Credit Benchmark have released the April Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 20,000 credit analysts at 40 of the world’s leading financial institutions.

Drawn from more than 800,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

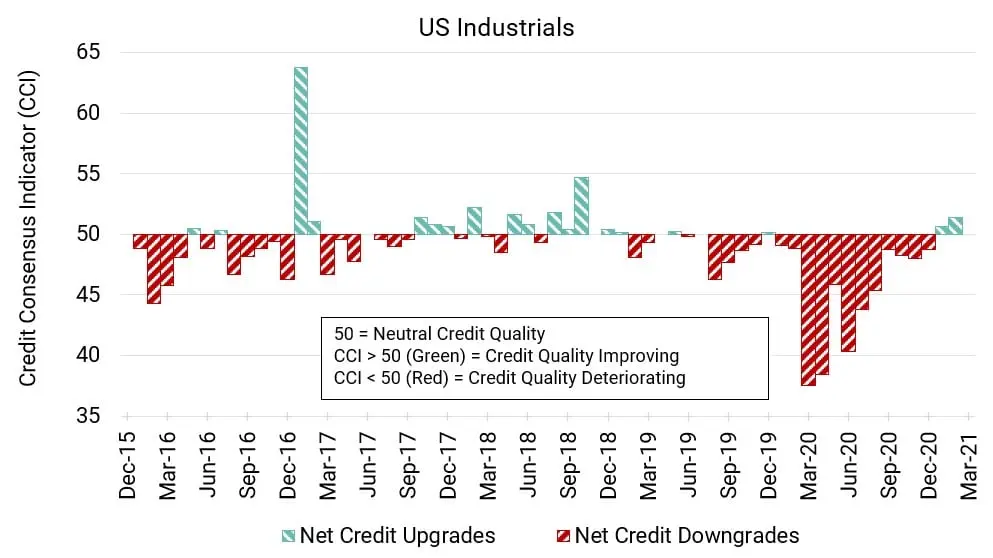

The US continues to improve in credit quality. For the second month in a row, forward-looking sentiment is above 50, something that last happened at the end of 2018, and recent data point to positive momentum in the months ahead. Manufacturing data is coming in strongly on multiple fronts, and less positive results may be temporary and explained by bad weather. Job growth is robust, and there are plenty of signs pointing to the strength of consumers. The US is accelerating its vaccination program. Fed Chair Jerome Powell noted ongoing fiscal and monetary support and said the outlook had “brightened substantially.” Some firms may experience supply chain problems, but overall, there’s reason for optimism.

The UK continues to edge closer to positive territory, though the same can’t be said for the EU, which moved in the opposite direction in the latest update – though the negative trend remains mild.

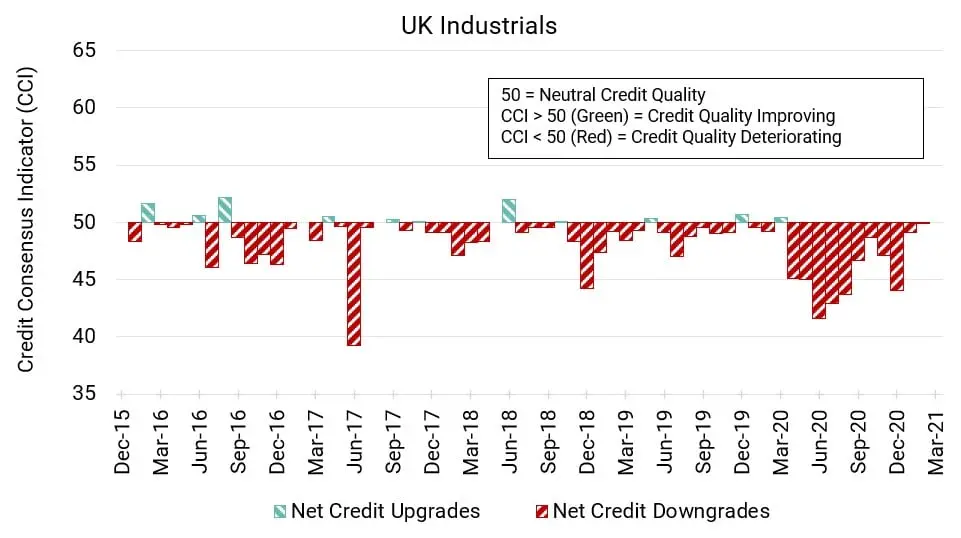

UK Industrials: On the Cusp

UK Industrial companies may not yet be in positive net credit territory, but they are inching closer.

This month’s CCI is 49.9, a positive change from last month’s CCI of 49.1.

Though the trend is moving in the right direction, negative influences still remain in the UK including the ongoing effects of the pandemic, spill over effects from financial industry problems, and multiple problems including Brexit.

.

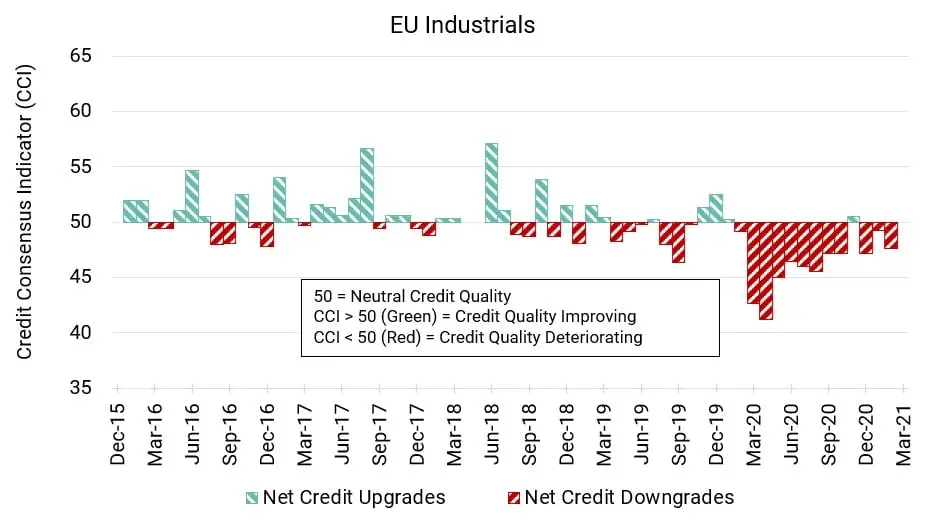

EU Industrials: Lingering Deterioration

The positive CCI reading from late 2020 now looks more like a temporary blip, as EU Industrial firms continue to register a negative CCI.

This month’s CCI is 47.6, a worsening from last month’s CCI of 49.3.

The EU is facing some headwinds, yet there are signs it is adapting to restrictions and problems may be less severe than anticipated.

.

US Industrials: Back-to-Back Improvement

US Industrial companies have registered a positive CCI reading for a second month running, making this the first back-to-back positive CCI since December 2018/January 2019.

The US CCI is 51.4 this month, up from 50.6 last month.

Supply chain issues may be an obstacle in the near term. Still, the overall outlook is robust in a variety of ways, and may yet get a boost from investment in infrastructure of various types.

.

To download the full CCI tear sheets for UK, EU, and US Industrials, please enter your details below: