US Retail Sector: Credit Trends

December 2017

Retail Industry Trends

“The number of people visiting U.S. stores on Thanksgiving and Black Friday fell 4% from last year, according to RetailNext Inc., which analyzes in-store videos to count shoppers. Meanwhile, online sales increased 18% over that period, said software company Adobe Systems Inc., a shift that is forcing traditional retailers to adopt new tactics.” – Wall Street Journal, Nov. 26 2017

Download the PDF “Retail Industry Trends”

Executive Summary

- The Global Retail sector is in a state of flux. Developing economies are showing strong growth, but the picture in Developed economies is more mixed. Retailers are experiencing rapid changes and some traditional companies are suffering as a result, especially in the US. This phenomenon has been called “The US Retail Apocalypse”.

- In the Developed economies, and in the US in particular, there are growing challenges due to the rising popularity of online shopping. Online sales represent more than 30% of US Retail sales growth in the past year.

- Credit Benchmark data show that there is a noticeable divergence between US Retail credit quality (bb-) when compared to Western Europe (bb).

- Every sector of the US Retail industry showed a credit quality decline in the first nine months of 2017.

- Apparel and Broadline players showed the largest credit deterioration.

- The over-expansion of physical stores in the US in the last two decades has resulted in a highly competitive environment and significant department store closings.

- The credit quality of department stores is much lower when compared to discount stores.

This report uses bank-sourced data to track recent credit risk trends in the Global and US Retail Industry Trends. The data covers 389 US Retail sector players, including those without stock market listings or without ratings from major agencies.

This dataset provides transparency for global, regional, corporate hierarchy and individual legal entity factors. It can also be used to estimate a range of metrics which track monthly changes in the position and shape of the distribution of bank credit risk estimates.

The dataset provides an independent dimension for sector credit analysis as well as for detailed comparisons with fundamental and macro- factors.

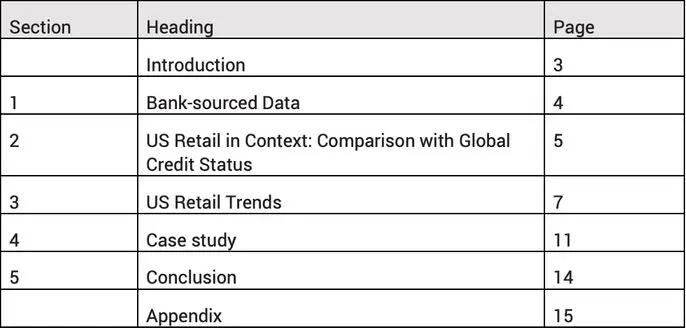

Table of Contents

Introduction

This report provides a detailed analysis of recent credit trends in the US Retail sector. It also shows the current credit status of the Global Retail sector, in both cases using data contributed by global IRB and CCAR-regulated banks.

The Global Retail sector is subject to a number of conflicting influences. The global “middle class” now represents nearly half of the global population. The associated rising disposable income and increased discretionary spending is good news for retailers in the developing nations, which have seen steady growth in new shopping malls1 .

The position is very different in developed nations. One common view is that the suburban middle class are being squeezed; that elderly rural populations have a decreasing propensity to consume; and that young urban millennials who face high accommodation costs now value experiences over possessions.

For all groups, online shopping provides a cheaper and more convenient alternative to traditional bricks and mortar outlets. This “Amazon effect” is a major factor: e-commerce is growing at annual rates of 10% – 20% depending on the segment; traditional retail growth is barely keeping up with GDP, at around 1.5%. E-commerce is having a significant impact on malls and department stores. US Retail store closures have been running at double the rate of openings, even though consumer confidence remains high. Somewhere between a quarter and a half of all US shopping malls are expected to close over the next five years.

The credit worthiness of traditional retailer chains has also been impacted as a result of high self-imposed debt burdens to support over-expansion of physical stores in the past two decades. Additionally, over the last several years, private equity firms have significantly increased the amount of leveraged buyouts of traditional retailers. These rising debt levels will soon be subject to rising refinancing rates.

The combined impact of these factors has been called a “Retail Apocalypse”.

1. Bank-sourced Data

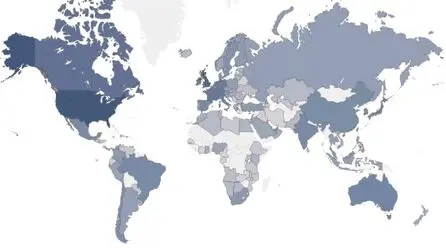

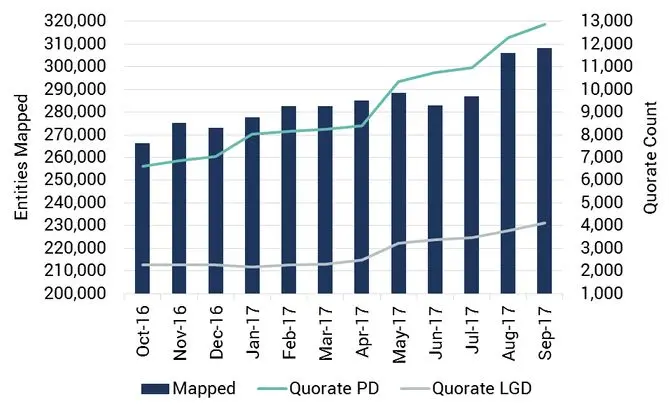

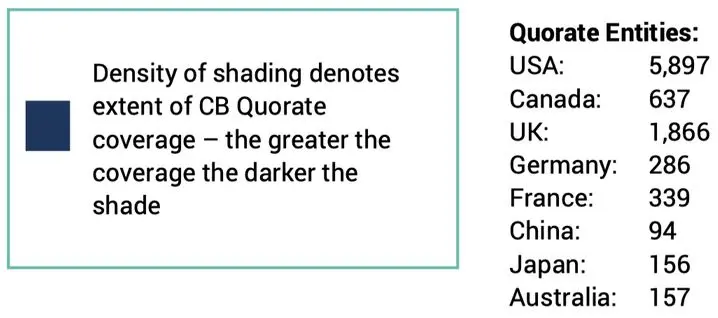

Credit Benchmark aggregates and anonymizes 1-year forward-looking through-the-cycle Probabilities of Default (“PD”) at the individual obligor level, based on the views of a growing number of global IRB and CCAR-regulated banks. The dataset is updated and published monthly. Exhibit 1.1 shows the current coverage.

Exhibit 1.1 Credit Benchmark Coverage

Exhibit 1.1.1 Global Coverage

Exhibit 1.1.2 Dataset Growth

As of December 2017, consensus quorate2 estimates are available on 13,000 obligors including sovereigns, corporates, banks, funds and non-bank financial entities, spanning multiple geographies and entity sizes. The dataset also includes close to 300,000 additional mapped entities that can be leveraged to produce top-down portfolio views, indices and transition matrices.

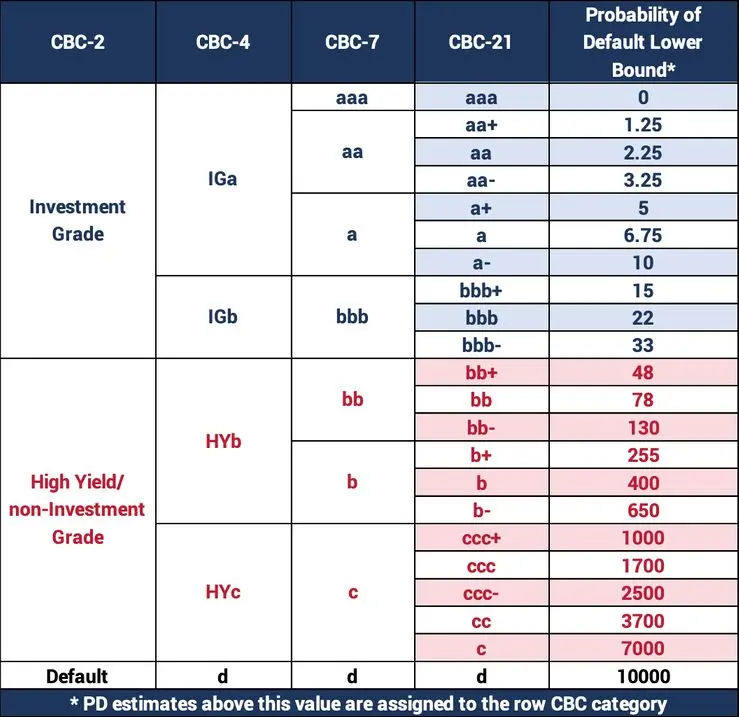

The single name estimates represent the consensus of the collective views of credit risk from experts in global banks. This approach leverages the Diversity Prediction Theorem3 , with single PD estimates aggregated and mapped to the Credit Benchmark Consensus (“CBC”) category scale.4

2. US Retail in Context: Comparison with Global Credit Status

This section compares credit risk trends for quorate and semi-quorate5 large general retailers in three regions: US, UK and Western Europe6 .

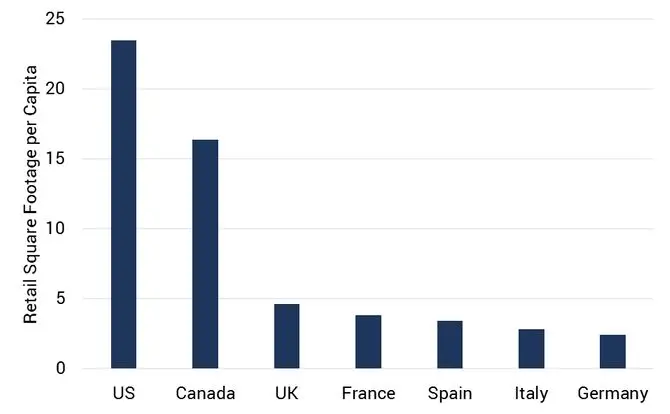

Since the 1970s, US retail mall expansion has been four times higher than the population growth rate.7 This has resulted in a very competitive environment, and has left the sector vulnerable to the new challenges of online shopping and a shrinking middle class.

The UK currently faces specific retail issues: retail sales have been depressed by rapid food price inflation, and wavering consumer confidence. Data from credit-card provider Visa shows that traditional face-to-face retail sales in the UK are affected much more than e-commerce.8 Traditional retail sales have shown sluggish growth over the last three years, turning negative last year. UK e-commerce sales are growing steadily at around 5%.

Online shopping has had an impact in other European countries. For example, Zalando (the German version of Amazon), reported sales growth of 25% in Q3 2017 alone.9 Traditional German retailing has so far handled the challenge well; stronger consumer confidence and innovative retail experiences have slowed the penetration of e-commerce.

Exhibit 2.1 plots retail square footage per-capita for seven major economies, taken from the 2015 Cowan Research study.

Exhibit 2.1 Retail Square Footage per Capita

Source: Cowan Research

This shows, for example, that per-capita retail square footage in the US is ten times higher than in Germany.

The following analysis summarizes the banks’ view on credit risk in the Retail sector.

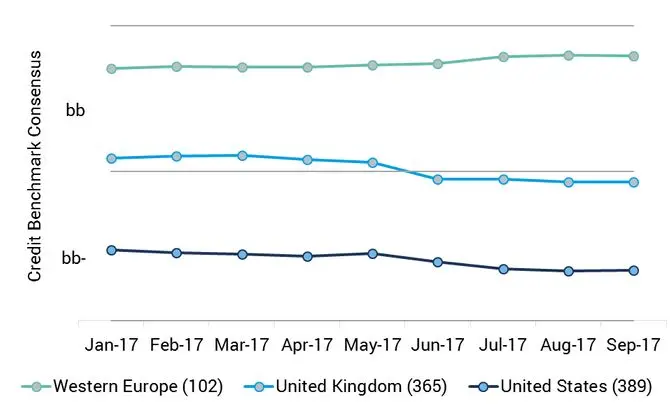

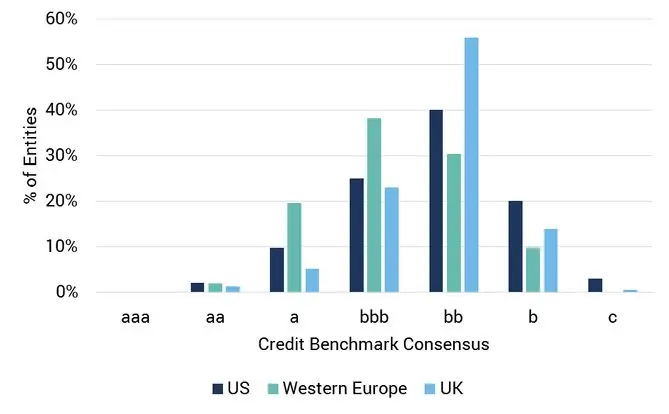

Exhibit 2.2 shows credit quality trends and distributions in the Retail sector for the US, the UK and Western Europe (ex-UK).

Exhibit 2.2 Credit Risk in the US, the UK and Western Europe (ex-UK)

Exhibit 2.2.1 Credit Risk Trends

Exhibit 2.2.2 Credit Risk Distributions

Exhibit 2.2.1 shows that US Retail credit quality is the lowest of these three groups, and Western Europe is the highest. There is a trend towards increasing credit risk in the US and the UK, rising by almost 10% over the last nine months. Western Europe (ex-UK), by contrast, shows a decrease.

Exhibit 2.2.2 analyses credit risk distribution of entities in the different regions. This shows that most of the Western European borrowers are in the bbb category, while both the UK and the US show a peak in the bb category. The dispersion of borrowers across the credit categories is significantly higher for US borrowers than for the UK entities.

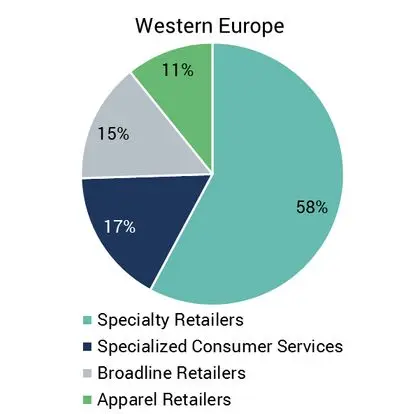

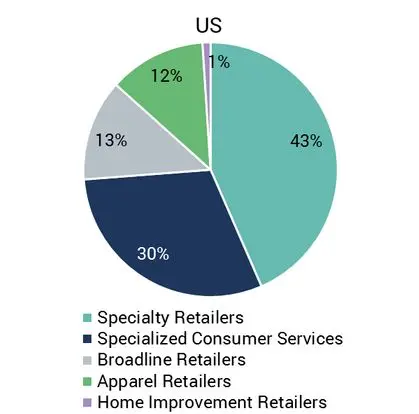

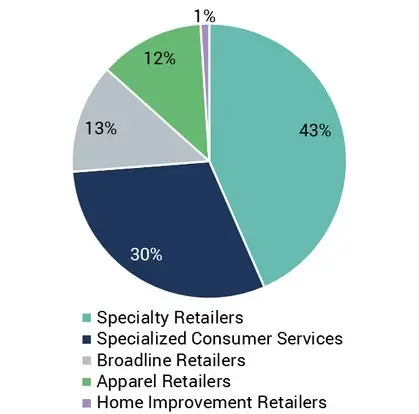

Exhibit 2.3 charts the distribution of borrowers across Retail segments.

Exhibit 2.3 Index Composition

Exhibit 2.3 charts the distribution of borrowers across Retail segments. This shows that the distribution is comparable across the three regions.

3. US Retail Trends

There are some key trends recently impacting the Retail Industry Trends in the US. Prolonged low interest rates have encouraged debt-led expansion, contributing to market oversaturation. The popularity of online shopping is increasing (currently representing 9% of overall retail sales) 10 and traditional brick and mortar retail outlets are also suffering from an increasingly squeezed middle class.

Despite negative headlines, retail sales have been growing in recent years; the sales during the first six months of 2016 increased by $110bn compared to the same time period last year. 11 However, research by IHL Group shows that there are significant differences between segments. Sales in Furniture, Cosmetics, Mass Merchants and Dollar Stores are growing, while sales in Department stores, Sporting goods, Clothes, Shoes and Electronics are decreasing. Department stores in particular are struggling, with store closures outnumbering openings.

Our analysis consists of almost 400 quorate and semi-quorate large US General Retailers, mainly focused on Specialty Retailers, Specialized Consumers Services, Broadline Retailers and Apparel Retailers.

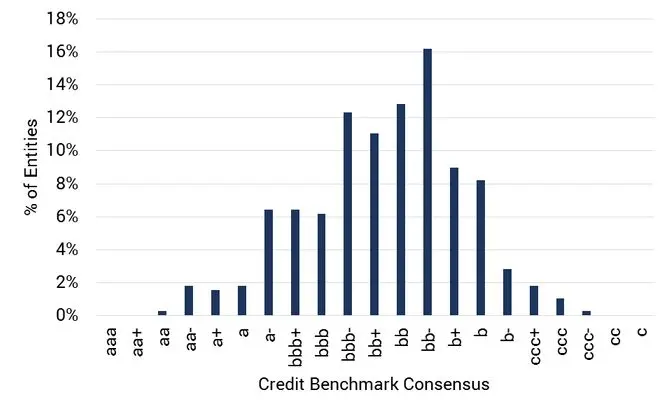

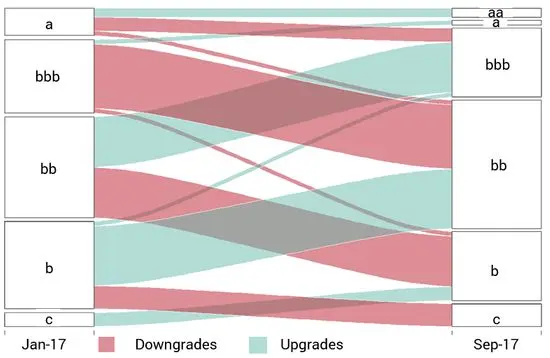

Exhibits 3.1 and 3.2 show the distribution and notch changes of the analyzed entities.

Exhibit 3.1 Distribution of Constituents

Exhibit 3.2 Analysis of Upgrades and Downgrades

Exhibit 3.1 indicates that the US General Retailers are concentrated in the bb credit categories. Over the last 9 months, 21% of these companies were upgraded or downgraded. The bb category showed the smallest percentage (14%) of notch changes. The c category showed the largest percentage (25%) of notch changes.

Exhibit 3.2 shows that most of the downgrades occurred between the bbb and bb category. For non-investment grade, upgrades dominate.

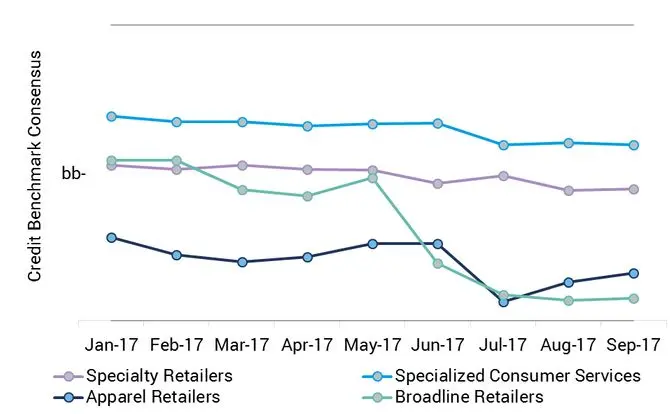

Exhibit 3.3 shows the composition of the US Retail index analyzed in this paper, and Exhibit 3.4 shows credit trends in various US Retail segments.

Exhibit 3.3 US Retail Index Composition

Exhibit 3.4 Credit Trends in US Retail

Exhibit 3.4 shows that all of the General Retail segments have been deteriorating. Specialized Consumer Services and Specialty Retailers show a moderate decline. Apparel Retailers showed the highest credit risk at the start of 2017 by a considerable margin, but Broadline Retailers have now overtaken them.

It is worth noting that the US Retail sector is probably more exposed to the underperforming Apparel and Broadline segments; this will contribute to the overall decline noted in Exhibit 2.2.1.

The steep decline in Apparel and Broadline Retailers credit quality is in line with the IHL group finding about the segments under stress – Broadline Retailers include some of the main department stores like Sears, Dillard’s, Macy’s and Kohl’s and the credit risk in this sector has risen by 29% since the beginning of the year.

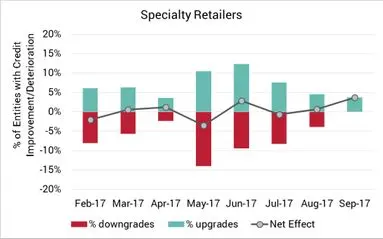

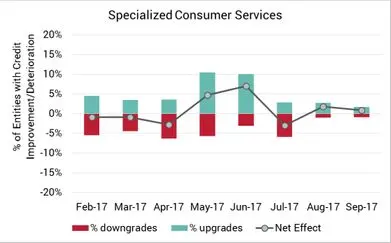

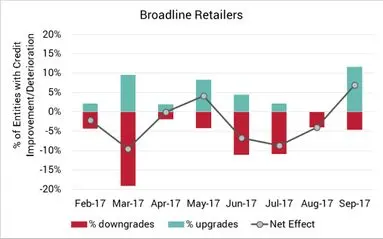

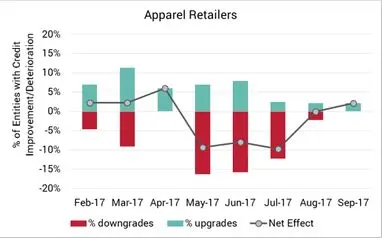

Exhibit 3.7 shows the time series of the percentage of entities with deteriorating or improving credit quality by sector.

Exhibit 3.7 Credit Quality Improvement and Deterioration by Segments

This shows that the net effect was close to being balanced over the 9 month period for Specialty Retailers and Specialized Consumer Services. Apparel Retailers had a difficult Q2 but appear to be more balanced in recent months. In Broadline Retail, entities with deteriorating credit quality outnumbered entities with improving credit quality in six out of the eight observed months.

Online shopping is growing, representing more than 30% of the retail sales growth over the last year. The average annual growth rate of e-commerce sales over 2011-2017 is close to 15%, while traditional retail grows by 3% per year.12 But the share of e-commerce in retail sales overall is currently only 9% (albeit up from 5% in 2011).

The online effect can be seen in the recent Black Friday sales. Footfall in US stores on Thanksgiving and Black Friday was down 4% on last year,13 while online sales increased by 18%. 14 Generally, the clear winner of rising online sales is Amazon; its online revenue was $95bn in 2016, representing almost one quarter of all e-commerce sales.

“Clicks and Mortar” is another expanding segment. The top 50 US e-commerce retailers include eight department stores, with online sales standing at $16.4bn. For four of these stores, e-commerce represents more than 15% of their total revenues and exceeds 5% for the rest. However, according to HRC Advisors this concept is less profitable for department stores than in-store sales. They estimate that e-commerce variable costs reduce department store profits by over 20%.

The department store sector is analyzed in more detail in the next section.

3.1 Discount Stores vs Department Stores

IHL Group report that discount stores are opening more stores than they are closing, while department stores struggle and their net difference of opens and closures is negative. Discount and convenience stores dominate the list of store openings with Aldi and Lidl expanding to the US from Europe.

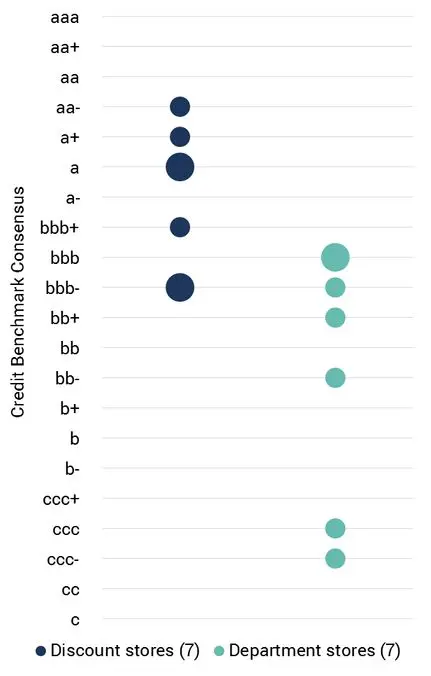

Exhibit 3.1.1 shows credit risk for seven discount stores and seven department stores. In this graph, the larger bubbles indicates two companies with the same rating.

Exhibit 3.1.1 Credit Risk of Discount Stores vs Department Stores15

This shows that the credit quality of department stores is much lower compared to the credit quality of discount stores. All of the discount stores are in the investment grade category, while five of the seven department stores are considered non-investment grade.

4. Case study

4.1 Introduction

Credit Benchmark (“CB”) is currently working with contributing banks to develop a new service for benchmarking and monitoring their credit portfolios. The Credit Benchmark Portfolio Monitoring report allows clients to:

- Compare their portfolio selection within a market against an appropriate benchmark.

- Compare their aggregate credit view against other IRB and CCAR-regulated banks’ credit view for the same portfolio.

- Compare differences within the portfolio at the segment and entity level.

4.2 Case Study

Bank A has submitted a portfolio of 200 US Retailers to CB along with historical data on the creditworthiness of the entities. Bank A wants to learn three things about their US Retailer Portfolio:

- How has the credit quality of Bank A’s portfolio evolved?

- How has the credit quality of Bank A’s portfolio changed compared to the broader market?

- How do Bank A’s internal credit assessments on the portfolio compare to the views of other IRB and CCAR-regulated banks on the portfolio?

Exhibit 4.1 Credit Evolution: US Retailers Portfolio of Bank A vs CB US Retailers Index

- How has the credit quality of Bank A’s portfolio evolved?

In Exhibit 4.1, the consensus credit quality (represented by the green line) of Bank A’s portfolio has declined from 2016 through 2017. This consensus view on the portfolio includes credit data from Bank A alongside the credit data from other banks participating in the CB service.

- How has the credit quality of Bank A’s portfolio changed compared to the broader market?

Also on Exhibit 4.1 is the historical credit quality of the CB US Retailers Index (dark blue). 16 Compared to the US Retail Portfolio of Bank A, the CB US Retail Index has deteriorated less over the last two years. This indicates that the US Retail portfolio of Bank A is deteriorating faster than the broader US Retail market. Because both trends are formed using all IRB and CCAR-regulated banks’ credit opinions, the reason for this faster deterioration can be largely attributed to the counterparty selection of Bank A

Exhibit 4.2 Bank A’s US Retailers: Bank A’s Credit View vs IRB and CCAR Bank’s Credit View (Excluding Bank A)

- How do Bank A’s internal credit assessments compare to the views of other IRB and CCARregulated banks on the portfolio?

Exhibit 4.2 compares credit view of Bank A on their US Retail Portfolio with views of other IRB and CCAR-regulated banks. The orange line charted above represents the credit view of Bank A only; this shows that Bank A views the credit quality of their US Retail Portfolio to be stable over the last two years. However, the other IRB and CCAR-regulated banks (represented by the blue line) report that the credit quality of Bank A’s portfolio has deteriorated from 2016 through 2017. Because the two trends are looking at the same list of names, the trend difference highlights differences between internal credit opinions of Bank A and the other IRB and CCAR-regulated banks.

In addition to answering the three questions about Bank A’s US Retail portfolio at an aggregate level, Credit Benchmark can help Bank A further analyze portfolio differences at the segment and entity level.

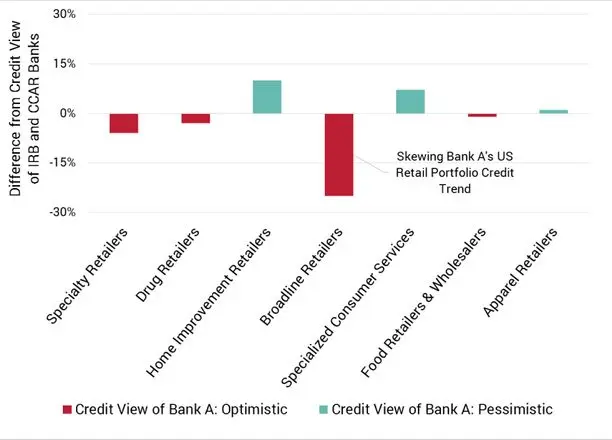

Exhibit 4.3 Distance of Bank A’s Credit View vs IRB and CCAR Bank’s Credit View at the Segment Level

The Exhibit 4.3 shows that Bank A’s view of credit worthiness is very similar to other IRB and CCAR-regulated banks; with the exception of Broadline Retailers where Bank A has a more optimistic view (higher credit rating) on the names within this segment as compared to the peer banks. The difference for Broadline Retailers could have emerged as the other IRB and CCAR-regulated banks downgraded the segment with Bank A’s credit view either remaining the same or improving for the same group of entities.

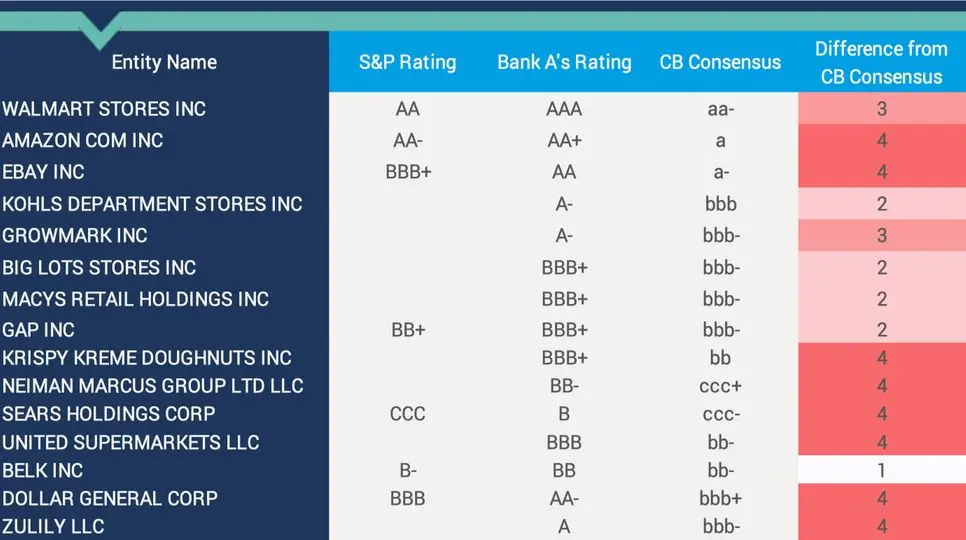

Exhibit 4.4 Distance of Bank A’s Credit View vs IRB and CCAR Bank’s Credit View at the Entity Level

N.B. The S&P Ratings shown here relate to Long Term, Foreign Currency ratings for the specific legal entity. Some of these firms may have local currency ratings, subsidiary ratings or issue ratings which are often used as proxies.

Exhibit 4.4, further refines the analysis to highlight specific entities where Bank A’s credit view is more optimistic than the view of other IRB and CCAR-regulated banks. In this case, Bank A’s credit view is more favorable than the view of the peer banks across all 15 of Bank A’s US Broadline Retail names. The entity level analysis is available for all contributing banks where Credit Benchmark has at least two other risk estimates contributed by the other IRB and CCAR-regulated banks.

4.3 Case Study

The Credit Benchmark service provides clients with the ability to compare how a select portfolio, in this case US Retail names, has evolved compared to the broader market and the other IRB and CCAR-regulated banks participating in the CB service. This type of analysis provides a unique way of understanding counterparty selection and rating accuracy.

5. Conclusion

There is no doubt that traditional US Retailers are facing a number of difficulties. Some of their issues are shared in other Western economies, but they are particularly acute in the US. Over-expansion and heavy debt burdens accumulated during an extended period of low interest rates have left some of them vulnerable to competitive pressures from pure e-commerce companies as well as from newly entrant discount stores.

This is reflected in bank-sourced credit data; the consensus rating for US Retailers is noticeably lower than for those in Western Europe and all segments have shown recent declines. The Broadline and Apparel segments show the largest decline in credit quality.

But the global outlook for retail looks healthy, especially in developing economies. And many of the traditional retailers are finding ways to adapt – the “Clicks and Mortar” model, improved physical retail experiences, partnerships with pure e-commerce, and the growing demand for niche, specialty retailers.

A recent report by IHL group summarizes the position:

“Despite the headwinds and the negative headlines, retail as a whole is quite healthy. Retail Sales are up $121.5b through the first 7 months of 2017. To put that growth into perspective, that is about the size of the annual retail trade for the Netherlands….It is obvious that some of online retail’s strengths fit with the categories that are shrinking in sales in bricks and mortar stores. At the same time, much of the consumer products that drive the bulk of online sales are in categories that are also growing quite well at the store level. Which brings us to the statement that it’s all retail, and those that focus on the customer experience in retail will succeed and those who refuse to change will be in trouble going forward.”

– Debunking the Retail Apocalypse, IHL Group

This report has also presented an extended case study, showing some examples of the type of peer group benchmarking which is available to Credit Portfolio Managers in banks which contribute to the Credit Benchmark dataset.

Appendix 1: The CBC Scale

Appendix 2: List of US General Retail Quorate Names

Apparel Retailers

ALEX & ANI LLC

AMERICAN EAGLE OUTFITTERS INC

ARDEN ELIZABETH INC

ASCENA RETAIL GROUP INC

AVON INTERNATIONAL OPERATIONS INC

BROOKS BROS GROUP INC

CARTER WILLIAM CO

COLUMBIA SPORTSWEAR CO

ESTEE LAUDER INC

FOOT LOCKER INC

FOREVER 21 INC

G III LEATHER FASHIONS INC

GENESCO INC

J CREW GROUP INC

KORS MICHAEL USA INC

L BRANDS INC

LAUREN RALPH CORP

MENS WEARHOUSE INC

TALBOTS INC

TIFFANY & CO

TIFFANY & CO CANADA

TJX COS INC

TOO FACED COSMETICS LLC

UNIFIRST CORP

Broadline Retailers

AMAZON COM INC

BELK INC*

BIG LOTS STORES INC*

COSTCO WHOLESALE CORP*

CST BRANDS INC

DILLARDS INC*

DOLLAR GENERAL CORP*

DOLLAR TREE INC*

EBAY INC

FAMILY DOLLAR STORES INC

GAP INC

GROWMARK INC

HSN INC

KOHLS CORP*

KOHLS DEPARTMENT STORES INC

KRISPY KREME DOUGHNUTS INC

LANDS END INC

LORD & TAYLOR ACQUISITION INC

MACYS INC*

MACYS RETAIL HOLDINGS INC

MEIJER INC

NEIMAN MARCUS GROUP LTD LLC*

NORDSTROM INC*

PRICELINE GROUP INC

RODAN & FIELDS LLC

ROSS STORES INC*

SEARS HOLDINGS CORP*

SHUTTERFLY INC

STAPLES INC

TARGET CORP*

UNITED SUPERMARKETS LLC

VINEYARD VINES LLC

WALMART STORES INC*

ZULILY LLC

Specialty Retailers

ACETO CORP

ACUITY BRANDS INC

ADMI CORP

ADVANCE STORES CO INC

AMNEAL PHARMACEUTICALS LLC

AUTONATION INC

BARNES & NOBLE INC

BEST BUY CO INC

BROOKS AUTOMATION INC

BUILDERS FIRSTSOURCE INC

CARMAX AUTO SUPERSTORES INC

CLOROX CO COACH INC

COMMUNICATIONS TEST DESIGN INC

DAKTRONICS INC

ERAC USA FINANCE LLC

ESTEE LAUDER COS INC

GAMESTOP CORP

GENERAL NUTRITION CENTERS INC

GLUCK E CORP

GROUP 1 AUTOMOTIVE INC

HAWORTH INC

HOFFMANN LA ROCHE INC

IMMUCOR INC

INTERFACE INC

ITRON INC, WA

JORDACHE ENTERPRISES INC

KAR AUCTION SERVICES INC

LIFETIME BRANDS INC

LITHIA MOTORS INC

MCCORMICK & CO INC

MCJUNKIN RED MAN CORP

Home Improvement Retailers

BED BATH & BEYOND INC

HOME DEPOT INC

LOWES COS INC

Specialized Consumer Services

ADVANCE AUTO PARTS INC

ALEXANDER PROUDFOOT CO

ALSCO INC ANALOGIC CORP

BLACK & VEATCH HOLDING CO

BOSTON CONSULTING GROUP INC

BRIGHT HORIZONS FAMILY SOLUTIONS LLC

BROADRIDGE FINANCIAL SOLUTIONS INC

CARDTRONICS INC

CARDTRONICS USA INC

CAREERBUILDER LLC

CDM SMITH INC

CHENEGA CORP

COVANCE INC

DAYMON WORLDWIDE INC DELOITTE LLP, NY

DUKE ENDOWMENT EBAY PARTNER NETWORK INC

EHI INTERNATIONAL FINANCE SARL

EMERALD EXPOSITIONS HOLDING INC

ERAC IRELAND LTD

HDR INC

HEICO COS LLC

HEIDRICK & STRUGGLES INTERNATIONAL INC

HOTELBEDS USA INC

HUNTON & WILLIAMS LLP

INVENTIV HEALTH INC

LEGALZOOM COM INC

LOCKE LORD LLP

MARCUM LLP

MARITZ HOLDINGS INC

MATTHEWS INTERNATIONAL CORP

NIELSEN HOLDINGS PLC

PAE HOLDING CORP

RPX CORP

SAPIENT CORP

SERVICE CORP INTERNATIONAL

SERVICEMASTER CO LLC

SNAP ON INC

SOTHEBYS INC

TEMPLETON JOHN FOUNDATION

TOWERS WATSON DELAWARE INC

VICAR OPERATING INC

WEIGHT WATCHERS INTERNATIONAL INC

WHEELS INCWILLIS TOWERS WATSON PLC

Specialty Retailers

MICHAELS STORES INC

NEIMAN MARCUS GROUP INC

NISSAN NORTH AMERICA INC

OFFICE DEPOT INC

OWENS CORNING

OWENS CORNING SALES LLC

PARTY CITY HOLDINGS INC

PETCO ANIMAL SUPPLIES INC

PETROLEUM WHOLESALE LP

PETSMART INC

PEYSER DAVID SPORTSWEAR INC

PILOT TRAVEL CENTERS LLC

PRESTIGE BRANDS HOLDINGS INC

PRICESMART INC

QVC INC

RADIO SYSTEMS CORP

RESMED INC

RESTORATION HARDWARE INC

ROGERS CORP

SA RECYCLING LLC

SCHINDLER ELEVATOR CORP

SENSIENT TECHNOLOGIES CORP

SONIC AUTOMOTIVE INC

STRAUSS LEVI INTERNATIONAL INC

TECHNIC INC

TI GROUP AUTOMOTIVE SYSTEMS LLC

TOYOTA MOTOR SALES USA INC

VISHAY INTERTECHNOLOGY INC

VOXX INTERNATIONAL CORP

WARNER MUSIC GROUP CORP

YAMAHA MOTOR CORP USA

YURMAN DAVID ENTERPRISES LLC

Download the article “Retail Industry Trends” on PDF.

More from Credit Benchmark

We aggregate the views of thousands of institutional credit analysts to create new, unique consensus data and analytics. Our clients use the unique entity- and aggregate-level data and analytics to understand and manage their risks effectively. The data helps clients focus their attention on where and when it matters most, whether in their risk management, investment process, or regulatory compliance. Learn more.

Reporting was contributed by

Barbora Makova

Jacob Hibbert

Delia Nunez

Footnotes

1 Theresa Agovino. ”Property Investors Bet on Emerging-Market Mall Culture.” The Wall Street Journal 3 Oct. 2017. Web. 29 Nov. 2017 https://www.wsj.com/articles/property-investors-bet-on-emerging-market-mall-culture-1507028403

2 Based on Probability of Default estimates from three or more contributing banks.

3 The ‘Wisdom of Crowds’ was initially observed by Francis Galton and is the basis for the value in crowdsourced datasets. It is the popular version of the Diversity Prediction Theorem which can be stated as: “The squared error of the collective prediction equals the average squared error minus the predictive diversity” – implying that if the diversity in a group is large, the error of the crowd is small.

4 The Credit Benchmark Consensus (“CBC”) is a 21-category scale explicitly linked to probability of default estimates sourced from major banks. A CBC of bbb+ is broadly comparable with BBB+ from S&P and Fitch or Baa1 from Moody’s.

5 Quorate entities have observations from three and more banks, semi-quorate entities are entities with observations from two banks.

6 Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, and Switzerland

7 IHL Group – Debunking The Retail Apocalypse (August 2017)

8 VISA – Visa’s UK Consumer Spending Index, Compiled by IHS Markit on behalf of Visa (November 2017)

9 Yoni Van Looveren. ” Zalando grows more than 25 % in third quarter.” Retail Detail 7 Nov. 2017. Web. 29 Nov. 2017 https://www.retaildetail.eu/en/news/fashion/zalando-grows-more-25-third-quarter

10 US Census Bureau

11 US Census Bureau

12 US Census Bureau

13 RetailNext Inc

14 Adobe Systems Inc.

15 The entities used in Exhibit 3.1.1 are marked by a star in Appendix 2.

16 The US Retail Index is constructed using Credit Benchmark Index Methodology as discussed in White Paper “Bank-Sourced Credit Indices”, which is available on Credit Benchmark website.

Restricted Distribution

Disclaimer: Credit Benchmark does not solicit any action based upon this report, which is not to be construed as an invitation to buy or sell any security or financial instrument. This report is not intended to provide personal investment advice and it does not take into account the investment objectives, financial situation and the particular needs of a particular person who may read this report.