Rating (CCR) is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.

Credit Benchmark brings together internal credit risk views from 40+ of the world’s leading financial institutions. The contributions are anonymized, aggregated, and published in the form of entity-level consensus ratings and aggregate analytics to provide an independent, real-world perspective of risk. Consensus ratings are available for 55,000+ financials, corporate, funds, and sovereign entities globally across emerging and developed markets, and 90% of the entities covered are otherwise unrated.