Credit Benchmark has published the latest monthly credit consensus data (from February 2020) based on contributions from 40+ financial institutions, covering 50,000 separate legal entities.

The monthly upgrades and downgrades overview is now based on data adjusted for changes in contributor mix.

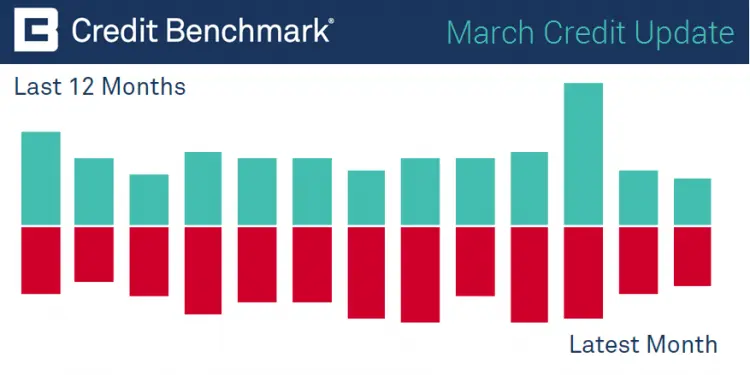

Monthly consensus upgrades and downgrades:

- 360 obligors

improved their credit standing by at least one notch. - 266

obligors deteriorated. - 69

moved more than one notch. - The

frequency of upgrades and downgrades has decreased.

Last month showed improvements across 331 obligors and deterioration across 333, with 66 moving by more than one notch.

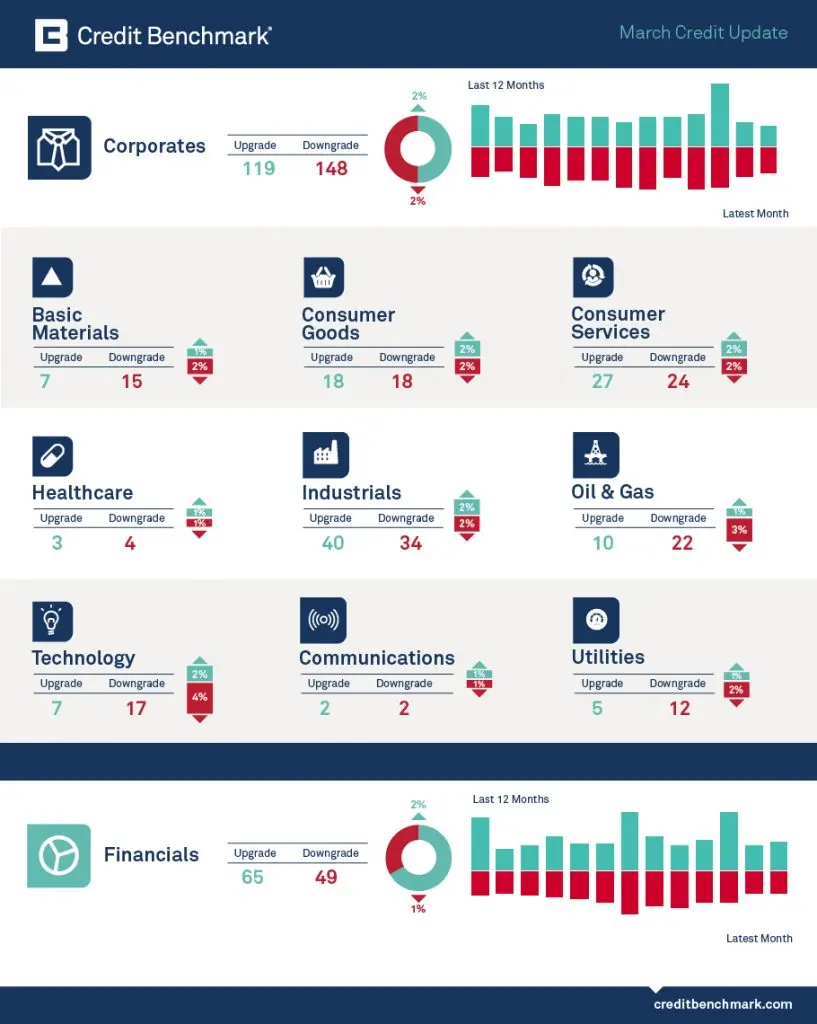

Industries:

- Upgrades

dominate downgrades in just one of the ten reported industries and four out of

ten have more downgrades.

- Financials

shows an improvement in credit quality with 65 upgrades and 49 downgrades.

- The

industries showing deteriorations are:- Basic

Materials with 7 upgrades and 15 downgrades. - Oil

& Gas with 10 upgrades and 22 downgrades. - Technology

with 7 upgrades and 17 downgrades.

- Basic

Note: Monthly upgrade / downgrade movement is based on 26,000 individual Consensus PDs.

To learn more about consensus ratings and analytics from Credit Benchmark, email [email protected].

Disclaimer: Credit Benchmark does not solicit any action based upon this report, which is not to be construed as an invitation to buy or sell any security or financial instrument. This report is not intended to provide personal investment advice and it does not take into account the investment objectives, financial situation and the particular needs of a particular person who may read this report.