To download the April 2021 Auto Aggregate PDF, click here.

After a long period of trouble, the US auto sector may be nearing an on-ramp. Risk remains elevated but is not getting worse. The US consumer may be itching to get moving after a long bought of cabin fever; they are certainly in a strong position due to fiscal relief. Auto sales in the US are red hot; even with the chip shortage and other supply chain problems, first quarter sales were strong.

But the chip shortage and supply chain problems should not be underestimated. GM stopped production at multiple plants because of it, and production delays may last beyond this year.

The same problems are hurting the UK auto sector, which doesn’t have rising sales to fall back on. The sector at least managed to avoid tariffs from Brexit.

The US and UK auto sectors need to put the pandemic in the rear view mirror before legitimate improvements come. But with vaccination rates strong in each country, that point may come sooner rather than later.

US Auto and Auto Parts Industry

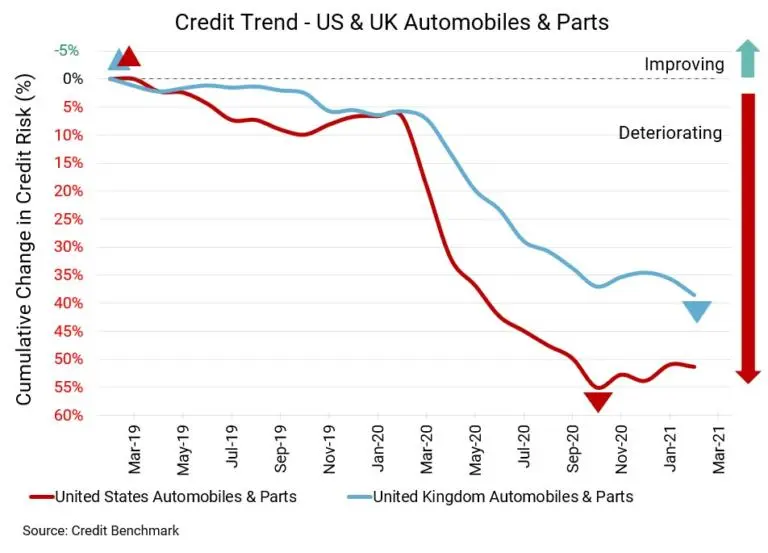

Deterioration for the US auto sector is levelling off. The year-over-year decline in credit quality is 42%, but the drop from six months ago is 3% and there’s been little change in the last few months. Default risk remains at 51 bps, compared to 50 bps six months ago and 36 bps at the same point last year. This sector’s current CCR rating is bb+, and 80% of firms have a CCR rating of bbb or lower. Overall US corporate default risk is 65 bps and its CCR is bb+, with 81% of firms at bbb or lower.

UK Auto and Auto Parts Industry

The UK auto sector remains in much worse shape than the US auto sector. Credit quality has declined by 31% over the last year, 6% from six months ago, and 2% from last month. Default risk is far higher at 85 bps, compared to 84 bps last month, 81 bps six months ago, and 65 bps at the same point last year. This sector’s current CCR rating is bb, and 86% of firms have a CCR rating of bbb or lower. Overall UK corporate default risk is 82 bps and its CCR is bb+, with 91% of firms at bbb or lower.

About Credit Benchmark Monthly Auto Industry Aggregate

This monthly index reflects the aggregate credit risk for US and UK firms in the automobile and auto parts sectors. It illustrates the average probability of default for auto firms as well as parts suppliers to achieve a comprehensive view of how sector risk will be impacted by trends in the auto industry. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Consensus Rating (CCR) is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.