Credit Benchmark have released a new whitepaper analyzing the COVID-19 impact on global credit quality and solvency. Download the full whitepaper below.

Scientists are still trying to understand the long-term impact of COVID-19 on the human body as the world scrambles to comprehend this novel strain of virus. The longer-term consequences of COVID-19 on the global economy are similarly unknown, but it is evident that significant disruption to manufacturing, trade and consumer sentiment has well and truly been felt.

There are serious concerns about inflation, reflected in gold prices close to all-time highs. These concerns are partly driven by the explosion in Government debt, and partly due to major changes in supply chains. Supply chains in the wake of COVID-19 will be shorter, more robust, and companies will try to keep their options open by using multiple suppliers.

Input costs will probably rise as a result, since there is a cost to removing uncertainty – and this will be reflected in consumer prices. Trade tensions are likely to intensify as Governments aim to protect their economies, so average import prices will probably increase.

But every crisis brings winners as well as losers. Every tragic closure of a long-standing business leaves a potential niche to be filled by a well-funded new entrant. Global investment banks are already seeing Schumpeter-style waves of restructuring M&A; the corporate winners will be those who have stayed sufficiently solvent to continue trading, to invest in one of the newly vacated or created business segments, or to take advantage of financially distressed competitors.

A new whitepaper from Credit Benchmark uses Consensus credit estimates for the past few months to assess the impact of COVID-19 on credit and solvency across the global economy.

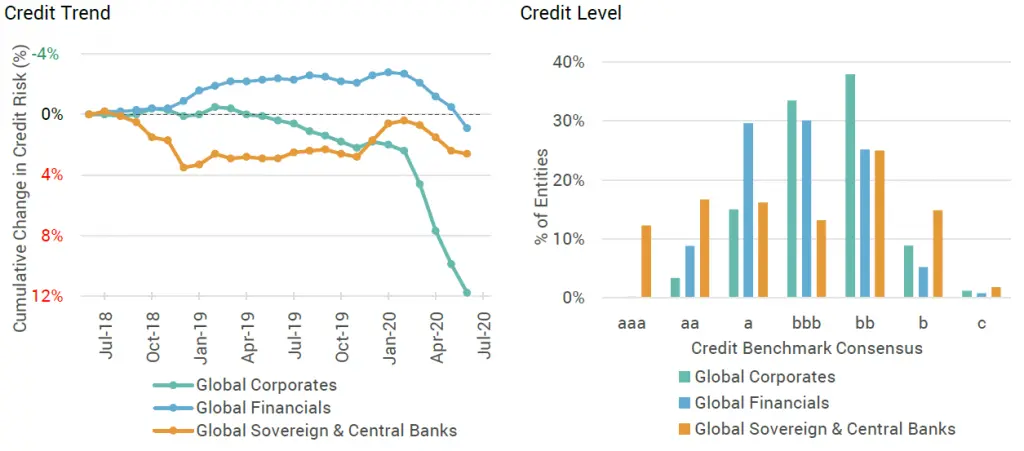

Credit Trend & Level: Global Corporates, Global Financials, Global Sovereigns & Central Banks

The analysis looks at countries, industries, and sectors, as well as individual corporate borrowers. It shows where downgrades are concentrated, and some of the surprising sources of upgrades. The paper demonstrates these effects across the credit spectrum, from the highest to the lowest credit quality. It shows how many obligors are likely to run into solvency problems, as well as case studies where solvency simply ran out.

The key observations from the paper are as follows:

- Corporates have deteriorated much more than Financials.

- Travel and Leisure, Airlines and Hotels, Real Estate and Retail are hardest hit. Health Care and Pharmaceuticals, Utilities, Food and Beverages have understandably held up.

- A number of Sovereigns show downgrades, and seven have dropped out of coverage.

- Financials – apart from Real Estate – are improving.

- The “Fallen Angels” rate is well above long run average.

- Investment Grade categories saw few CRA downgrades, but consensus data shows rising risk.

- Migration data suggests that the 2020 default rate may be at the top end of current expectations.